a Seller May Not Accept a Certificate of Exemption for an Entity Based Exemption on a 2020-2026

Understanding the Certificate of Exemption for Entity-Based Exemptions

The Certificate of Exemption for Entity-Based Exemptions is a crucial document for businesses operating in Kentucky. This certificate allows certain entities to make tax-exempt purchases under specific conditions. It is important to understand that not all sellers are required to accept this certificate. The exemption applies primarily to entities that meet the criteria set by the Kentucky Department of Revenue. Familiarity with these criteria can help businesses avoid unnecessary tax liabilities.

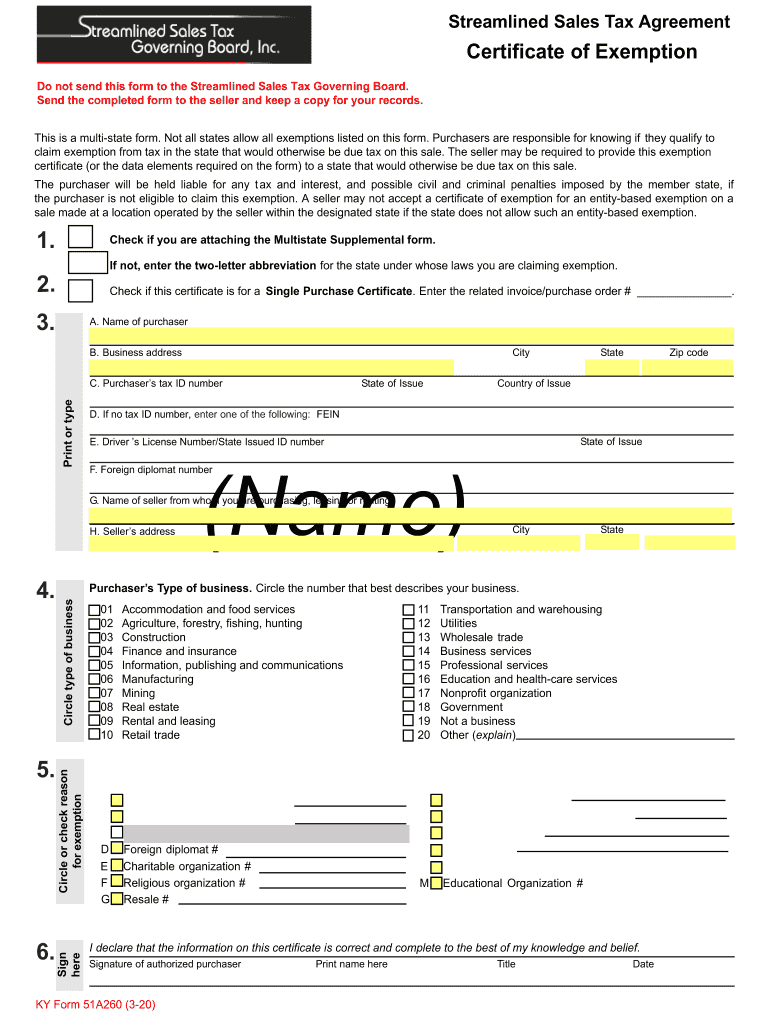

Steps to Complete the Certificate of Exemption

Completing the Certificate of Exemption involves several key steps. First, the entity must verify its eligibility based on the criteria established by the state. Next, the entity should accurately fill out the required information on the certificate, including its name, address, and the nature of the exemption. It is essential to provide correct details to prevent delays or rejections. Finally, the completed certificate should be presented to the seller at the time of purchase to validate the tax-exempt status.

Legal Use of the Certificate of Exemption

The legal use of the Certificate of Exemption is governed by state tax laws. It is vital for businesses to ensure that they are using the certificate in compliance with these laws. Misuse of the certificate can lead to penalties, including back taxes and fines. Sellers may refuse to accept the certificate if they believe it does not meet the legal requirements, underscoring the importance of understanding the applicable regulations.

State-Specific Rules for the Certificate of Exemption

Kentucky has specific rules regarding the use of the Certificate of Exemption. These rules dictate who qualifies for the exemption and under what circumstances it can be applied. For instance, certain non-profit organizations and government entities may be eligible, while others may not. Businesses should consult the Kentucky Department of Revenue for detailed guidelines to ensure compliance and proper usage.

Eligibility Criteria for the Certificate of Exemption

To qualify for the Certificate of Exemption, entities must meet specific eligibility criteria established by Kentucky law. Generally, these criteria include being a recognized non-profit organization, a government entity, or a specific type of business that operates under an exemption statute. Understanding these criteria is essential for businesses to determine their eligibility and to avoid potential tax issues.

Required Documents for Obtaining the Certificate

When applying for the Certificate of Exemption, businesses must prepare certain documents. These typically include proof of the entity's status, such as articles of incorporation or a letter from the IRS confirming tax-exempt status. Additionally, businesses may need to provide a completed application form and any supporting documentation that verifies their eligibility for the exemption. Ensuring that all required documents are submitted can streamline the approval process.

Penalties for Non-Compliance with Exemption Rules

Failure to comply with the rules surrounding the Certificate of Exemption can result in significant penalties. Businesses may face back taxes on purchases made without proper exemption, as well as additional fines. It is crucial for entities to understand the implications of non-compliance and to adhere strictly to the guidelines set forth by the Kentucky Department of Revenue to avoid these consequences.

Quick guide on how to complete a seller may not accept a certificate of exemption for an entity based exemption on a

Easily Set Up A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A on Any Device

Managing documents online has become increasingly popular with organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without any delays. Handle A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related workflow today.

How to Change and eSign A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A Effortlessly

- Find A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a seller may not accept a certificate of exemption for an entity based exemption on a

Create this form in 5 minutes!

How to create an eSignature for the a seller may not accept a certificate of exemption for an entity based exemption on a

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is Kentucky streamlined tax and how does it work?

Kentucky streamlined tax refers to a simplified sales tax system that aims to make tax compliance easier for businesses operating in Kentucky. By using this system, businesses can reduce their administrative burdens and focus on growth while ensuring they remain compliant with state tax laws.

-

How can airSlate SignNow help with Kentucky streamlined tax documentation?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing important documents related to Kentucky streamlined tax. Our solution allows businesses to streamline their document workflows, reducing the time spent on paperwork while ensuring all compliance requirements are met.

-

What are the pricing options for airSlate SignNow regarding Kentucky streamlined tax?

airSlate SignNow offers competitive pricing tailored for businesses needing to manage Kentucky streamlined tax documentation. Plans are available to suit various business sizes, ensuring that you can find a cost-effective solution that meets your needs without compromising on features.

-

What features does airSlate SignNow offer to support Kentucky streamlined tax purposes?

We provide features such as customizable templates, automated reminders, and secure eSigning, all essential for managing Kentucky streamlined tax effectively. Our platform ensures that you can easily track document statuses and maintain compliance throughout the tax process.

-

Are there specific benefits to using airSlate SignNow for Kentucky streamlined tax?

Using airSlate SignNow for Kentucky streamlined tax can lead to increased efficiency, cost savings, and improved document security. By digitizing your workflows, you can reduce processing time and avoid common errors associated with manual documentation.

-

Can airSlate SignNow integrate with accounting software for Kentucky streamlined tax?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software to enhance the management of Kentucky streamlined tax. By syncing your document workflows with existing systems, you can simplify your tax documentation and reporting processes.

-

Is airSlate SignNow compliant with Kentucky tax regulations?

AirSlate SignNow is designed with compliance in mind, adhering to all relevant Kentucky tax regulations, including those related to streamlined tax. Businesses can confidently use our platform, knowing that their documents are handled according to state laws.

Get more for A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A

- Final notice of default for past due payments in connection with contract for deed west virginia form

- Assignment of contract for deed by seller west virginia form

- Notice of assignment of contract for deed west virginia form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement west virginia form

- Buyers home inspection checklist west virginia form

- Sellers information for appraiser provided to buyer west virginia

- Legallife multistate guide and handbook for selling or buying real estate west virginia form

- Subcontractors agreement west virginia form

Find out other A Seller May Not Accept A Certificate Of Exemption For An Entity based Exemption On A

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online