Illinois Schedule P 2019

What is the Illinois Schedule P

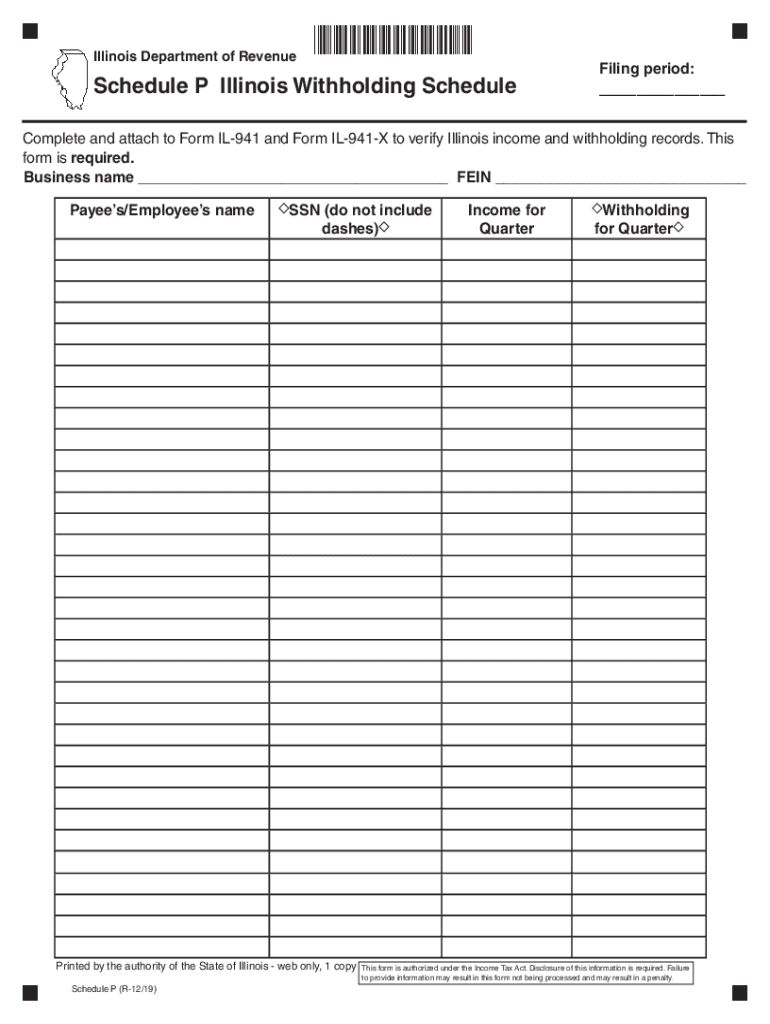

The Illinois Schedule P is a tax form used by employers to report withholding for employees in the state of Illinois. Specifically, it is associated with the Illinois Form 941-X, which is used for correcting errors on previously filed quarterly payroll tax returns. The Schedule P outlines the amount of Illinois income tax withheld from employee wages and is essential for ensuring compliance with state tax regulations.

Steps to complete the Illinois Schedule P

Completing the Illinois Schedule P involves several important steps to ensure accuracy and compliance. First, gather all necessary payroll records for the applicable tax period. Next, review previous filings to identify any discrepancies that need correction. Fill out the Schedule P by entering the corrected amounts in the appropriate fields, ensuring that all calculations are accurate. After completing the form, review it for any errors before submission. Finally, submit the Schedule P along with the corrected Form 941-X to the Illinois Department of Revenue.

Legal use of the Illinois Schedule P

The Illinois Schedule P is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed by an authorized representative of the business. Additionally, the form must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws governing electronic signatures. This compliance ensures that the document is recognized by state authorities and can be used for any necessary legal purposes.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Illinois Schedule P to avoid penalties. Typically, the Schedule P must be filed along with the corrected Form 941-X within a specific timeframe after identifying an error. For quarterly filers, this usually means submitting the form by the end of the month following the end of the quarter in which the error occurred. Keeping track of these deadlines helps ensure timely compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Illinois Schedule P can be submitted through various methods, providing flexibility for employers. The form can be filed online through the Illinois Department of Revenue’s e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the state. In-person submissions are also accepted at designated state offices, allowing for direct interaction with tax officials if needed.

Key elements of the Illinois Schedule P

Several key elements must be included when completing the Illinois Schedule P. These include the employer's identification information, the period for which the corrections are being made, and the specific amounts of income tax that were withheld. Additionally, it is important to provide explanations for the corrections being made, as this helps clarify the reasons for the adjustments and supports the accuracy of the submission.

Quick guide on how to complete illinois schedule p 2019

Complete Illinois Schedule P effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Illinois Schedule P on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Illinois Schedule P with ease

- Obtain Illinois Schedule P and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your selection. Modify and eSign Illinois Schedule P and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois schedule p 2019

Create this form in 5 minutes!

How to create an eSignature for the illinois schedule p 2019

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the 2019 Illinois 941X Schedule P?

The 2019 Illinois 941X Schedule P is a form used to correct errors on previously filed Illinois 941 returns. This schedule allows businesses to report adjustments effectively and ensure accurate tax compliance in Illinois. Utilizing the 2019 Illinois 941X Schedule P is essential for rectifying mistakes and mitigating penalties.

-

How can airSlate SignNow help with the 2019 Illinois 941X Schedule P?

airSlate SignNow streamlines the process of completing and eSigning the 2019 Illinois 941X Schedule P. With its user-friendly platform, businesses can easily upload, edit, and send forms electronically, saving time and reducing paperwork. Our solution enhances accuracy and compliance with tax regulations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the 2019 Illinois 941X Schedule P, offers numerous benefits. It provides a secure and efficient way to manage document workflows, ensuring that all signatures are legally binding and stored safely. This minimizes the risk of errors and enhances overall productivity.

-

Is airSlate SignNow cost-effective for small businesses handling the 2019 Illinois 941X Schedule P?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses dealing with documents like the 2019 Illinois 941X Schedule P. Our pricing model accommodates various business sizes, ensuring that even small enterprises can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the 2019 Illinois 941X Schedule P?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage the 2019 Illinois 941X Schedule P. By connecting with your existing tools, you can enhance your workflow and improve the accuracy of your tax filings.

-

What features does airSlate SignNow offer for completing the 2019 Illinois 941X Schedule P?

airSlate SignNow provides a range of features to assist in completing the 2019 Illinois 941X Schedule P, including templates, automated reminders, and real-time tracking. These tools facilitate collaboration and ensure that everyone involved stays informed throughout the document signing process.

-

Is it secure to eSign the 2019 Illinois 941X Schedule P with airSlate SignNow?

Yes, eSigning the 2019 Illinois 941X Schedule P with airSlate SignNow is secure. We utilize advanced encryption and secure storage measures to protect sensitive information. Our compliance with industry standards also ensures that your data remains confidential and safe from unauthorized access.

Get more for Illinois Schedule P

Find out other Illinois Schedule P

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will