How to Use Keyboard as Mouse Enable Mouse Keys and Move 2021-2026

IRS Guidelines for Form IL Schedule P

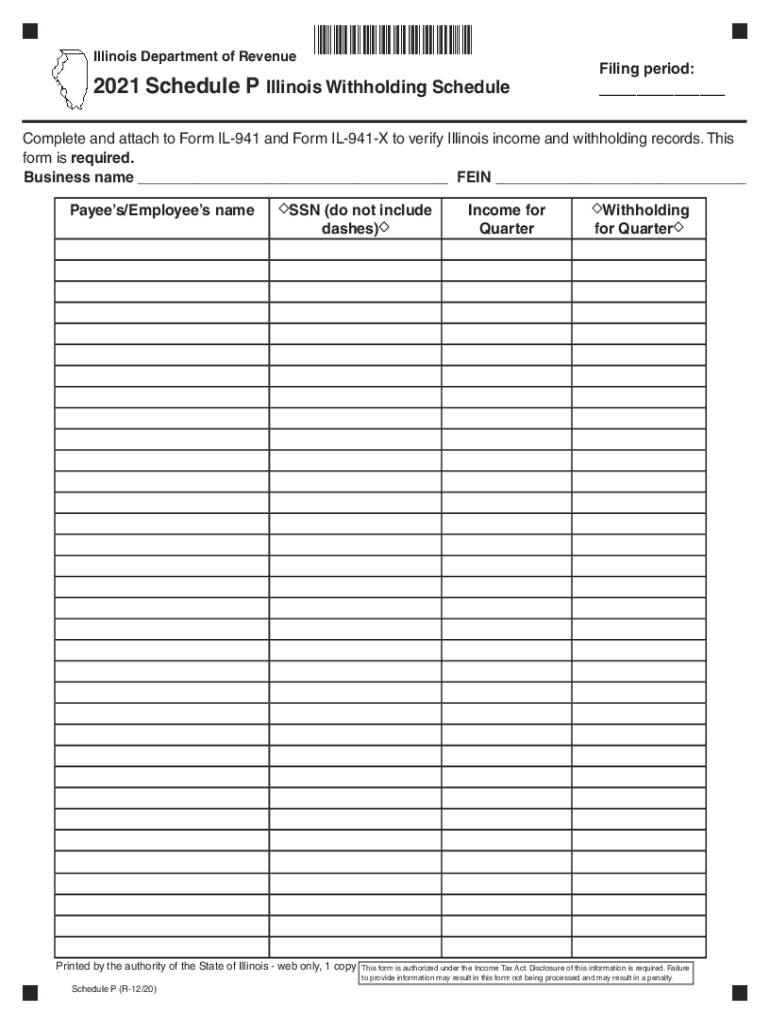

The IL Schedule P is essential for taxpayers in Illinois who need to report specific tax information. It aligns with IRS guidelines to ensure compliance with federal tax regulations. Understanding these guidelines is crucial for accurate reporting and to avoid potential penalties. The IRS provides detailed instructions on how to fill out the form, including eligibility criteria and necessary documentation. Taxpayers should refer to the IRS website or consult a tax professional for the most current guidelines.

Filing Deadlines / Important Dates

Timely filing of the IL Schedule P is vital to avoid penalties. The deadlines typically coincide with the federal tax filing dates. For most taxpayers, the deadline is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any specific state extensions or changes in deadlines that may apply. Keeping a calendar of important dates can help ensure that all filings are completed on time.

Required Documents for Form IL Schedule P

To complete the IL Schedule P accurately, certain documents are necessary. Taxpayers should gather their W-2 forms, 1099 forms, and any other relevant income statements. Additionally, documentation related to deductions, credits, or other adjustments must be included. Having these documents ready can streamline the process and help ensure that all information reported is accurate and complete.

Form Submission Methods

Submitting the IL Schedule P can be done through various methods, including online, by mail, or in-person. For online submissions, taxpayers can use e-filing services that are compliant with state regulations. Mailing the form requires sending it to the appropriate state address, which can vary based on the taxpayer's location. In-person submissions may be available at local tax offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Penalties for Non-Compliance

Failing to file the IL Schedule P on time or inaccurately reporting information can result in penalties. The state of Illinois imposes fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes. Understanding these penalties can motivate timely and accurate submissions, helping taxpayers avoid unnecessary financial burdens.

Eligibility Criteria for IL Schedule P

Not all taxpayers are required to file the IL Schedule P. Eligibility typically depends on income levels, filing status, and specific tax situations. For instance, self-employed individuals or those with certain types of income may need to file this schedule. It is essential to review the eligibility criteria outlined by the Illinois Department of Revenue to determine if filing is necessary.

Quick guide on how to complete how to use keyboard as mouse enable mouse keys and move

Execute How To Use Keyboard As Mouse Enable Mouse Keys And Move seamlessly on any gadget

Digital document management has become increasingly popular among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed files, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers all the functionalities you need to create, modify, and eSign your documents quickly and without delays. Manage How To Use Keyboard As Mouse Enable Mouse Keys And Move on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process now.

How to modify and eSign How To Use Keyboard As Mouse Enable Mouse Keys And Move effortlessly

- Obtain How To Use Keyboard As Mouse Enable Mouse Keys And Move and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using features that airSlate SignNow has specifically designed for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then select the Done button to store your changes.

- Decide how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Alter and eSign How To Use Keyboard As Mouse Enable Mouse Keys And Move and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to use keyboard as mouse enable mouse keys and move

Create this form in 5 minutes!

How to create an eSignature for the how to use keyboard as mouse enable mouse keys and move

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the IL 941 Schedule P and how does it benefit businesses?

The IL 941 Schedule P is a form used by employers in Illinois to report and pay withholding taxes. Understanding how to properly utilize the IL 941 Schedule P can help businesses avoid penalties and ensure compliance. With airSlate SignNow, you can easily eSign and manage your IL 941 Schedule P documents, simplifying the reporting process.

-

How can airSlate SignNow help with completing the IL 941 Schedule P?

airSlate SignNow offers an intuitive platform that allows you to fill out and eSign your IL 941 Schedule P electronically. This not only speeds up the completion process but also ensures that your documents are securely stored and easily accessible. Our platform enhances accuracy and reduces the chances of errors when filing this important form.

-

Is there a cost associated with using airSlate SignNow for the IL 941 Schedule P?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to features that facilitate the completion and eSigning of documents like the IL 941 Schedule P. You can choose a plan that suits your budget while benefiting from our comprehensive document management solutions.

-

What features does airSlate SignNow provide for the IL 941 Schedule P?

airSlate SignNow offers features such as templates, automated workflows, and secure eSigning for forms like the IL 941 Schedule P. These tools enable users to create, manage, and sign documents efficiently while maintaining compliance with IRS regulations. The ease of use signNowly enhances productivity for businesses dealing with tax forms.

-

Can airSlate SignNow integrate with other accounting software for IL 941 Schedule P?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, allowing for a streamlined process when handling the IL 941 Schedule P. This integration helps businesses maintain accuracy in their tax reporting and ensures that all necessary forms are completed correctly. It also reduces the time spent on manual data entry.

-

Is it safe to eSign the IL 941 Schedule P using airSlate SignNow?

Absolutely, airSlate SignNow employs advanced security measures to protect your eSignature and sensitive information associated with the IL 941 Schedule P. With features like encryption and secure storage, you can eSign documents confidently, knowing that your data is safeguarded against unauthorized access.

-

What are the main benefits of using airSlate SignNow for the IL 941 Schedule P?

Using airSlate SignNow for the IL 941 Schedule P streamlines the signing process, reduces paperwork, and enhances compliance. The platform allows for faster document turnaround, which can help businesses meet important filing deadlines with ease. Additionally, it offers a more organized and efficient method for managing essential tax forms.

Get more for How To Use Keyboard As Mouse Enable Mouse Keys And Move

Find out other How To Use Keyboard As Mouse Enable Mouse Keys And Move

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer