Can I Claim Dental Expenses on My Taxes? Find Out Here 2024-2026

Understanding the Arkansas Itemized Deduction

The Arkansas itemized deduction allows taxpayers to deduct certain expenses from their taxable income, potentially lowering their overall tax liability. This deduction is available for various expenses, including medical costs, state and local taxes, mortgage interest, and charitable contributions. To qualify, taxpayers must choose to itemize their deductions instead of taking the standard deduction. Understanding what qualifies can help maximize potential savings on your Arkansas tax return.

Eligibility Criteria for the Arkansas Itemized Deduction

To be eligible for the Arkansas itemized deduction, taxpayers must meet specific criteria. Individuals must have incurred qualifying expenses during the tax year. Additionally, they must choose to itemize their deductions on their tax return rather than opting for the standard deduction. It is important to keep detailed records of all expenses claimed, as the Arkansas Department of Finance and Administration may require documentation to support the deductions taken.

Key Elements of the Arkansas Deduction Form

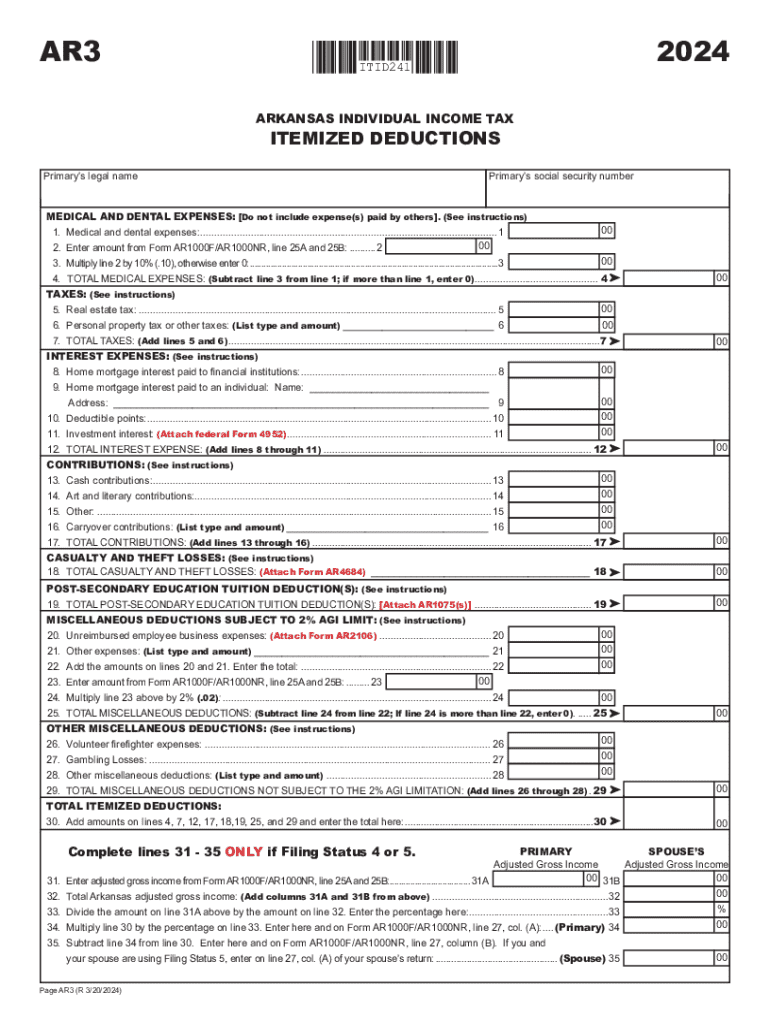

The Arkansas deduction form is essential for reporting itemized deductions on your tax return. The primary form used is the AR3, which allows taxpayers to list qualifying deductions. Key elements of this form include sections for medical expenses, state and local taxes paid, mortgage interest, and charitable contributions. Each section requires accurate reporting of amounts to ensure compliance with state tax laws.

Steps to Complete the Arkansas Itemized Deduction Form

Completing the Arkansas itemized deduction form involves several steps. First, gather all necessary documentation for your qualifying expenses. Next, obtain the AR3 form, which can be printed or filled out electronically. Fill in the required sections with accurate amounts, ensuring that all deductions are supported by receipts or other documentation. Finally, review the completed form for accuracy before submitting it with your Arkansas tax return.

Filing Deadlines for Arkansas Itemized Deductions

Filing deadlines for Arkansas itemized deductions align with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely submission of their returns and avoid penalties. Extensions may be available, but it is crucial to file the necessary paperwork before the original deadline.

IRS Guidelines for Itemized Deductions

The IRS provides comprehensive guidelines regarding itemized deductions, which apply to Arkansas taxpayers as well. These guidelines outline eligible expenses, documentation requirements, and limitations on certain deductions. Familiarizing oneself with these rules can help taxpayers navigate the complexities of itemizing deductions and ensure compliance with federal tax regulations. It is advisable to consult IRS publications or a tax professional for detailed information.

Common Scenarios for Claiming Arkansas Itemized Deductions

Various taxpayer scenarios may influence the decision to claim Arkansas itemized deductions. For instance, homeowners with substantial mortgage interest payments may benefit from itemizing. Similarly, individuals with high medical expenses or significant charitable contributions may find that itemizing provides a more considerable tax benefit than the standard deduction. Understanding these scenarios can help taxpayers make informed decisions about their tax filings.

Create this form in 5 minutes or less

Find and fill out the correct can i claim dental expenses on my taxes find out here

Create this form in 5 minutes!

How to create an eSignature for the can i claim dental expenses on my taxes find out here

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arkansas itemized deduction?

The Arkansas itemized deduction allows taxpayers to deduct certain expenses from their taxable income, potentially lowering their overall tax liability. This deduction can include medical expenses, mortgage interest, and charitable contributions. Understanding how to maximize your Arkansas itemized deduction can lead to signNow savings.

-

How can airSlate SignNow help with Arkansas itemized deduction documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to your Arkansas itemized deduction. With our user-friendly platform, you can easily manage and store important tax documents securely. This ensures that you have all necessary paperwork organized and accessible when filing your taxes.

-

What features does airSlate SignNow offer for tax professionals handling Arkansas itemized deductions?

airSlate SignNow provides features such as customizable templates, bulk sending, and real-time tracking, which are essential for tax professionals managing Arkansas itemized deductions. These tools enhance efficiency and accuracy, allowing professionals to focus on providing value to their clients. Additionally, our platform ensures compliance with legal standards.

-

Is airSlate SignNow cost-effective for managing Arkansas itemized deductions?

Yes, airSlate SignNow is a cost-effective solution for managing Arkansas itemized deductions. Our pricing plans are designed to fit various business sizes and needs, ensuring that you only pay for what you use. By reducing the time spent on document management, you can save money while maximizing your tax benefits.

-

Can I integrate airSlate SignNow with other accounting software for Arkansas itemized deductions?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your Arkansas itemized deductions. This integration allows for smooth data transfer and ensures that all your financial documents are in one place. You can enhance your workflow and improve accuracy with these integrations.

-

What are the benefits of using airSlate SignNow for Arkansas itemized deductions?

Using airSlate SignNow for Arkansas itemized deductions offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform allows you to eSign documents quickly, reducing turnaround time. Additionally, the secure storage of documents ensures that your sensitive information is protected.

-

How does airSlate SignNow ensure compliance with Arkansas tax laws regarding itemized deductions?

airSlate SignNow is designed to comply with all relevant Arkansas tax laws, including those related to itemized deductions. Our platform is regularly updated to reflect changes in legislation, ensuring that your documents meet legal requirements. This commitment to compliance helps you avoid potential issues during tax season.

Get more for Can I Claim Dental Expenses On My Taxes? Find Out Here

- Passport renewal application us passport service guide form

- Ds11pdf us department of state application for a us form

- Delaware sellers disclosure of real property condition form

- Pptc153pdf save reset form protected when completed b print form

- Wwwcourseherocomfile129036926pptc482pdf save reset form protected when completed b

- Motor vehicle commission volunteersnjgov form

- Instructions for completing the national provider identifier form

- Pdf non attendance at drug service hepatitis c outreach clinics form

Find out other Can I Claim Dental Expenses On My Taxes? Find Out Here

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter