Adsearch Yahoo Comlearnmore 2021

IRS Guidelines

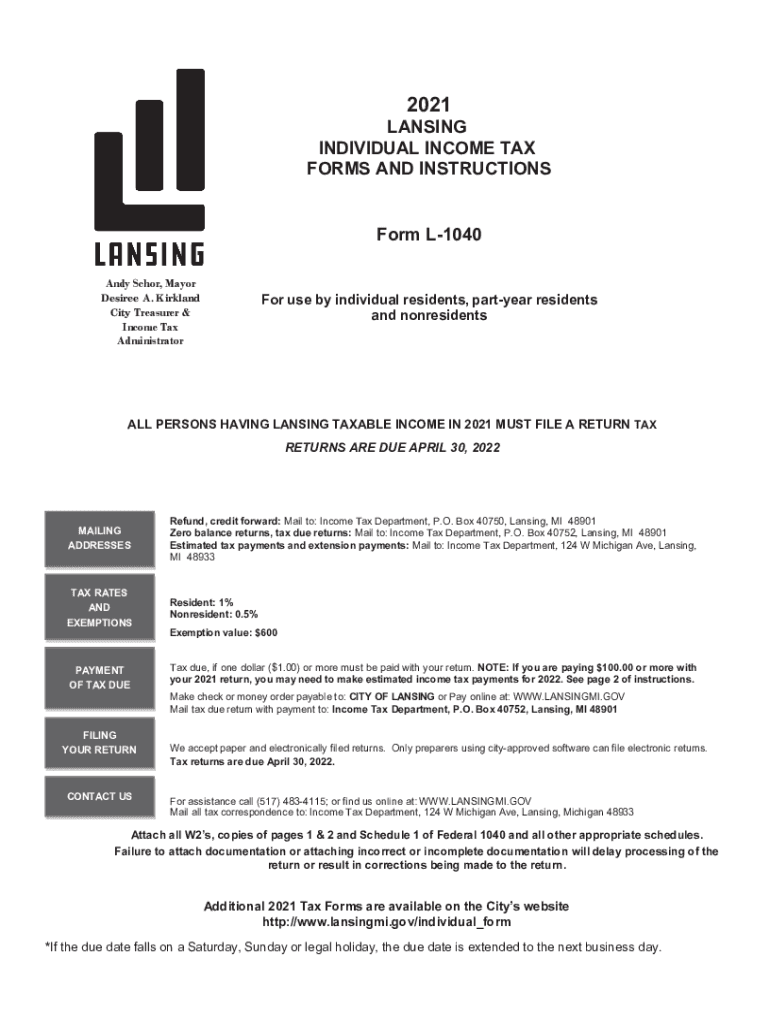

The IRS provides detailed guidelines for filling out the 1040 instructions city form, which is essential for accurate tax reporting. These guidelines outline the necessary steps to ensure compliance with federal tax laws. Taxpayers should familiarize themselves with the specific requirements for their city, as local regulations may influence how the form is completed. The IRS website offers resources that clarify the process and provide updates on any changes to tax laws that may affect the filing of the 1040 instructions city form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1040 instructions city form is crucial for avoiding penalties. Typically, the deadline for submitting tax returns is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any state-specific deadlines that may apply. Keeping track of these dates can help ensure timely submissions and maintain compliance with tax obligations.

Required Documents

To complete the 1040 instructions city form accurately, taxpayers must gather several required documents. These typically include W-2 forms from employers, 1099 forms for additional income, and any relevant documentation for deductions or credits. Having these documents organized and readily available can streamline the filing process and reduce the likelihood of errors. It's advisable to review the specific requirements for the city to ensure all necessary documents are included.

Form Submission Methods (Online / Mail / In-Person)

The 1040 instructions city form can be submitted through various methods, providing flexibility for taxpayers. Options include filing online through authorized e-filing services, mailing a paper form to the appropriate tax authority, or submitting in-person at designated locations. Each method has its advantages, such as faster processing times for online submissions and the ability to track the status of e-filed returns. Taxpayers should choose the method that best suits their needs while ensuring compliance with local regulations.

Penalties for Non-Compliance

Failing to comply with the requirements for the 1040 instructions city form can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is essential for taxpayers to understand the implications of non-compliance and take proactive steps to meet their filing obligations. Regularly reviewing tax regulations and seeking assistance when needed can help mitigate the risk of penalties.

Eligibility Criteria

Eligibility criteria for filing the 1040 instructions city form may vary based on factors such as income level, residency status, and specific deductions or credits. Taxpayers should assess their eligibility to ensure they are using the correct form and following the appropriate guidelines. Understanding these criteria can help avoid complications during the filing process and ensure that taxpayers benefit from any applicable tax advantages.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can significantly impact how the 1040 instructions city form is completed. For instance, self-employed individuals may need to report additional income and expenses, while retirees might have different sources of income to consider. Students may qualify for specific credits or deductions related to education expenses. Recognizing these unique situations allows taxpayers to tailor their filings accordingly and maximize their potential refunds.

Quick guide on how to complete adsearchyahoocomlearnmore

Complete Adsearch yahoo comlearnmore effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Adsearch yahoo comlearnmore on any system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Adsearch yahoo comlearnmore with ease

- Locate Adsearch yahoo comlearnmore and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Adsearch yahoo comlearnmore and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct adsearchyahoocomlearnmore

Create this form in 5 minutes!

People also ask

-

What are the 1040 instructions city related features of airSlate SignNow?

airSlate SignNow offers intuitive features for handling 1040 instructions city documents, including eSigning, templates, and document tracking. This allows users to streamline their tax filing process while ensuring compliance with local regulations. Additionally, our platform offers a secure cloud storage solution for all your documents.

-

How does airSlate SignNow help with 1040 instructions city compliance?

By using airSlate SignNow, you can easily incorporate the latest 1040 instructions city guidelines into your document workflow. Our software keeps you updated on tax regulations, ensuring that your documents are compliant with current laws. This feature minimizes the risk of errors and audits, making tax season less stressful.

-

What is the pricing structure for utilizing airSlate SignNow related to 1040 instructions city?

AirSlate SignNow offers competitive pricing plans tailored for individuals and businesses needing assistance with 1040 instructions city. We provide various subscription tiers that align with your eSigning and document management needs. You can choose a plan that consistently fits your budget while enjoying premium features!

-

Can I integrate airSlate SignNow with other tax software for 1040 instructions city?

Yes! airSlate SignNow easily integrates with popular tax software and accounting tools, enhancing your workflow for handling 1040 instructions city. This integration allows users to import documents seamlessly and ensures that all necessary paperwork is easily accessible, saving you time and effort during tax season.

-

What are the benefits of using airSlate SignNow for 1040 instructions city documents?

Using airSlate SignNow for your 1040 instructions city documentation provides numerous benefits, including enhanced efficiency and improved accuracy. Our eSigning capabilities allow for faster processing of tax documents, while real-time tracking ensures everyone involved knows the document status. This results in a streamlined process that saves you valuable time.

-

Is airSlate SignNow secure for storing 1040 instructions city sensitive data?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive 1040 instructions city data. With secure cloud storage, data encryption, and multi-factor authentication, our platform ensures that your information remains confidential and safe from unauthorized access.

-

How does airSlate SignNow simplify the eSigning process for 1040 instructions city?

AirSlate SignNow simplifies the eSigning process for 1040 instructions city by providing an intuitive interface that makes document signing quick and straightforward. Users can sign documents from any device, at any time, reducing the hassle associated with traditional signing methods. This convenience helps you finalize your tax returns faster.

Get more for Adsearch yahoo comlearnmore

- North carolina disabled form

- Quitclaim deed husband and wife to three individuals north carolina form

- North carolina general warranty deed form

- North carolina general nc form

- North carolina llc search form

- Quitclaim deed from individual to two individuals in joint tenancy north carolina form

- North carolina satisfaction form

- North carolina husband wife 497316852 form

Find out other Adsearch yahoo comlearnmore

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form