DOR Tax Talk in Gov 2020

Overview of the Indiana Inventory Report

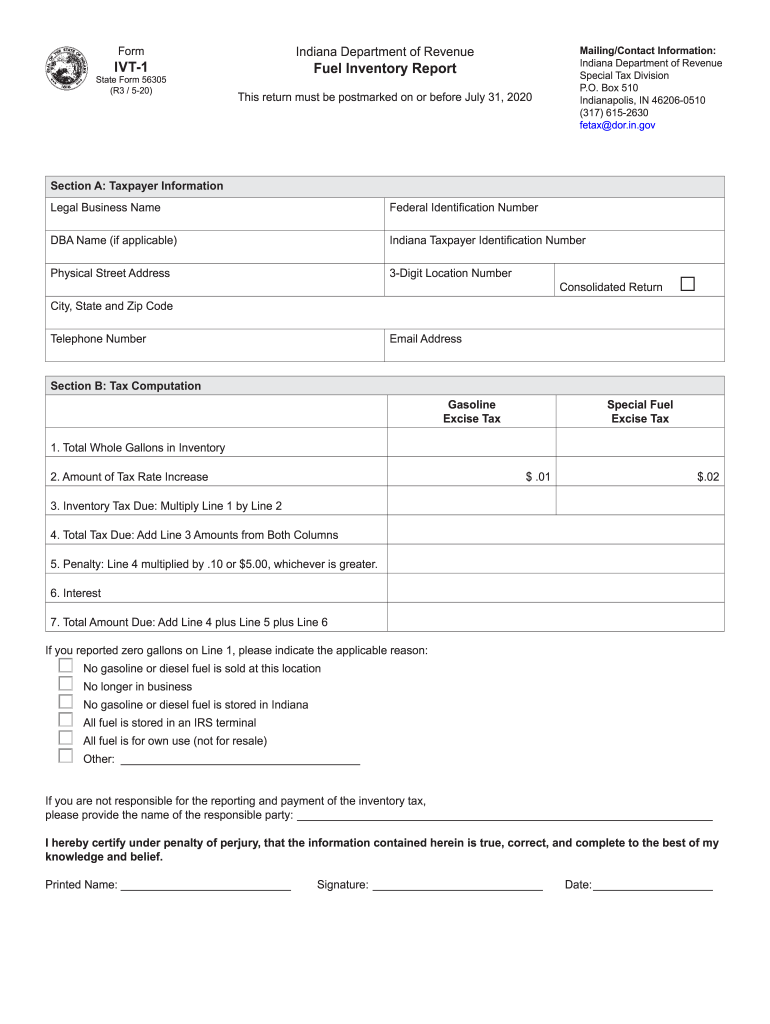

The Indiana inventory report is a crucial document used by businesses to report their inventory levels to the Indiana Department of Revenue (DOR). This report is essential for compliance with state tax regulations and provides an accurate representation of a business's assets. Understanding the requirements and processes associated with this report can help ensure timely and accurate submissions.

Steps to Complete the Indiana Inventory Report

Completing the Indiana inventory report involves several key steps:

- Gather necessary information about your inventory, including quantities and values.

- Access the Indiana DOR website to download the appropriate form, typically referred to as the Indiana form IVT-1.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the submission options available.

Required Documents for Submission

When preparing to submit the Indiana inventory report, it is important to have the following documents ready:

- Inventory records detailing the quantities and values of items held.

- Previous inventory reports, if applicable, to ensure consistency and accuracy.

- Any supporting documentation required by the Indiana DOR to validate your inventory claims.

Legal Use of the Indiana Inventory Report

The Indiana inventory report serves a legal purpose in documenting a business's inventory for tax assessment. It is essential to ensure that the report is filled out correctly to avoid potential legal issues. The report must comply with state regulations and be submitted by the designated deadlines to maintain good standing with the Indiana DOR.

Filing Deadlines for the Indiana Inventory Report

Timely filing of the Indiana inventory report is critical. Businesses must be aware of the specific deadlines set by the Indiana DOR. Typically, the inventory report is due annually, and failing to meet this deadline can result in penalties or additional scrutiny from tax authorities.

Penalties for Non-Compliance

Non-compliance with the requirements of the Indiana inventory report can lead to several penalties, including:

- Fines imposed by the Indiana DOR for late submissions.

- Increased scrutiny during audits, which may result in additional tax liabilities.

- Potential legal consequences if discrepancies are found in reported inventory levels.

Digital vs. Paper Version of the Indiana Inventory Report

Businesses have the option to submit the Indiana inventory report in either digital or paper format. The digital version often streamlines the process, allowing for quicker submission and processing times. However, some businesses may prefer the traditional paper method for record-keeping purposes. It is important to choose the method that best fits your operational needs while ensuring compliance with state regulations.

Quick guide on how to complete dor tax talk ingov

Effortlessly Prepare DOR Tax Talk IN gov on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-conscious substitute for conventional printed and signed agreements, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage DOR Tax Talk IN gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest way to alter and eSign DOR Tax Talk IN gov without hassle

- Locate DOR Tax Talk IN gov and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in several clicks from any device you prefer. Modify and eSign DOR Tax Talk IN gov and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor tax talk ingov

Create this form in 5 minutes!

How to create an eSignature for the dor tax talk ingov

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an Indiana inventory report?

An Indiana inventory report is a comprehensive document that details the assets and inventory of a business operating in Indiana. It typically includes information on stock levels, valuation, and turnover rates. This report is essential for maintaining accurate records, ensuring compliance, and facilitating informed business decisions.

-

How can airSlate SignNow help with Indiana inventory reports?

airSlate SignNow streamlines the process of creating and signing Indiana inventory reports by providing an easy-to-use platform for document management. With features like electronic signatures and templates, businesses can quickly generate and send inventory reports for review and approval. This not only saves time but also enhances accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for Indiana inventory reports?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, whether you're a small startup or a large enterprise. The pricing is structured to provide value, allowing you to manage multiple Indiana inventory reports without breaking the bank. Check the website for the latest pricing options and features included in each plan.

-

Are there any specific features tailored for Indiana inventory reporting?

Yes, airSlate SignNow includes features specifically designed for generating Indiana inventory reports, such as customizable templates and easy integration with accounting software. These features allow users to create accurate and professional inventory reports quickly. The platform also supports document tracking and audit trails for enhanced accountability.

-

Can I integrate airSlate SignNow with my existing inventory management system?

Absolutely! airSlate SignNow can be integrated with various inventory management systems to streamline the creation of Indiana inventory reports. This integration allows users to pull data directly from their inventory systems, ensuring that reports are up-to-date and accurate. Consult the integration documentation for specifics on compatibility.

-

What are the benefits of using airSlate SignNow for managing Indiana inventory reports?

Using airSlate SignNow for Indiana inventory reports enhances efficiency and accuracy, reducing the chances of errors in your documentation. The platform's electronic signature feature speeds up approval processes, accelerating overall business operations. Additionally, its user-friendly interface simplifies the reporting process, making it accessible to all team members.

-

Is there support available for using airSlate SignNow for Indiana inventory reporting?

Yes, airSlate SignNow offers robust customer support for users managing Indiana inventory reports. Whether you need help with setup, integration, or any specific feature, their support team is available to assist. Comprehensive resources, including tutorials and FAQs, are also provided to guide you through the process.

Get more for DOR Tax Talk IN gov

Find out other DOR Tax Talk IN gov

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter