MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate 2020-2026

Understanding the MI W4 Employee's Michigan Withholding Exemption Certificate

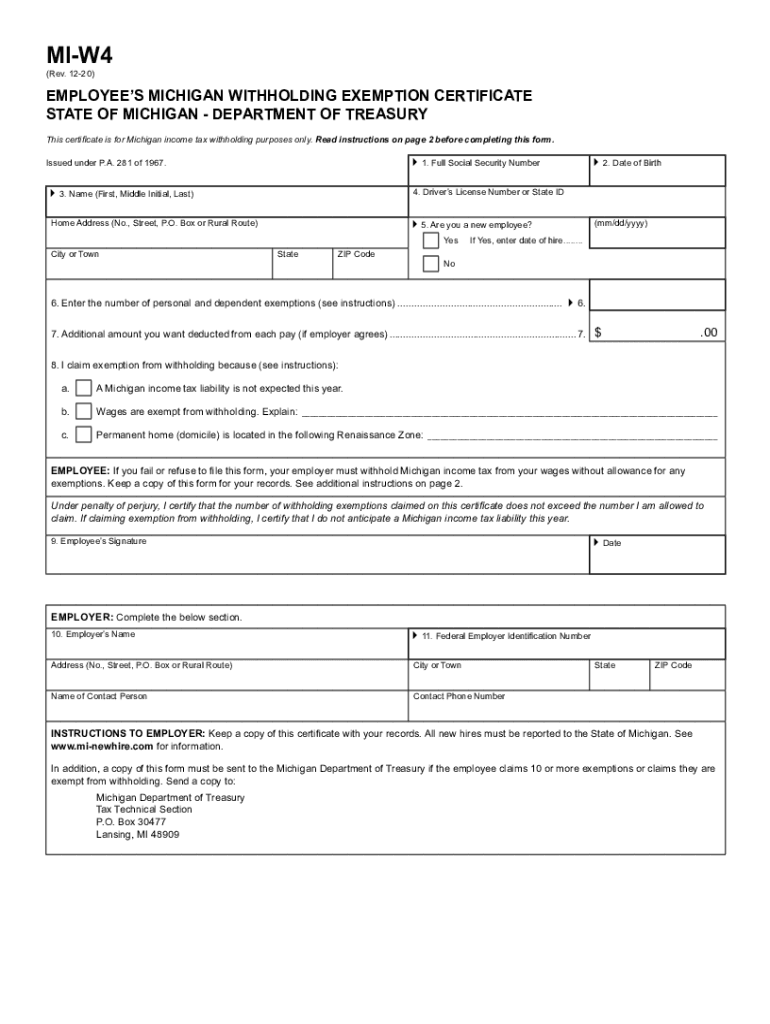

The MI W4 form, officially known as the Employee's Michigan Withholding Exemption Certificate, is a crucial document for employees in Michigan. This form allows individuals to claim exemptions from state income tax withholding based on their specific financial situations. Understanding this form is essential for ensuring proper tax withholding and compliance with state regulations.

Steps to Complete the MI W4 Form

Completing the MI W4 form involves several key steps to ensure accuracy and compliance. First, gather necessary personal information, including your name, address, and Social Security number. Next, determine your withholding exemptions based on your financial situation, such as dependents and filing status. Carefully fill out each section of the form, ensuring all information is correct. Finally, sign and date the form before submitting it to your employer.

Legal Use of the MI W4 Form

The MI W4 form is legally recognized for determining the amount of state income tax withheld from an employee's paycheck. To be valid, the form must be completed accurately and submitted to the employer. Employers are required to keep the form on file and use it to calculate the appropriate withholding amounts. Failure to submit a valid MI W4 form may result in incorrect withholding, leading to potential tax liabilities for the employee.

Key Elements of the MI W4 Form

Several key elements must be included in the MI W4 form for it to be effective. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Indicate whether you are single, married, or head of household.

- Exemptions: Claim exemptions based on dependents and other qualifying factors.

- Signature: A valid signature and date are required for the form to be considered complete.

How to Obtain the MI W4 Form

The MI W4 form can be obtained easily through various channels. Employers typically provide this form to new employees during the onboarding process. Additionally, the form is available online through the Michigan Department of Treasury's website, where individuals can download and print it for their use. It is important to ensure you are using the most current version of the form to avoid any issues with compliance.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the MI W4 form is essential for compliance. Typically, employees should submit their completed MI W4 form to their employer as soon as they start a new job or experience a change in their financial situation. Employers are required to update their withholding calculations based on the most recent MI W4 form submitted by the employee. Keeping track of any changes in tax laws or deadlines is also important for maintaining compliance.

Examples of Using the MI W4 Form

There are various scenarios in which an employee may need to use the MI W4 form. For instance, a new employee starting a job would complete this form to ensure the correct amount of state income tax is withheld from their paycheck. Additionally, if an employee experiences a significant life change, such as marriage or the birth of a child, they may need to update their MI W4 form to reflect their new filing status and exemptions. Regularly reviewing and updating the MI W4 form can help employees manage their tax withholding effectively.

Quick guide on how to complete mi w4 emploees michigan withholding exemption certificate mi w4 emploees michigan withholding exemption certificate

Effortlessly prepare MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate without hassle

- Obtain MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and hit the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and eSign MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi w4 emploees michigan withholding exemption certificate mi w4 emploees michigan withholding exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the mi w4 emploees michigan withholding exemption certificate mi w4 emploees michigan withholding exemption certificate

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is mi w4 and how does it relate to airSlate SignNow?

The mi w4 is a form used by employees in Michigan to determine the amount of state income tax to withhold from their paychecks. airSlate SignNow provides a seamless way to electronically sign and submit your mi w4 form, ensuring quick processing and compliance with state regulations.

-

How can airSlate SignNow help me manage my mi w4 forms?

With airSlate SignNow, you can easily create, edit, and send your mi w4 forms electronically. This saves time and helps ensure that your forms are completed accurately and submitted on time, reducing the risk of errors that could postpone your tax withholding updates.

-

Is there a cost associated with using airSlate SignNow for my mi w4 form?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, making it a cost-effective solution for managing documents like the mi w4 form. You can choose a plan that fits your budget and take advantage of features that streamline your document signing processes.

-

What features does airSlate SignNow offer for completing mi w4 forms?

airSlate SignNow provides features such as customizable templates, secure eSignature options, and automated reminders for mi w4 forms. These features enhance your efficiency by allowing you to manage your documents quickly and securely, ensuring they are always up-to-date.

-

Can I integrate airSlate SignNow with other software to manage my mi w4?

Yes, airSlate SignNow offers integrations with various software tools, such as CRM systems and project management platforms, making it easier to manage your mi w4 and other documents. These integrations help streamline your workflow and keep your documents organized.

-

Are there benefits to using airSlate SignNow for my mi w4 over traditional methods?

Using airSlate SignNow for your mi w4 form provides several benefits over traditional paper methods, including speed, security, and accessibility. You can complete and sign your forms electronically from anywhere, reducing the need for physical paperwork and ensuring you meet deadlines.

-

How secure is my information when using airSlate SignNow for mi w4 forms?

airSlate SignNow implements robust security measures to protect your personal information when submitting mi w4 forms. All documents are encrypted and stored securely, ensuring compliance with data protection regulations and giving you peace of mind.

Get more for MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate

- Transfer on death deed or tod beneficiary deed from individual to four 4 individuals does not include alternate beneficiary form

- Prime contractors notice of lien rights by corporation or llc wisconsin form

- Quitclaim deed from individual to llc wisconsin form

- Warranty deed from individual to llc wisconsin form

- Wisconsin deed tod form

- Prime contractors claim of lien by individual wisconsin form

- Wi husband wife form

- Warranty deed from husband and wife to corporation wisconsin form

Find out other MI W4 Emploee's Michigan Withholding Exemption Certificate MI W4 Emploee's Michigan Withholding Exemption Certificate

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure