Provincial Sales Tax PST Number ApplicationProvincial 2017-2026

Understanding the Provincial Sales Tax PST Number Application

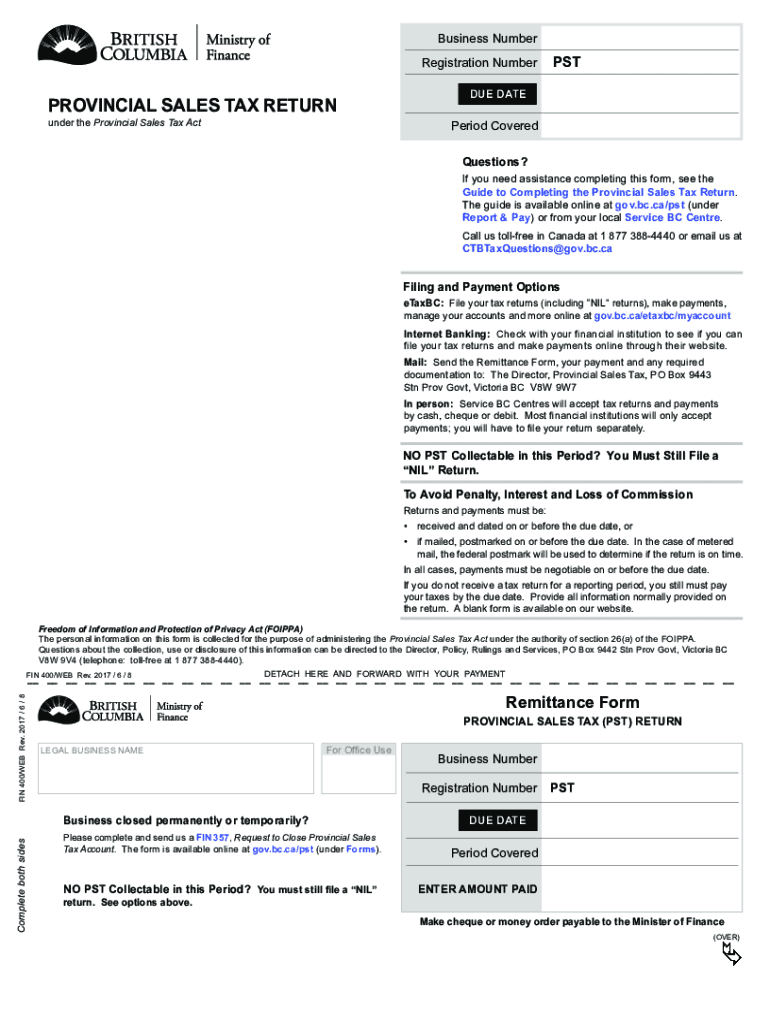

The Provincial Sales Tax (PST) Number Application is a crucial document for businesses operating in states that impose a sales tax. This application allows businesses to obtain a PST number, which is necessary for collecting and remitting sales tax on taxable goods and services. Understanding the purpose and requirements of this application is essential for compliance with state tax regulations.

Steps to Complete the Provincial Sales Tax PST Number Application

Completing the PST Number Application involves several key steps:

- Gather necessary information about your business, including the legal name, address, and type of business entity.

- Provide details about the nature of your business activities, including the types of goods or services sold.

- Include any relevant identification numbers, such as your Employer Identification Number (EIN).

- Review the application for accuracy and completeness before submission.

How to Obtain the Provincial Sales Tax PST Number Application

The PST Number Application can typically be obtained through the state’s tax department website or office. Many states offer the application in a downloadable format, allowing businesses to fill it out electronically or print it for manual completion. It is important to ensure that you are using the most current version of the application to avoid any processing delays.

Legal Use of the Provincial Sales Tax PST Number Application

Using the PST Number Application legally requires adherence to state regulations regarding sales tax collection. Once you receive your PST number, it is essential to use it correctly when collecting sales tax from customers. This ensures that your business remains compliant with state laws and avoids potential penalties for non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the PST Number Application can vary by state. It is important to check with your local tax authority for specific deadlines related to application submission and sales tax remittance. Missing these deadlines can result in fines or other penalties, so staying informed is crucial for business compliance.

Required Documents

When applying for a PST number, certain documents may be required to support your application. Commonly required documents include:

- Proof of business registration, such as a business license or incorporation documents.

- Identification numbers, including your EIN or Social Security Number (SSN).

- Financial statements or tax returns may be requested for verification purposes.

Penalties for Non-Compliance

Failure to comply with PST regulations can result in significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance emphasizes the importance of timely application and accurate tax collection practices.

Quick guide on how to complete provincial sales tax pst number applicationprovincial

Finish Provincial Sales Tax PST Number ApplicationProvincial effortlessly on any gadget

Web-based document administration has become increasingly favored by both businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents quickly without delays. Handle Provincial Sales Tax PST Number ApplicationProvincial on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Provincial Sales Tax PST Number ApplicationProvincial effortlessly

- Obtain Provincial Sales Tax PST Number ApplicationProvincial and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Provincial Sales Tax PST Number ApplicationProvincial and ensure excellent communication at every step of your form completion journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct provincial sales tax pst number applicationprovincial

Create this form in 5 minutes!

How to create an eSignature for the provincial sales tax pst number applicationprovincial

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are the key features of the 2014 fin400 sales solution?

The 2014 fin400 sales solution offers a robust suite of features designed to enhance document management. Key functionalities include eSignature capabilities, customizable templates, and seamless document sharing, all aimed at streamlining your sales processes. By integrating these features, businesses can improve their efficiency and speed up sales cycles.

-

How does airSlate SignNow improve the 2014 fin400 sales process?

airSlate SignNow signNowly enhances the 2014 fin400 sales process by providing tools that automate document handling. With its easy-to-use interface, users can quickly send, sign, and track documents, reducing turnaround times. This efficiency allows sales teams to focus on closing deals rather than managing paperwork.

-

What is the pricing structure for the 2014 fin400 sales solution?

The pricing for the 2014 fin400 sales solution is competitive and designed to accommodate businesses of all sizes. airSlate SignNow offers various subscription tiers, each tailored to meet different needs and usage levels. Prospective customers can choose a plan that fits their budget and requirements for eSignature and document management.

-

Can the 2014 fin400 sales solution integrate with other tools?

Yes, the 2014 fin400 sales solution can seamlessly integrate with numerous other tools. airSlate SignNow supports integration with popular CRMs, payment gateways, and cloud storage services. This compatibility ensures that businesses can enhance their workflows and maintain efficiency across various platforms.

-

What benefits does the 2014 fin400 sales offer for remote teams?

The 2014 fin400 sales solution is particularly beneficial for remote teams as it allows for anytime, anywhere access to documents. airSlate SignNow facilitates real-time collaboration and electronic signatures, making it easier for teams to close deals without being in the same location. This flexibility maximizes productivity and accelerates sales cycles.

-

Is the 2014 fin400 sales solution secure for sensitive documents?

Absolutely, the 2014 fin400 sales solution prioritizes security and compliance. airSlate SignNow employs advanced encryption and security protocols to protect sensitive information throughout the signing process. Users can confidently handle confidential documents knowing that their data is secure.

-

How easy is it to use the 2014 fin400 sales solution?

The 2014 fin400 sales solution is designed for ease of use, ensuring that even individuals with minimal tech knowledge can navigate it effectively. With a simple interface and step-by-step guidance, users can swiftly learn how to send and sign documents. This user-friendly approach minimizes the learning curve and promotes adoption across teams.

Get more for Provincial Sales Tax PST Number ApplicationProvincial

Find out other Provincial Sales Tax PST Number ApplicationProvincial

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free