Topic No 502 Medical and Dental ExpensesInternal 2019

Understanding the AR3 Online Form

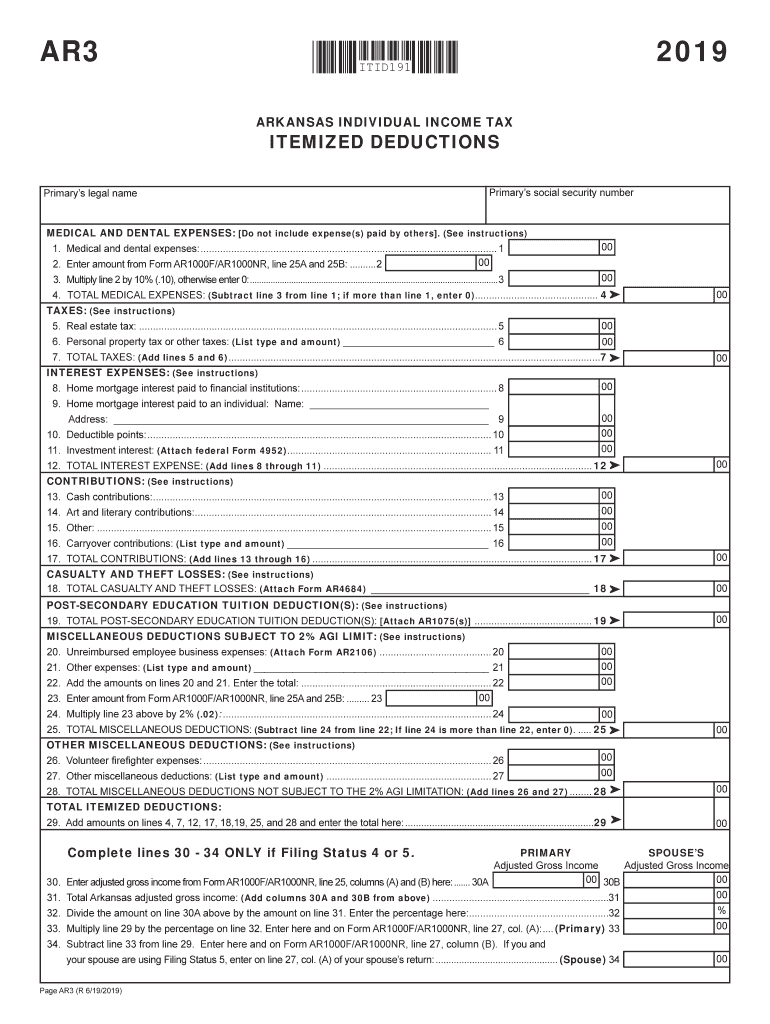

The AR3 online form is essential for Arkansas taxpayers who need to report their itemized deductions. This form allows individuals to detail their medical and dental expenses, mortgage interest, property taxes, and other qualifying deductions. Completing the AR3 online streamlines the filing process, making it more efficient and accessible for users across the state.

Steps to Complete the AR3 Online Form

Filling out the AR3 online form involves several key steps:

- Gather necessary documentation, including receipts for medical expenses, mortgage statements, and property tax bills.

- Access the AR3 online form through a secure platform that supports eSignatures.

- Input your personal information and financial details accurately, ensuring all entries match your supporting documents.

- Review your entries for accuracy before submitting the form.

- Submit the form electronically and retain a copy for your records.

Legal Use of the AR3 Online Form

The AR3 online form is legally recognized when completed according to Arkansas state tax laws. It is important to ensure that all information provided is truthful and accurate to avoid potential penalties. Utilizing a reliable electronic signature solution can enhance the legal standing of your submission, ensuring compliance with state regulations.

Required Documents for the AR3 Online Form

To successfully complete the AR3 online form, you will need to gather the following documents:

- Receipts for medical and dental expenses.

- Form 1098 for mortgage interest paid.

- Property tax statements.

- Any other documentation that supports your itemized deductions.

Filing Deadlines for the AR3 Online Form

It is crucial to be aware of the filing deadlines for the AR3 online form to avoid late fees and penalties. Generally, the deadline for submitting your Arkansas state tax return, including the AR3 form, aligns with the federal tax deadline, which is typically April 15. However, it is advisable to verify specific dates each tax year as they may vary.

Examples of Using the AR3 Online Form

Many taxpayers benefit from using the AR3 online form to maximize their deductions. For instance, a homeowner who paid significant mortgage interest and property taxes can use the AR3 to claim these expenses, potentially lowering their taxable income. Similarly, individuals with high medical expenses may find that itemizing these costs on the AR3 provides a greater tax benefit than taking the standard deduction.

Quick guide on how to complete topic no 502 medical and dental expensesinternal

Complete Topic No 502 Medical And Dental ExpensesInternal effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Handle Topic No 502 Medical And Dental ExpensesInternal on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Topic No 502 Medical And Dental ExpensesInternal without hassle

- Locate Topic No 502 Medical And Dental ExpensesInternal and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your document: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Topic No 502 Medical And Dental ExpensesInternal while ensuring outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct topic no 502 medical and dental expensesinternal

Create this form in 5 minutes!

How to create an eSignature for the topic no 502 medical and dental expensesinternal

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is ar3 online and how does it work?

ar3 online is a digital solution provided by airSlate SignNow that allows users to effortlessly eSign documents and manage their signing processes. It utilizes advanced technology to ensure that document workflows are streamlined, making it ideal for businesses looking to save time and resources.

-

How much does ar3 online cost?

The pricing for ar3 online is designed to be cost-effective, with various plans tailored to meet different organizational needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while accessing all the essential features of airSlate SignNow.

-

What are the key features of ar3 online?

ar3 online offers a robust set of features, including customizable templates, real-time tracking, and the ability to sign documents from anywhere. Additionally, users can integrate with popular applications to streamline their workflow further and enhance productivity.

-

Can I integrate ar3 online with other tools?

Yes, ar3 online supports integration with a wide range of applications, making it easy to incorporate into your existing workflow. Integrations with tools like Google Drive, Salesforce, and various CRMs allow users to automate document processes without any disruption.

-

What benefits does ar3 online provide for businesses?

By using ar3 online, businesses can signNowly reduce the time spent on document management and increase overall efficiency. The user-friendly interface and comprehensive features lead to faster signing processes, ensuring that agreements are executed promptly and securely.

-

Is ar3 online secure for eSigning documents?

Absolutely, ar3 online prioritizes security and compliance, using industry-standard encryption and authentication methods. This ensures that all documents signed through airSlate SignNow are protected, giving users peace of mind when handling sensitive information.

-

Who can benefit from using ar3 online?

ar3 online is perfect for various industries, including real estate, healthcare, and legal sectors. Any business that requires document signing can benefit from the efficiency and simplicity that airSlate SignNow offers, making it accessible for everyone.

Get more for Topic No 502 Medical And Dental ExpensesInternal

Find out other Topic No 502 Medical And Dental ExpensesInternal

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement