Full Payment of Any Amount Due for a Taxable Year is Due by the Original Due Date 2020

Understanding the Full Payment Due Date for Taxable Year 2019

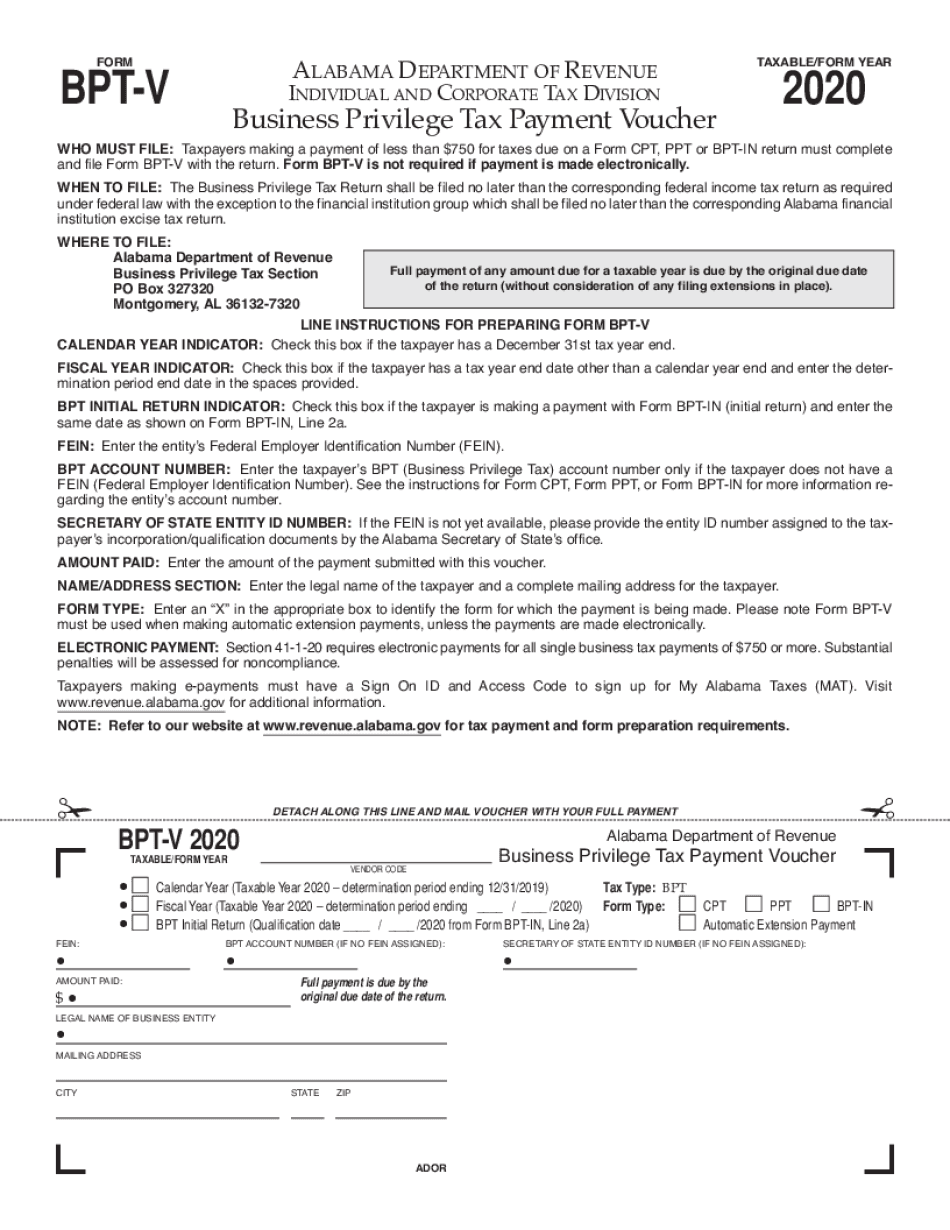

The full payment of any amount due for the taxable year 2019 must be submitted by the original due date. This date is crucial for ensuring compliance with Alabama tax regulations. For most businesses, the original due date aligns with the federal tax deadlines, typically falling on April 15 of the following year. It is essential to be aware of this date to avoid any penalties or interest charges that may accrue from late payments.

Steps to Ensure Full Payment by the Original Due Date

To ensure that you meet the full payment requirements by the original due date, follow these steps:

- Review your tax documents and calculate the total amount due for the 2019 business privilege tax.

- Prepare your payment method, whether it be electronic or by mail.

- Submit your payment before the deadline to avoid penalties.

- Keep a record of your payment confirmation for your records.

Required Documents for Full Payment Submission

When preparing to make your full payment for the 2019 bpt, ensure you have the following documents ready:

- Your completed Alabama initial business privilege tax return for 2019.

- Any supporting documentation that may be required, such as financial statements or proof of income.

- Your payment method details, whether it be a check, credit card, or electronic transfer information.

Penalties for Non-Compliance with Payment Deadlines

Failing to submit your full payment by the original due date can result in significant penalties. The state of Alabama may impose late fees or interest on the unpaid balance. These penalties can accumulate quickly, making it essential to adhere to the deadlines. Understanding the potential financial implications can motivate timely compliance.

IRS Guidelines for Business Privilege Tax Payments

The IRS provides specific guidelines regarding the payment of business privilege taxes. It is important to familiarize yourself with these regulations to ensure compliance. The IRS outlines the necessary forms and payment methods, which can include electronic submissions. Following these guidelines helps to streamline the payment process and reduce the risk of errors.

Form Submission Methods for the 2019 BPT

For the 2019 bpt, there are several submission methods available:

- Online submission through the Alabama Department of Revenue’s website.

- Mailing a physical copy of your completed form along with your payment.

- In-person submission at designated tax offices, which may provide immediate confirmation of your payment.

Eligibility Criteria for Filing the 2019 BPT

To be eligible to file the 2019 business privilege tax return, businesses must meet specific criteria set forth by Alabama law. Generally, all businesses operating in Alabama are required to file, regardless of their revenue. Understanding these eligibility requirements can help ensure that you are compliant and avoid potential issues with your filing.

Quick guide on how to complete full payment of any amount due for a taxable year is due by the original due date

Prepare Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents rapidly without delays. Manage Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date with ease

- Obtain Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and carries the same legal effect as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct full payment of any amount due for a taxable year is due by the original due date

Create this form in 5 minutes!

How to create an eSignature for the full payment of any amount due for a taxable year is due by the original due date

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the 2019 bpt and how does it work with airSlate SignNow?

The 2019 bpt refers to the Business Process Template that streamlines document workflows. With airSlate SignNow, you can integrate this template to enhance your electronic signature processes, ensuring efficiency and compliance. By utilizing the 2019 bpt, users can easily manage their document flows, making the signing process faster and more effective.

-

How much does airSlate SignNow cost for using the 2019 bpt?

Pricing for airSlate SignNow varies based on the features you choose, including the 2019 bpt. Typically, the plans start at a competitive rate, allowing businesses of all sizes to find a suitable package. It's best to check the official pricing page for detailed information on costs associated with implementing the 2019 bpt in your workflows.

-

What features does the airSlate SignNow platform provide with the 2019 bpt?

When utilizing the 2019 bpt with airSlate SignNow, you gain access to powerful features such as advanced eSignature capabilities, template creation, and integrations with popular applications. These features enable users to automate their processes, increasing overall productivity by leveraging the full functionality of the 2019 bpt.

-

Can the 2019 bpt be integrated with other tools?

Yes, the 2019 bpt can be easily integrated with a wide range of tools and applications using airSlate SignNow. This includes CRM systems, cloud storage services, and various business applications, which helps streamline your entire workflow. This level of integration enhances the capability of the 2019 bpt by ensuring seamless document management across different platforms.

-

What are the benefits of using the 2019 bpt with airSlate SignNow?

Using the 2019 bpt with airSlate SignNow provides numerous benefits, including increased efficiency and reduced turnaround times for document signing. Additionally, this integration helps ensure compliance with legal standards while offering a user-friendly experience for all parties involved. Overall, it simplifies and accelerates your document processes signNowly.

-

Is the 2019 bpt suitable for all types of businesses?

Absolutely! The 2019 bpt is designed to accommodate businesses of all sizes and industries. Whether you are a small startup or a large corporation, airSlate SignNow can tailor the implementation of the 2019 bpt to meet your specific needs. This flexibility makes it an ideal choice for diverse business environments.

-

What type of support does airSlate SignNow offer for the 2019 bpt?

airSlate SignNow offers comprehensive support for users implementing the 2019 bpt, including tutorials, FAQs, and customer service assistance. This ensures that you have the resources needed to maximize the effectiveness of the 2019 bpt in your document workflows. The support team is dedicated to helping you troubleshoot and optimize your usage.

Get more for Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date

- Quitclaim deed by two individuals to llc vermont form

- Warranty deed from two individuals to llc vermont form

- Enhanced life estate deed 497428693 form

- Vermont license real estate form

- License to sell personal estate vermont form

- License to convey mortgage or lease personal estate vermont form

- Report on the license to sell vermont form

- Report on the license to convey mortgage or lease vermont form

Find out other Full Payment Of Any Amount Due For A Taxable Year Is Due By The Original Due Date

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy