Request for Taxpayer ReliefCancel or Waive Penalties or Form

What is the request for taxpayer relief?

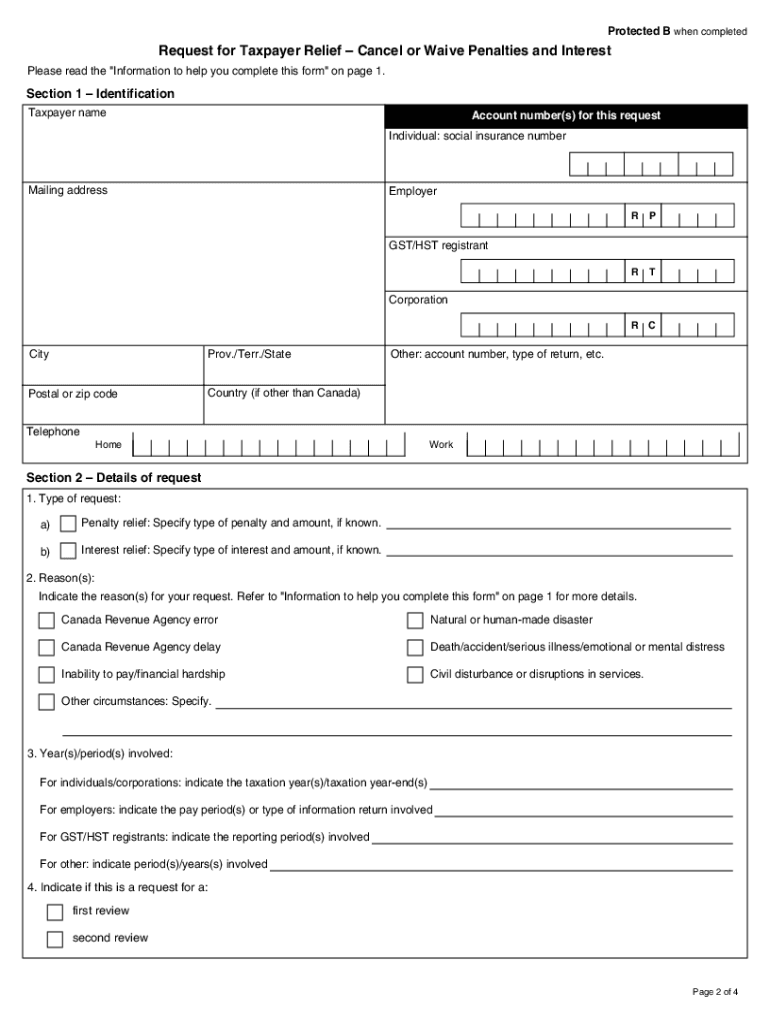

The request for taxpayer relief, specifically the form rc4288, is a formal application submitted to the Canada Revenue Agency (CRA) by individuals or businesses seeking to cancel or waive penalties and interest on unpaid taxes. This form is particularly relevant for taxpayers who have faced extraordinary circumstances that hindered their ability to meet tax obligations. Such circumstances may include natural disasters, serious illness, or financial hardship. Understanding the purpose of this form is crucial for those looking to alleviate their tax burdens and regain compliance with tax regulations.

Key elements of the request for taxpayer relief

The key elements of the request for taxpayer relief on form rc4288 include the identification of the taxpayer, the specific tax year in question, and a detailed explanation of the circumstances that led to the inability to pay taxes on time. Additionally, the form requires supporting documentation to substantiate the claims made, such as medical records or financial statements. It is essential to provide accurate and complete information to enhance the chances of approval.

Steps to complete the request for taxpayer relief

Completing the request for taxpayer relief using form rc4288 involves several important steps:

- Gather necessary documentation, including proof of the circumstances affecting your tax situation.

- Fill out the form rc4288 accurately, ensuring all required fields are completed.

- Attach supporting documents that validate your claims, such as medical or financial records.

- Review the completed form for accuracy and completeness before submission.

- Submit the form either online through the CRA's portal or by mailing it to the appropriate CRA office.

Eligibility criteria for the request for taxpayer relief

To be eligible to submit the request for taxpayer relief using form rc4288, taxpayers must demonstrate that they have experienced circumstances beyond their control that prevented timely tax payment. This includes but is not limited to natural disasters, severe illness, or significant financial difficulties. Additionally, taxpayers must be in good standing with the CRA, meaning they must not have any outstanding tax obligations that are not being addressed. Meeting these criteria is essential for a successful application.

Required documents for the request for taxpayer relief

When submitting form rc4288, it is important to include various supporting documents to strengthen your case. Required documents may include:

- Proof of income or financial hardship, such as pay stubs or bank statements.

- Medical documentation if health issues contributed to the inability to pay taxes.

- Any correspondence with the CRA regarding your tax situation.

- Evidence of natural disasters or other extraordinary circumstances, such as insurance claims or police reports.

Form submission methods for the request for taxpayer relief

Taxpayers can submit the request for taxpayer relief using form rc4288 through various methods. The primary options include:

- Online submission via the CRA's secure online portal, which allows for quicker processing.

- Mailing the completed form and supporting documents to the designated CRA office, ensuring to use a reliable mailing service.

- In-person submission at a local CRA office, which may be beneficial for those needing assistance with the form.

Quick guide on how to complete request for taxpayer reliefcancel or waive penalties or

Complete Request For Taxpayer ReliefCancel Or Waive Penalties Or effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Request For Taxpayer ReliefCancel Or Waive Penalties Or on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Request For Taxpayer ReliefCancel Or Waive Penalties Or without hassle

- Obtain Request For Taxpayer ReliefCancel Or Waive Penalties Or and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Request For Taxpayer ReliefCancel Or Waive Penalties Or and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for taxpayer reliefcancel or waive penalties or

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the rc4288 pdf and how is it used?

The rc4288 pdf is a specific document format used for electronic signatures. It allows users to easily create, send, and eSign important documents online, ensuring a streamlined workflow. Utilizing airSlate SignNow with the rc4288 pdf enhances efficiency and security in document handling.

-

How can I create an rc4288 pdf using airSlate SignNow?

Creating an rc4288 pdf with airSlate SignNow is simple. Once you log into your account, you can upload your documents, and then easily convert them into the rc4288 pdf format. Follow the prompts to add eSignature fields and customize as necessary.

-

What are the pricing options for airSlate SignNow when handling rc4288 pdf?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. These plans allow users to manage rc4288 pdf documents effectively, with options for individual, business, and enterprise solutions. Explore our pricing page for details on each plan's features and benefits.

-

Can I integrate airSlate SignNow with other applications for rc4288 pdf?

Yes, airSlate SignNow provides seamless integrations with various applications like Google Drive, Dropbox, and CRM systems. This makes working with rc4288 pdf documents even easier, allowing you to manage files from your preferred platforms. Check our integrations page for a complete list of compatible applications.

-

What benefits does airSlate SignNow offer for rc4288 pdf users?

Using airSlate SignNow for your rc4288 pdf documents offers numerous advantages, including quick eSigning, secure document storage, and easy access from any device. Additionally, it enhances team collaboration by allowing multiple users to interact with the document simultaneously.

-

Is there a mobile app for managing rc4288 pdf with airSlate SignNow?

Yes, airSlate SignNow has a mobile app available for iOS and Android devices that allows you to manage your rc4288 pdf documents on the go. The app enables you to create, edit, and eSign documents from anywhere, ensuring productivity without being tied to your desk.

-

How do I ensure the security of my rc4288 pdf documents?

airSlate SignNow prioritizes security for all its users. With the rc4288 pdf, your documents are encrypted and stored securely. Additionally, features like two-factor authentication and audit trails help safeguard your sensitive information.

Get more for Request For Taxpayer ReliefCancel Or Waive Penalties Or

- Special durable power of attorney for bank account matters virginia form

- Virginia small business startup package virginia form

- Virginia property management package virginia form

- Virginia annual 497428502 form

- Va corporation 497428503 form

- Sample corporate records for a virginia professional corporation virginia form

- Virginia professional form

- Sample transmittal letter for articles of incorporation virginia form

Find out other Request For Taxpayer ReliefCancel Or Waive Penalties Or

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online