1040 Form and Instructions Long Form 2020

What is the 1040 Form and Instructions Long Form

The 1040 Form is a standard federal income tax form used by individuals in the United States to report their income, calculate their tax liability, and determine whether they owe additional taxes or are eligible for a tax refund. The long form provides a comprehensive method for taxpayers to detail their income sources, deductions, and credits. It is essential for those with more complex financial situations, such as self-employed individuals or those with significant itemized deductions.

Steps to Complete the 1040 Form and Instructions Long Form

Completing the 1040 Form involves several key steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documents, including W-2s, 1099s, and records of deductible expenses. Next, fill out personal information, such as your name, address, and Social Security number. Then, report your income by listing all sources and corresponding amounts. After that, calculate adjustments to income and determine your taxable income. Finally, apply any tax credits and deductions, and calculate your total tax liability or refund. Review your form for accuracy before submission.

How to Obtain the 1040 Form and Instructions Long Form

The 1040 Form and its instructions can be obtained from various sources. The most straightforward method is to visit the official IRS website, where you can download and print the form along with the instructions. Additionally, many local libraries and post offices provide physical copies. Tax preparation software often includes the 1040 Form, allowing for easy electronic filing. Ensure you have the correct version for the tax year you are filing.

Legal Use of the 1040 Form and Instructions Long Form

The 1040 Form is legally recognized as a valid document for reporting personal income to the IRS. To ensure its legal standing, it must be completed accurately and submitted by the designated deadline. Electronic submissions are accepted, provided they adhere to IRS regulations. Using a reliable eSignature platform, like signNow, can enhance the legal validity of your electronically filed forms by ensuring compliance with eSignature laws, such as ESIGN and UETA.

Required Documents for the 1040 Form and Instructions Long Form

To complete the 1040 Form accurately, several documents are essential. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation for deductible expenses, such as receipts and bank statements

- Previous year’s tax return for reference

Having these documents organized will streamline the completion process and help ensure all income and deductions are accurately reported.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Form are crucial to avoid penalties. Typically, the deadline for submitting your tax return is April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. For taxpayers who require additional time, filing for an extension is possible, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete 2020 1040 form and instructions long form

Handle 1040 Form And Instructions Long Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 1040 Form And Instructions Long Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 1040 Form And Instructions Long Form with ease

- Locate 1040 Form And Instructions Long Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your document, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign 1040 Form And Instructions Long Form and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 1040 form and instructions long form

Create this form in 5 minutes!

How to create an eSignature for the 2020 1040 form and instructions long form

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

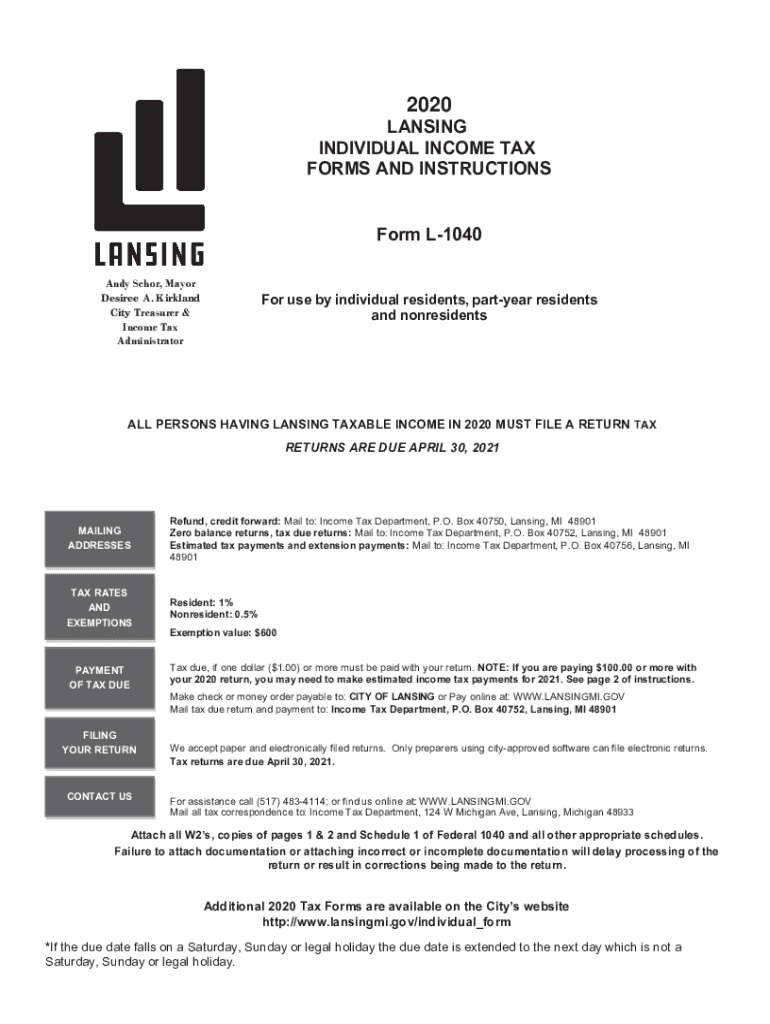

What are Lansing tax forms 2019 and why are they important?

Lansing tax forms 2019 are official documents required for individuals and businesses in Lansing to accurately report their income and determine their tax obligations for that year. Completing these forms is crucial for compliance with state tax laws and to avoid penalties. Using airSlate SignNow, you can easily eSign and submit these forms securely and efficiently.

-

How can airSlate SignNow help with filing Lansing tax forms 2019?

airSlate SignNow simplifies the process of filing Lansing tax forms 2019 by allowing users to fill out, eSign, and share documents seamlessly. With our user-friendly interface, you can ensure that all necessary details are accurately completed. This not only saves time but also reduces the risk of errors that can lead to complications with tax authorities.

-

What pricing plans does airSlate SignNow offer for eSigning Lansing tax forms 2019?

airSlate SignNow offers a variety of pricing plans to cater to different business needs when managing Lansing tax forms 2019. Our pricing is competitive and designed to provide value by including features such as unlimited document signing and cloud storage. You can choose a plan that suits your budget and business size, ensuring affordability without compromising on features.

-

Are there any features specifically useful for dealing with Lansing tax forms 2019?

Yes, airSlate SignNow includes features tailored for working with Lansing tax forms 2019, such as template creation and automatic reminders. You can create reusable templates for common tax forms to streamline your future filings. Additionally, automated reminders help ensure you stay on top of deadlines, preventing last-minute rushes.

-

Can I integrate airSlate SignNow with other software for Lansing tax forms 2019?

Absolutely! airSlate SignNow offers integrations with various software applications that can assist in managing Lansing tax forms 2019. Whether you use accounting software or document management systems, our platform can seamlessly connect with them to enhance your workflow and document processing efficiency.

-

What are the benefits of using airSlate SignNow for Lansing tax forms 2019?

Using airSlate SignNow for Lansing tax forms 2019 provides numerous benefits, including enhanced efficiency, security, and convenience. With our solution, you can sign forms electronically from anywhere, reducing the need for physical paperwork. Moreover, your documents are stored securely, ensuring that sensitive information is protected throughout the filing process.

-

Is airSlate SignNow easy to use for filing Lansing tax forms 2019?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to file Lansing tax forms 2019. The intuitive interface guides you through the process, ensuring that even those who are not tech-savvy can navigate our platform with ease. Comprehensive support resources are also available to assist you whenever needed.

Get more for 1040 Form And Instructions Long Form

Find out other 1040 Form And Instructions Long Form

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure