FIN 578, IBA Tax Refund of a Corporation This Form Must Be Completed by a Registered Corporation Claiming a Tax Refund under the 2016-2026

Understanding the FIN 578, IBA Tax Refund Form

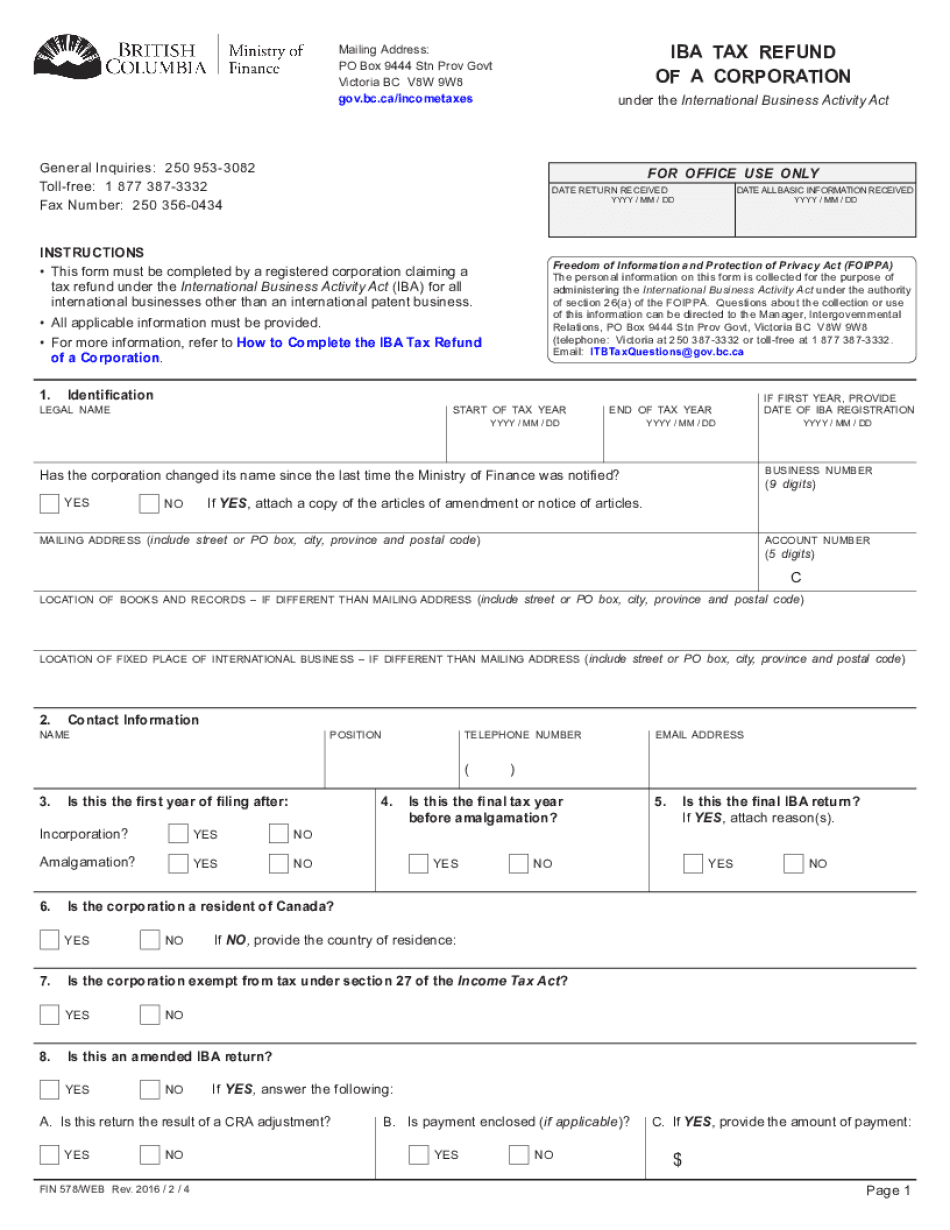

The FIN 578 form is essential for registered corporations seeking a tax refund under the International Business Activity Act. This form is specifically designed for businesses engaged in international activities, excluding those related to international patents. It allows corporations to claim refunds on taxes paid, facilitating financial relief and encouraging international business operations.

Steps to Complete the FIN 578 Form

Completing the FIN 578 form requires careful attention to detail to ensure accuracy and compliance with tax regulations. Here are the key steps:

- Begin by gathering all necessary financial documentation related to international business activities.

- Fill out the form with accurate information regarding your corporation, including its legal name, address, and tax identification number.

- Detail the specific international business activities that qualify for the tax refund.

- Calculate the amount of tax refund being claimed based on the provided guidelines.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the FIN 578 Form

To qualify for the FIN 578 tax refund, corporations must meet specific eligibility criteria. These include:

- The corporation must be registered in the United States.

- The business must engage in qualifying international activities as defined by the International Business Activity Act.

- All tax obligations must be current and compliant with federal and state regulations.

Required Documents for Submission

When submitting the FIN 578 form, corporations need to provide supporting documentation to validate their claims. Required documents typically include:

- Proof of registration as a corporation in the United States.

- Financial statements detailing international business activities.

- Copies of tax returns for the periods being claimed.

Filing Methods for the FIN 578 Form

The FIN 578 form can be submitted through various methods to accommodate different preferences. Corporations may choose to:

- File the form online through designated government portals.

- Mail a printed version of the completed form to the appropriate tax authority.

- Submit the form in person at local tax offices, if applicable.

IRS Guidelines for the FIN 578 Form

Adhering to IRS guidelines is crucial for the successful submission of the FIN 578 form. These guidelines outline:

- Specific instructions for completing each section of the form.

- Deadlines for filing to ensure timely processing of refund claims.

- Compliance requirements to avoid penalties associated with incorrect submissions.

Quick guide on how to complete fin 578 iba tax refund of a corporation this form must be completed by a registered corporation claiming a tax refund under the

Effortlessly Prepare FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The on Any Device

Digital document management has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow offers all the tools you need to generate, modify, and eSign your documents swiftly without delays. Manage FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Alter and eSign FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The with Ease

- Locate FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, and inaccuracies that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 578 iba tax refund of a corporation this form must be completed by a registered corporation claiming a tax refund under the

Create this form in 5 minutes!

How to create an eSignature for the fin 578 iba tax refund of a corporation this form must be completed by a registered corporation claiming a tax refund under the

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is fin iba and how does airSlate SignNow utilize it?

Fin iba refers to streamlined digital processes that enhance the efficiency of document management. airSlate SignNow is designed to facilitate this by allowing users to send and eSign documents quickly, thus improving workflow and reducing delays.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different needs and budgets. The basic plan starts at an affordable rate, making it a cost-effective solution for users looking to leverage fin iba without breaking the bank.

-

What key features does airSlate SignNow provide?

airSlate SignNow includes features such as document templates, user-friendly signing workflows, and advanced security measures. These capabilities are designed to support fin iba, ensuring that users can manage their documents effortlessly.

-

How does airSlate SignNow improve team collaboration?

By utilizing airSlate SignNow, teams can collaborate seamlessly on documents with real-time updates and comments. This collaborative approach plays a crucial role in achieving fin iba, allowing for quicker decision-making and document completion.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various applications to enhance productivity. By connecting with popular tools, businesses can ensure that their processes align with fin iba principles, maximizing efficiency across platforms.

-

What benefits does airSlate SignNow provide for small businesses?

Small businesses can greatly benefit from airSlate SignNow by saving time and reducing paper-related costs. This aligns with fin iba goals by streamlining operations and allowing small teams to focus more on growth and less on administrative tasks.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely. airSlate SignNow takes document security seriously, implementing encryption and compliance measures. This focus on security supports fin iba by ensuring that sensitive information remains protected during the eSigning process.

Get more for FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The

- Wisconsin transfer death form

- Transfer death beneficiary form

- Quitclaim deed life estate 497430531 form

- Release estate form 497430532

- Notice intent file form

- Quitclaim deed from individual to two individuals in joint tenancy wisconsin form

- Renunciation and disclaimer of joint tenant or tenancy interest wisconsin form

- Subcontractor identification notice wisconsin form

Find out other FIN 578, IBA Tax Refund Of A Corporation This Form Must Be Completed By A Registered Corporation Claiming A Tax Refund Under The

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form