Treasury & Income Tax OfficeLansing, MI Official Website 2022

How to complete the Lansing income tax form

Filling out the Lansing income tax form requires careful attention to detail. Begin by gathering all necessary personal information, including your Social Security number, address, and income details. Ensure you have your W-2 forms or 1099s available, as these documents provide essential income data. The form typically includes sections for reporting your total income, deductions, and any applicable credits.

Each section of the form should be completed accurately, as errors can lead to delays or penalties. After filling out the form, review all entries for accuracy. If you are using a digital tool like signNow, you can easily edit and adjust your entries before finalizing the document.

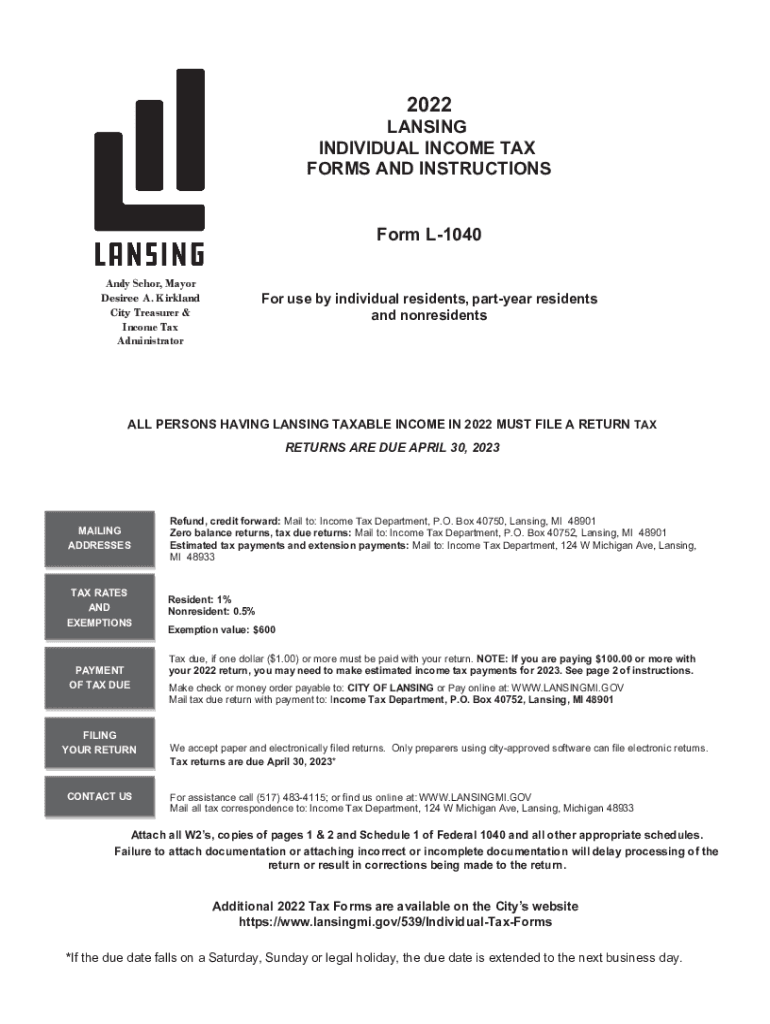

Filing deadlines and important dates

Understanding the filing deadlines for the Lansing income tax form is crucial to avoid penalties. Typically, the deadline for submitting your local income tax return is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's advisable to check for any specific updates or changes from the Lansing Treasury & Income Tax Office.

Additionally, if you need more time to complete your return, you may be able to request an extension. However, this does not extend the time to pay any taxes owed, so be sure to estimate and pay any due amounts by the original deadline.

Required documents for filing

To successfully complete the Lansing income tax form, you will need several key documents. These typically include:

- W-2 forms from employers, detailing your earnings and withheld taxes

- 1099 forms for any freelance or contract work

- Records of other income, such as rental or investment income

- Receipts for deductible expenses, if applicable

- Previous year's tax return for reference

Having these documents organized and accessible will streamline the filing process and help ensure accuracy in your tax return.

Form submission methods

The Lansing income tax form can be submitted through various methods, providing flexibility for taxpayers. You can choose to file online using secure digital platforms, which often allow for easy completion and submission. Alternatively, you may print the completed form and mail it directly to the Lansing Treasury & Income Tax Office.

For those who prefer in-person interactions, visiting the office to submit your form is also an option. Regardless of the method chosen, ensure that you retain copies of all submitted documents for your records.

Penalties for non-compliance

Failing to file the Lansing income tax form on time can result in significant penalties. These may include late fees and interest on any taxes owed. The city may also impose additional penalties for inaccuracies or failure to report income. It is essential to understand these potential consequences to avoid unnecessary financial burdens.

To mitigate risks, consider filing your return early and ensuring that all information is complete and accurate. If you encounter challenges, consulting with a tax professional can provide guidance and support.

Eligibility criteria for filing

Eligibility to file the Lansing income tax form generally depends on your residency status and income level. Residents of Lansing are required to file if they earn above a certain threshold, while non-residents may need to file if they earn income sourced from Lansing.

It is important to review the specific eligibility criteria set forth by the Lansing Treasury & Income Tax Office, as these guidelines can change. Ensuring you meet the necessary requirements will help you avoid complications during the filing process.

Quick guide on how to complete treasury ampamp income tax officelansing mi official website

Complete Treasury & Income Tax OfficeLansing, MI Official Website effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Treasury & Income Tax OfficeLansing, MI Official Website on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Treasury & Income Tax OfficeLansing, MI Official Website without hassle

- Find Treasury & Income Tax OfficeLansing, MI Official Website and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Treasury & Income Tax OfficeLansing, MI Official Website while ensuring effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct treasury ampamp income tax officelansing mi official website

Create this form in 5 minutes!

How to create an eSignature for the treasury ampamp income tax officelansing mi official website

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lansing income tax form, and why do I need it?

The Lansing income tax form is a mandatory document for residents and businesses in Lansing to report their income and calculate their taxation. Filing this form accurately helps avoid penalties and ensures compliance with local tax laws.

-

How can airSlate SignNow help with the Lansing income tax form?

airSlate SignNow streamlines the process of completing and eSigning the Lansing income tax form. Our platform allows you to easily upload, fill out, and send the form securely, saving you time and minimizing errors.

-

Is there a cost associated with using airSlate SignNow for the Lansing income tax form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different needs. Our plans are affordable and designed to provide the best value for businesses looking to manage the Lansing income tax form efficiently.

-

Are there any features specifically designed for the Lansing income tax form?

Absolutely! airSlate SignNow provides features like templates for the Lansing income tax form, customizable fields, and integration with tax software, ensuring a smooth filing process. Our platform enhances efficiency and accuracy.

-

Can I use airSlate SignNow on any device to fill out the Lansing income tax form?

Yes, airSlate SignNow is fully compatible with various devices, including desktops, tablets, and smartphones. You can access and complete the Lansing income tax form anytime and anywhere with our cloud-based solution.

-

How secure is airSlate SignNow when handling my Lansing income tax form?

Security is a top priority for airSlate SignNow. We implement robust encryption and security protocols to protect your data while you fill out and eSign your Lansing income tax form, ensuring confidentiality and compliance.

-

What integrations does airSlate SignNow offer for managing the Lansing income tax form?

airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the Lansing income tax form. This integration allows for quick data transfers and ensures your information is up-to-date.

Get more for Treasury & Income Tax OfficeLansing, MI Official Website

Find out other Treasury & Income Tax OfficeLansing, MI Official Website

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online