Grand Rapids Individual Income Tax Forms and Instructions 2018

What is the Grand Rapids Individual Income Tax Forms And Instructions

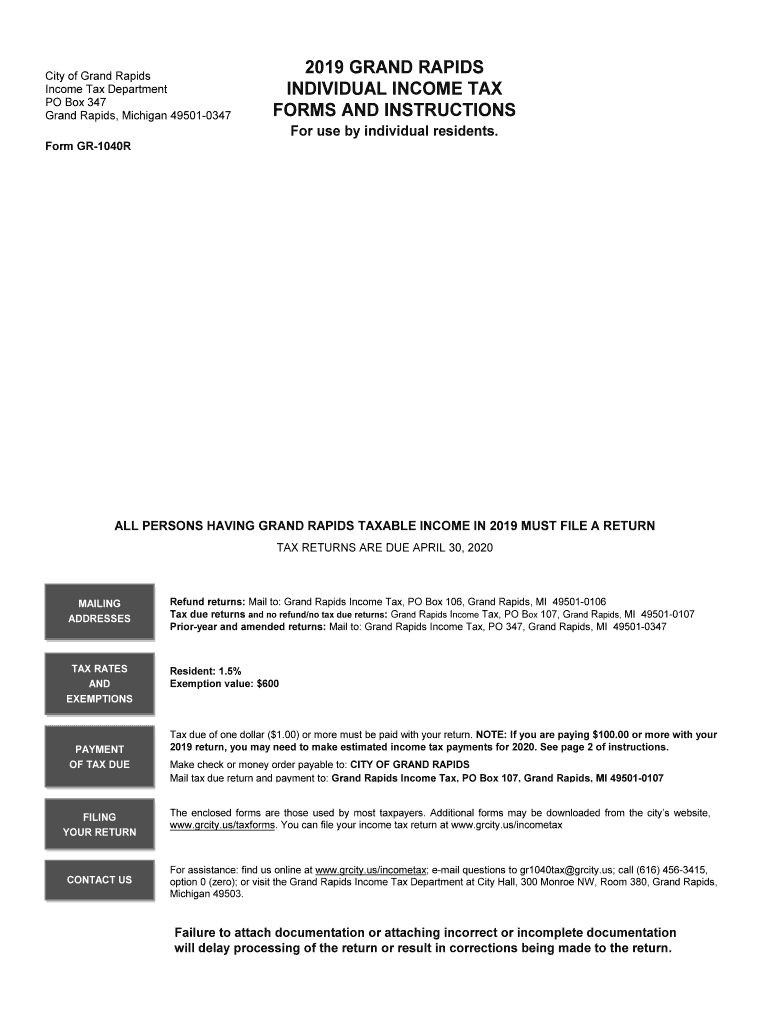

The Grand Rapids Individual Income Tax Forms and Instructions are essential documents used by residents of Grand Rapids, Michigan, to report their income and calculate their tax liabilities. These forms provide a structured way for individuals to declare their earnings, claim deductions, and determine the amount of tax owed to the city. The instructions accompanying the forms guide taxpayers through the process, ensuring compliance with local tax laws and regulations.

How to use the Grand Rapids Individual Income Tax Forms And Instructions

Using the Grand Rapids Individual Income Tax Forms involves several steps. First, taxpayers must obtain the correct forms, which can be accessed online or through local government offices. After gathering necessary financial information, such as W-2s and 1099s, individuals fill out the forms according to the provided instructions. It is important to follow the guidelines carefully to avoid errors that could lead to penalties or delays in processing. Once completed, the forms can be submitted through various methods, including online, by mail, or in person.

Steps to complete the Grand Rapids Individual Income Tax Forms And Instructions

Completing the Grand Rapids Individual Income Tax Forms involves a systematic approach:

- Gather all necessary documents, including income statements and previous tax returns.

- Download or request the Grand Rapids Individual Income Tax Forms.

- Carefully read the instructions to understand the requirements and deadlines.

- Fill out the forms accurately, ensuring all income and deductions are reported.

- Review the completed forms for any errors or omissions.

- Submit the forms through the preferred method, ensuring to keep a copy for personal records.

Legal use of the Grand Rapids Individual Income Tax Forms And Instructions

The Grand Rapids Individual Income Tax Forms are legally binding documents. When filled out and submitted correctly, they serve as official records of an individual's tax obligations. Compliance with local tax laws is crucial, as failure to file or inaccuracies can result in penalties. It is essential to ensure that all information is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Taxpayers in Grand Rapids should be aware of key filing deadlines for the Individual Income Tax Forms. Typically, the deadline for filing is April fifteenth of each year, although extensions may be available under certain circumstances. It is advisable to check for any updates or changes to the filing schedule, as local regulations may affect these dates.

Form Submission Methods (Online / Mail / In-Person)

There are multiple methods for submitting the Grand Rapids Individual Income Tax Forms. Taxpayers can choose to file online through the city’s designated portal, which offers a convenient and efficient way to submit forms. Alternatively, forms can be mailed to the appropriate tax office or delivered in person. Each method has its own set of requirements, so it is important to follow the instructions specific to the chosen submission method.

Quick guide on how to complete 2019 grand rapids individual income tax forms and instructions

Effortlessly Prepare Grand Rapids Individual Income Tax Forms And Instructions on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Grand Rapids Individual Income Tax Forms And Instructions on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Method to Alter and eSign Grand Rapids Individual Income Tax Forms And Instructions with Ease

- Obtain Grand Rapids Individual Income Tax Forms And Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Grand Rapids Individual Income Tax Forms And Instructions while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 grand rapids individual income tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the 2019 grand rapids individual income tax forms and instructions

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What are the Grand Rapids Individual Income Tax Forms and Instructions available through airSlate SignNow?

airSlate SignNow provides a comprehensive suite of Grand Rapids Individual Income Tax Forms and Instructions, streamlining the process of tax filing. Users can easily access, complete, and eSign the required forms directly within the platform. This feature ensures all necessary documentation is efficiently managed to meet local tax regulations.

-

How does airSlate SignNow ensure my Grand Rapids Individual Income Tax Forms and Instructions are secure?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption technology to protect all documents and user data, including your Grand Rapids Individual Income Tax Forms and Instructions. Additionally, it complies with industry standards and regulations to ensure your information remains confidential and secure.

-

What are the pricing options for accessing Grand Rapids Individual Income Tax Forms and Instructions on airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs, making access to Grand Rapids Individual Income Tax Forms and Instructions affordable. Whether you're a small business or a large enterprise, you can find a plan that fits your budget and allows for seamless document management. Visit our pricing page for more detailed information.

-

Can I integrate airSlate SignNow with other tools I use for filing my Grand Rapids Individual Income Tax Forms and Instructions?

Yes, airSlate SignNow provides integration with various third-party applications, enhancing your workflow for Grand Rapids Individual Income Tax Forms and Instructions. This compatibility allows you to connect seamlessly with popular tools to streamline your document signing and tax filing process, improving efficiency.

-

What are the benefits of using airSlate SignNow for Grand Rapids Individual Income Tax Forms and Instructions?

Using airSlate SignNow for Grand Rapids Individual Income Tax Forms and Instructions simplifies the tax filing process signNowly. The platform allows for quick access to forms, easy electronic signing, and secure storage of documents. These benefits save you time, reduce errors, and provide peace of mind during tax season.

-

Is there a customer support option if I have questions about Grand Rapids Individual Income Tax Forms and Instructions?

Absolutely! airSlate SignNow offers robust customer support to assist with any questions regarding Grand Rapids Individual Income Tax Forms and Instructions. You can signNow our support team through live chat, email, or phone, ensuring that you receive the help you need promptly and effectively.

-

How can I start using airSlate SignNow for my Grand Rapids Individual Income Tax Forms and Instructions?

Getting started with airSlate SignNow for your Grand Rapids Individual Income Tax Forms and Instructions is easy. Simply sign up for a free trial or select a pricing plan that suits your needs. Once registered, you’ll have immediate access to all the necessary forms and features to begin eSigning your documents.

Get more for Grand Rapids Individual Income Tax Forms And Instructions

- Insulation contract for contractor wisconsin form

- Paving contract for contractor wisconsin form

- Site work contract for contractor wisconsin form

- Siding contract for contractor wisconsin form

- Refrigeration contract for contractor wisconsin form

- Drainage contract for contractor wisconsin form

- Foundation contract for contractor wisconsin form

- Plumbing contract for contractor wisconsin form

Find out other Grand Rapids Individual Income Tax Forms And Instructions

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT