Lansing Income Tax Form 2019

What is the Lansing Income Tax Form

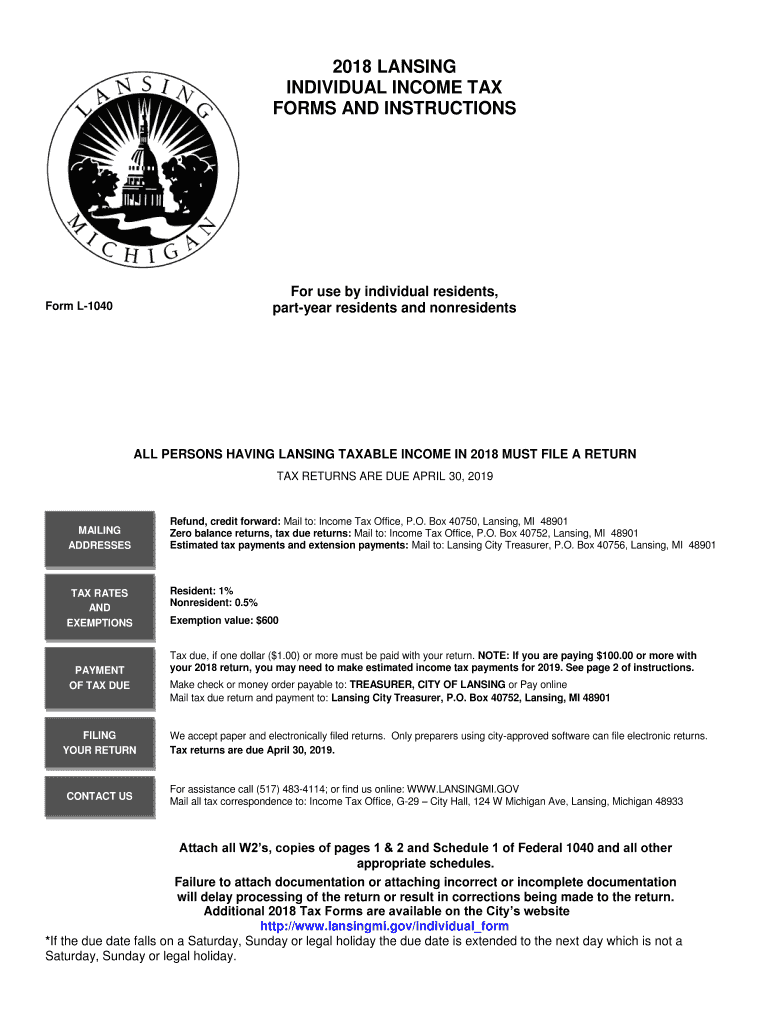

The Lansing Income Tax Form is a document required for individuals residing or earning income within the city of Lansing, Michigan. This form is essential for reporting income and calculating the appropriate city income tax owed. It is designed to ensure compliance with local tax regulations and is a critical component of the tax filing process for residents and non-residents who earn income in Lansing.

How to use the Lansing Income Tax Form

Using the Lansing Income Tax Form involves several steps to accurately report your income and calculate your tax liability. First, gather all necessary financial documents, such as W-2s and 1099s. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all sources of income and apply any deductions or credits you may qualify for. Finally, review your completed form for accuracy before submission.

Steps to complete the Lansing Income Tax Form

Completing the Lansing Income Tax Form requires careful attention to detail. Follow these steps:

- Collect all relevant income documents, such as W-2 forms and any other income statements.

- Enter your personal information accurately at the top of the form.

- Report your total income from all sources in the designated section.

- Apply any eligible deductions or credits according to the instructions provided.

- Calculate your total tax liability based on the information entered.

- Sign and date the form to certify its accuracy.

Legal use of the Lansing Income Tax Form

The Lansing Income Tax Form is legally binding when filled out correctly and submitted according to local regulations. To ensure its legal validity, it is important to adhere to the guidelines set forth by the city of Lansing. This includes providing accurate information and maintaining compliance with eSignature laws if the form is submitted electronically. The use of a reliable electronic signature solution can further enhance the legal standing of your submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Lansing Income Tax Form are crucial to avoid penalties. Typically, the deadline for filing individual income tax returns is April fifteenth of the following year. However, it is important to verify specific dates for the tax year in question. Additionally, if you owe taxes, payments are generally due on the same date as the filing deadline. Keeping track of these important dates will help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Lansing Income Tax Form can be submitted through various methods to accommodate different preferences. You can file online using the city’s designated tax portal, which offers a streamlined process for electronic submissions. Alternatively, you may print the completed form and mail it to the appropriate city department. In-person submissions are also possible at designated city offices, providing a direct option for those who prefer face-to-face interactions.

Quick guide on how to complete lansing income tax form

Prepare Lansing Income Tax Form effortlessly on any device

Web-based document management has become popular with companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without any delays. Manage Lansing Income Tax Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Lansing Income Tax Form without hassle

- Find Lansing Income Tax Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Lansing Income Tax Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lansing income tax form

Create this form in 5 minutes!

How to create an eSignature for the lansing income tax form

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 2018 online individual income tax form for city of Lansing?

The 2018 online individual income tax form for city of Lansing is a digital document that allows residents to file their income tax returns online. It streamlines the process of submitting your financial information to the city, ensuring accuracy and ease of access. By using this form, you can complete your tax obligations quickly and efficiently.

-

How can I access the 2018 online individual income tax form for city of Lansing?

You can access the 2018 online individual income tax form for city of Lansing directly through the official city website or through authorized tax service providers. Ensure you have the necessary documentation ready to fill out the form accurately. Once completed, you can submit it electronically for faster processing.

-

Is there a cost associated with filing the 2018 online individual income tax form for city of Lansing?

While the 2018 online individual income tax form for city of Lansing can be accessed for free, some tax preparation services may charge fees for additional assistance. It's important to review the pricing structure of any third-party services you might consider using. Utilizing airSlate SignNow can also provide cost-effective eSigning solutions.

-

What features does the airSlate SignNow platform offer for the 2018 online individual income tax form for city of Lansing?

The airSlate SignNow platform offers features such as eSigning, document sharing, and secure storage, making the completion of the 2018 online individual income tax form for city of Lansing both efficient and straightforward. You can collaborate with tax professionals or family members directly within the platform. This enhances productivity and ensures a hassle-free experience.

-

How does using airSlate SignNow benefit my filing of the 2018 online individual income tax form for city of Lansing?

Using airSlate SignNow for the 2018 online individual income tax form for city of Lansing provides several benefits, including time savings and secure document handling. It eliminates the need for physical paperwork and allows for easy tracking of your submission process. With user-friendly tools, you can ensure your tax filing is done accurately and without delays.

-

Can I integrate other applications with airSlate SignNow when filing the 2018 online individual income tax form for city of Lansing?

Yes, airSlate SignNow allows integration with various applications, making it easier to manage documents related to your 2018 online individual income tax form for city of Lansing. This seamless integration enhances your workflow, allowing you to gather necessary data from different platforms efficiently. You can incorporate your preferred financial tools to streamline your filing process.

-

What documents do I need to complete the 2018 online individual income tax form for city of Lansing?

To complete the 2018 online individual income tax form for city of Lansing, you will need several documents including W-2 forms, 1099 forms, and any other income-related statements. Additionally, prepare any deductions or credits you plan to claim. Having these documents ready will facilitate a smooth and accurate filing process.

Get more for Lansing Income Tax Form

Find out other Lansing Income Tax Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online