Il 941 Schedule Form 2018

What is the IL 941 Schedule Form

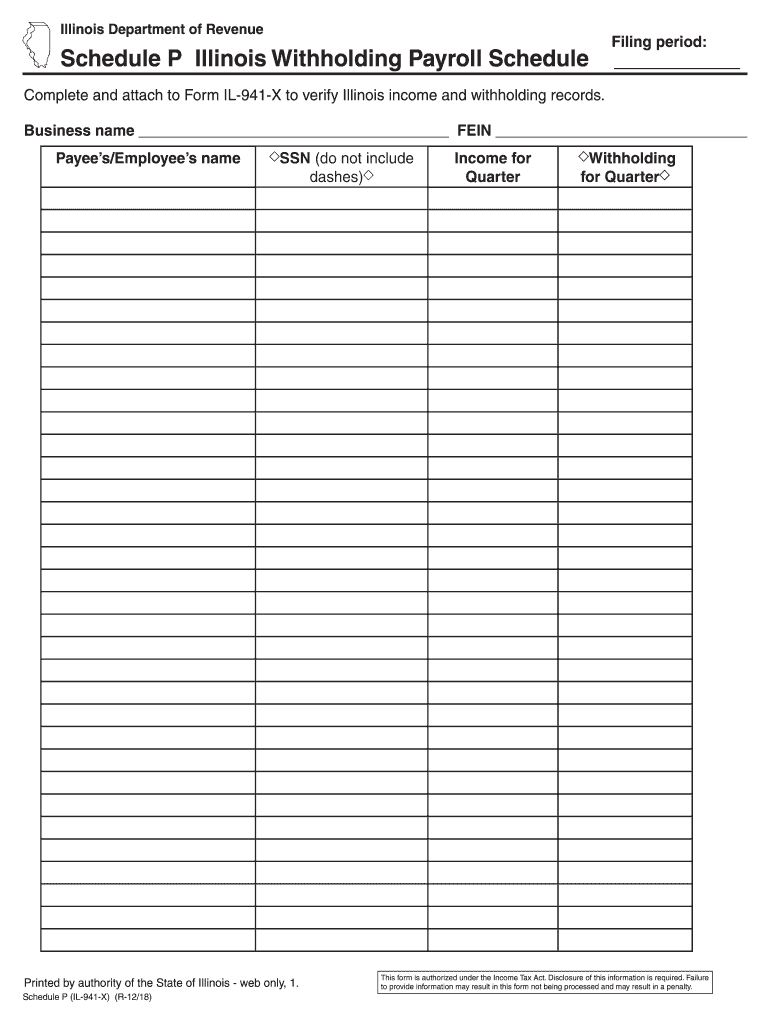

The IL 941 Schedule P is a supplementary form used by employers in Illinois to report and reconcile withholding tax for employees. It is specifically designed to accompany the IL-941 form, which is the Illinois Withholding Income Tax Return. The Schedule P allows employers to detail any adjustments made to their withholding amounts, ensuring accurate reporting to the Illinois Department of Revenue. Understanding this form is crucial for compliance with state tax regulations.

How to use the IL 941 Schedule Form

To use the IL 941 Schedule P effectively, employers should first gather all necessary payroll records for the reporting period. This includes total wages paid, taxes withheld, and any adjustments that need to be reported. After completing the IL-941, the employer will fill out the Schedule P to reflect any discrepancies or corrections. It is important to ensure that all figures are accurate and that the form is submitted alongside the IL-941 to avoid penalties.

Steps to complete the IL 941 Schedule Form

Completing the IL 941 Schedule P involves several key steps:

- Gather payroll records for the relevant tax period.

- Complete the IL-941 form, ensuring all withholding amounts are reported.

- Fill out the Schedule P by entering any corrections or adjustments needed.

- Double-check all figures for accuracy.

- Submit the completed IL-941 and Schedule P to the Illinois Department of Revenue by the due date.

Legal use of the IL 941 Schedule Form

The IL 941 Schedule P is legally recognized as part of the tax reporting process in Illinois. To ensure its legal validity, employers must adhere to the guidelines set forth by the Illinois Department of Revenue. This includes accurate reporting of withholding amounts and timely submission of the form. Failure to comply with these regulations can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the IL 941 Schedule P. Typically, the IL-941 and its accompanying Schedule P are due on a quarterly basis. The deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The IL 941 Schedule P can be submitted through various methods to accommodate different preferences. Employers can file the form online through the Illinois Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate address listed on the form instructions or delivered in person to a local Department of Revenue office. Choosing the right submission method can help ensure timely processing.

Quick guide on how to complete il 941 schedule form

Effortlessly Prepare Il 941 Schedule Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to retrieve the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Il 941 Schedule Form across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Il 941 Schedule Form with Ease

- Obtain Il 941 Schedule Form and click Get Form to initiate.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Il 941 Schedule Form to ensure seamless communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 941 schedule form

Create this form in 5 minutes!

How to create an eSignature for the il 941 schedule form

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 2019 Illinois 941x Schedule P and its purpose?

The 2019 Illinois 941x Schedule P is a form used by employers to amend previously filed Illinois withholding tax returns. It allows businesses to correct errors, including overpayments or underreporting of taxes. Using the correct forms ensures compliance and helps avoid penalties.

-

How can airSlate SignNow assist with filing the 2019 Illinois 941x Schedule P?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your amended documents, including the 2019 Illinois 941x Schedule P. This simplifies the filing process, making it quicker and more efficient for business owners. Enjoy streamlined workflows and ensure your amendments are filed correctly.

-

What are the pricing options for using airSlate SignNow for the 2019 Illinois 941x Schedule P?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring you can file the 2019 Illinois 941x Schedule P affordably. Our plans include features that enable seamless document management and eSignature capabilities. Explore our subscription options to find one that suits your needs.

-

Are there any specific features of airSlate SignNow that benefit users of the 2019 Illinois 941x Schedule P?

Yes, airSlate SignNow includes features like customizable templates, advanced tracking, and audit trails that enhance the process of filing the 2019 Illinois 941x Schedule P. These features ensure you have all the necessary information at your fingertips, making compliance easier. The platform also aids in reducing errors that could lead to costly mistakes.

-

Can airSlate SignNow integrate with other software for handling the 2019 Illinois 941x Schedule P?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and payroll software, allowing for efficient management of documents related to the 2019 Illinois 941x Schedule P. This integration means data can flow smoothly between systems, reducing manual entry and potential errors. Enhance your document management and ensure seamless workflows.

-

What benefits does airSlate SignNow offer when managing the 2019 Illinois 941x Schedule P?

Using airSlate SignNow for the 2019 Illinois 941x Schedule P provides numerous benefits including increased efficiency, reduced paperwork, and improved accuracy. Our platform enables you to manage document workflows digitally, which saves time and resources. Enjoy hassle-free eSigning and quick submission that keeps your business compliant.

-

Is it easy to request signatures for the 2019 Illinois 941x Schedule P using airSlate SignNow?

Yes, requesting signatures for the 2019 Illinois 941x Schedule P with airSlate SignNow is very straightforward. Users can easily send documents to multiple signers in just a few clicks. The transparency of the signing process allows you to track when documents have been viewed and signed.

Get more for Il 941 Schedule Form

- Transfer death deed 497430527 form

- Warranty deed from individual to three individuals wisconsin form

- Wisconsin transfer death form

- Transfer death beneficiary form

- Quitclaim deed life estate 497430531 form

- Release estate form 497430532

- Notice intent file form

- Quitclaim deed from individual to two individuals in joint tenancy wisconsin form

Find out other Il 941 Schedule Form

- How Do I Sign Alabama Cease and Desist Letter

- Sign Arkansas Cease and Desist Letter Free

- Sign Hawaii Cease and Desist Letter Simple

- Sign Illinois Cease and Desist Letter Fast

- Can I Sign Illinois Cease and Desist Letter

- Sign Iowa Cease and Desist Letter Online

- Sign Maryland Cease and Desist Letter Myself

- Sign Maryland Cease and Desist Letter Free

- Sign Mississippi Cease and Desist Letter Free

- Sign Nevada Cease and Desist Letter Simple

- Sign New Jersey Cease and Desist Letter Free

- How Can I Sign North Carolina Cease and Desist Letter

- Sign Oklahoma Cease and Desist Letter Safe

- Sign Indiana End User License Agreement (EULA) Myself

- Sign Colorado Hold Harmless (Indemnity) Agreement Now

- Help Me With Sign California Letter of Intent

- Can I Sign California Letter of Intent

- Sign Kentucky Hold Harmless (Indemnity) Agreement Simple

- Sign Maryland Hold Harmless (Indemnity) Agreement Now

- Sign Minnesota Hold Harmless (Indemnity) Agreement Safe