Medical and Dental Expenses Tax Credit Benefits Gov 2022

Understanding the Arkansas Itemized Deduction

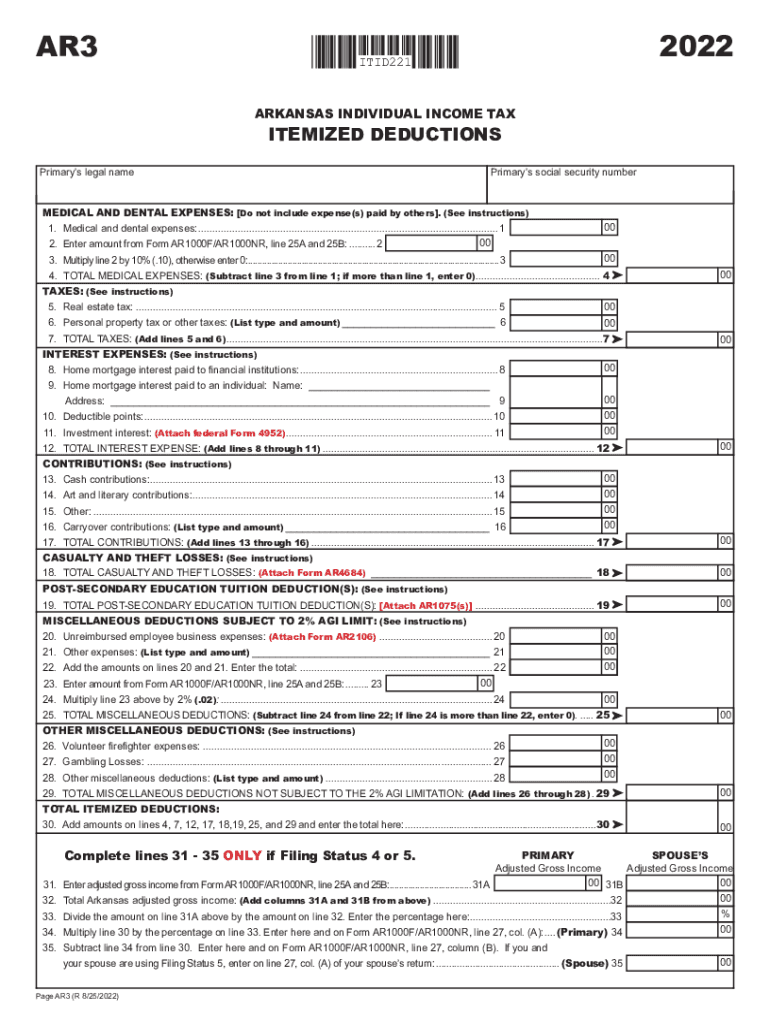

The Arkansas itemized deduction allows taxpayers to deduct specific expenses from their taxable income. This can lead to a lower overall tax liability. Common deductions include medical expenses, mortgage interest, state and local taxes, and charitable contributions. It is essential for taxpayers to determine whether itemizing deductions or taking the standard deduction will yield a more beneficial tax outcome.

Eligibility Criteria for the Arkansas Itemized Deduction

To qualify for the Arkansas itemized deduction, taxpayers must meet certain criteria. These include:

- Filing status: The deduction applies to individual taxpayers and married couples filing jointly, among other statuses.

- Itemized expenses: Taxpayers must have eligible expenses that exceed the standard deduction for their filing status.

- Documentation: Proper documentation must be maintained to substantiate each claimed deduction.

Steps to Complete the Arkansas Itemized Deduction Form

Completing the Arkansas itemized deduction form involves several key steps:

- Gather all relevant financial documents, including receipts for medical expenses, mortgage statements, and records of charitable contributions.

- Calculate the total amount of eligible itemized deductions.

- Fill out the Arkansas deduction form accurately, ensuring all figures are correct and supported by documentation.

- Review the completed form for accuracy before submission.

Required Documents for Filing the Arkansas Itemized Deduction

When filing for the Arkansas itemized deduction, taxpayers should prepare the following documents:

- Receipts for medical and dental expenses.

- Mortgage interest statements (Form 1098).

- Records of state and local taxes paid.

- Documentation of charitable contributions, such as receipts or bank statements.

IRS Guidelines for Itemized Deductions

The IRS provides specific guidelines regarding itemized deductions that Arkansas taxpayers must follow. These guidelines outline which expenses are eligible and the limits on certain deductions. Taxpayers should refer to IRS publications or consult a tax professional to ensure compliance with federal tax laws.

Filing Deadlines for the Arkansas Itemized Deduction

Taxpayers must be aware of important filing deadlines to avoid penalties. Typically, the deadline for filing state tax returns, including the Arkansas itemized deduction form, aligns with the federal tax deadline, which is usually April 15. Extensions may be available, but they must be filed timely to avoid late fees.

Quick guide on how to complete medical and dental expenses tax credit benefitsgov

Effortlessly Prepare Medical And Dental Expenses Tax Credit Benefits gov on Any Device

Digital document management has gained signNow traction among both businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without any delays. Handle Medical And Dental Expenses Tax Credit Benefits gov on any device with the airSlate SignNow applications for Android or iOS, enhancing any document-driven process today.

The easiest way to edit and eSign Medical And Dental Expenses Tax Credit Benefits gov without hassle

- Find Medical And Dental Expenses Tax Credit Benefits gov and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Medical And Dental Expenses Tax Credit Benefits gov to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct medical and dental expenses tax credit benefitsgov

Create this form in 5 minutes!

How to create an eSignature for the medical and dental expenses tax credit benefitsgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the benefit of using airSlate SignNow for filing Arkansas itemized deductions?

Using airSlate SignNow for filing your Arkansas itemized deductions can streamline your document management process. The platform enables you to easily prepare, send, and eSign all necessary documents, ensuring that you stay compliant with Arkansas tax laws. Its user-friendly interface and affordable pricing make it a great solution for both individuals and businesses.

-

How does airSlate SignNow integrate with Arkansas tax software for itemized deductions?

airSlate SignNow integrates seamlessly with popular Arkansas tax software, allowing you to sync your documentation directly with your tax filings. This integration simplifies the process of managing your Arkansas itemized deductions by centralizing all documents in one place. You can ensure accuracy and save time by eliminating manual data entry.

-

Is there a cost associated with using airSlate SignNow for Arkansas itemized deductions?

Yes, airSlate SignNow offers flexible pricing plans that cater to various needs, making it a cost-effective solution for handling Arkansas itemized deductions. You can choose from different pricing tiers depending on your usage requirements. With pay-as-you-go options, you only pay for what you need, ensuring you get the best value.

-

Can I create custom templates for Arkansas itemized deduction forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create custom templates for your Arkansas itemized deduction forms, making it easy to reuse documents for future filings. With customizable fields, you can tailor each template to fit the unique needs of your tax situation. This feature saves time and helps maintain accuracy in your submissions.

-

How secure is the airSlate SignNow platform for Arkansas itemized deductions?

airSlate SignNow prioritizes security, ensuring that all documents related to Arkansas itemized deductions are encrypted and stored safely. The platform complies with industry standards for data protection, giving you peace of mind while handling sensitive financial information. You can trust that your documents are secure from unauthorized access.

-

What types of documents can I manage for Arkansas itemized deductions using airSlate SignNow?

You can manage a variety of documents for Arkansas itemized deductions using airSlate SignNow, including W-2s, 1099s, and other related tax forms. The platform supports multiple document types, allowing you to seamlessly prepare all necessary paperwork for submission. This versatility helps you stay organized during tax season.

-

Does airSlate SignNow offer customer support for issues related to Arkansas itemized deductions?

Yes, airSlate SignNow provides robust customer support for any issues related to your Arkansas itemized deductions. Whether you have queries about functionality or need help with specific tax forms, their support team is readily available to assist you. You can signNow out through various channels, including chat and email.

Get more for Medical And Dental Expenses Tax Credit Benefits gov

Find out other Medical And Dental Expenses Tax Credit Benefits gov

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF