T1235 DirectorsTrustees and Like Officials Worksheet Canada Ca Form

Understanding the T3010 Fillable Form

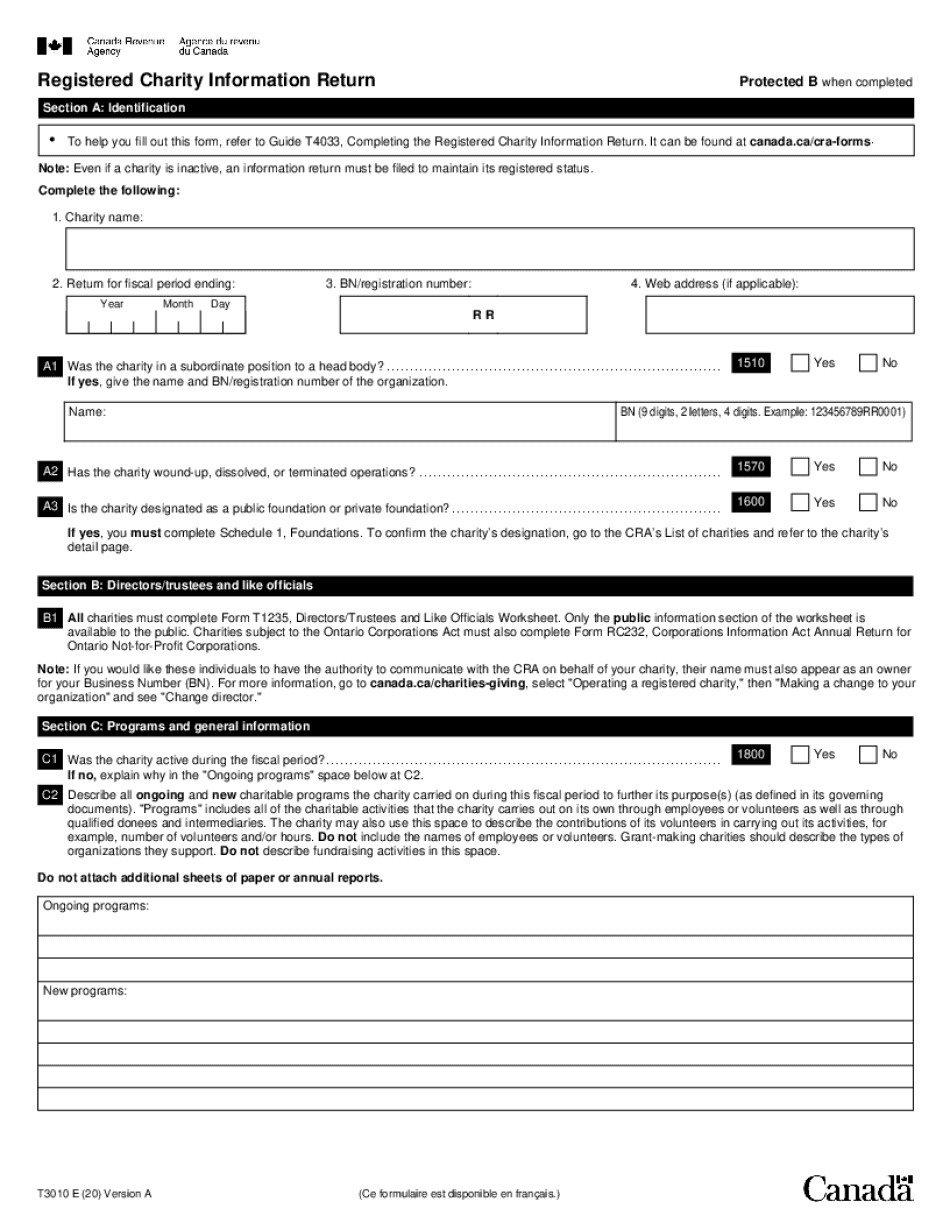

The T3010 fillable form, also known as the CRA T3010, is a crucial document for registered charities in Canada. It serves as the charity information return that organizations must file annually with the Canada Revenue Agency (CRA). This form collects essential information about the charity's activities, financial status, and compliance with regulations. It is important for maintaining transparency and accountability within the charitable sector.

Steps to Complete the T3010 Fillable Form

Filling out the T3010 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your charity's registration number and financial statements.

- Access the fillable form through the CRA website or a trusted platform.

- Complete each section methodically, ensuring accuracy in reporting income, expenditures, and activities.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, adhering to the CRA's guidelines for filing.

Legal Use of the T3010 Fillable Form

The T3010 form is legally required for registered charities in Canada. Filing this form ensures compliance with the Income Tax Act, which mandates that charities report their financial activities. Failure to submit the T3010 can result in penalties, including the potential loss of charitable status. It is essential to understand the legal implications of the information provided in the form.

Required Documents for Filing the T3010

To successfully complete the T3010 fillable form, certain documents are necessary:

- Financial statements for the fiscal year, including balance sheets and income statements.

- Records of donations received and expenditures made during the year.

- Details of programs and activities conducted by the charity.

- Any previous T3010 forms filed, if applicable, for reference.

Filing Deadlines for the T3010 Form

Registered charities must adhere to specific filing deadlines for the T3010 form. Generally, the form is due six months after the end of the charity's fiscal year. It is crucial to mark this date on your calendar to avoid late submissions, which can lead to penalties or complications with your charity's status.

Form Submission Methods

The T3010 fillable form can be submitted through various methods:

- Electronically via the CRA's online services, which is the preferred method for many organizations.

- By mail, ensuring that the form is sent to the correct CRA address based on your charity's location.

- In-person submissions at designated CRA offices, if necessary.

Examples of Using the T3010 Fillable Form

Understanding how to utilize the T3010 form effectively can be illustrated through various scenarios:

- A charity that provides educational services must report its program expenditures accurately to demonstrate compliance with its mission.

- A non-profit organization receiving significant donations needs to ensure transparency by detailing how funds are allocated.

- Charities involved in fundraising events must report the income generated and associated costs to maintain accountability.

Quick guide on how to complete t1235 directorstrustees and like officials worksheet canadaca

Manage T1235 DirectorsTrustees And Like Officials Worksheet Canada ca effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle T1235 DirectorsTrustees And Like Officials Worksheet Canada ca on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign T1235 DirectorsTrustees And Like Officials Worksheet Canada ca effortlessly

- Find T1235 DirectorsTrustees And Like Officials Worksheet Canada ca and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign T1235 DirectorsTrustees And Like Officials Worksheet Canada ca and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1235 directorstrustees and like officials worksheet canadaca

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the t3010 fillable form?

The t3010 fillable form is a form used by registered charities in Canada to account for their financial activities. This fillable version makes it easy for organizations to complete and submit the required information accurately and efficiently. With airSlate SignNow, you can easily manage and eSign the t3010 fillable form online.

-

How can I obtain the t3010 fillable form?

You can obtain the t3010 fillable form directly from the Canada Revenue Agency's website or through various forms management tools available online. Using airSlate SignNow, you can conveniently access, fill out, and eSign the t3010 fillable form without any hassle, ensuring the process is streamlined for your organization.

-

Is the t3010 fillable form available for free?

Yes, the t3010 fillable form itself is available for free from the Canada Revenue Agency. However, you may incur costs associated with eSigning services. With airSlate SignNow, you'll get a cost-effective solution to fill and eSign the t3010 fillable form efficiently, without additional hidden fees.

-

What are the benefits of using airSlate SignNow for the t3010 fillable form?

Using airSlate SignNow for the t3010 fillable form streamlines the entire process of completing and signing documents. It allows for real-time collaboration, automatic reminders, and secure storage, ensuring that your submission is timely and complies with regulations. Plus, it enhances productivity by reducing the time spent on paper-based tasks.

-

Does airSlate SignNow integrate with other tools for handling the t3010 fillable form?

Yes, airSlate SignNow seamlessly integrates with various management tools and software platforms, enhancing your workflow. This means you can import data, share the t3010 fillable form, and track its status without leaving your preferred applications. Integrations with CRM and accounting systems further simplify your processes.

-

Is it safe to use airSlate SignNow for the t3010 fillable form?

Absolutely! airSlate SignNow prioritizes security with advanced encryption protocols and compliance standards. When filling out and eSigning the t3010 fillable form, your data remains protected and confidential, allowing you to focus on your charitable activities without concerns about data bsignNowes.

-

Can multiple users collaborate on the t3010 fillable form using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the t3010 fillable form simultaneously. This feature is particularly beneficial for teams working together to ensure that all necessary information is included and accurate. You can invite team members to review, edit, and eSign the document efficiently.

Get more for T1235 DirectorsTrustees And Like Officials Worksheet Canada ca

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries virginia form

- Deed partnership is form

- Quitclaim deed for from two individuals to one individual virginia form

- Bargain sale form

- Deed of correction virginia form

- Legal last will and testament form for single person with no children virginia

- Legal last will and testament form for a single person with minor children virginia

- Virginia legal form

Find out other T1235 DirectorsTrustees And Like Officials Worksheet Canada ca

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer