Nebraska 12n Form 2020

What is the Nebraska 12n Form

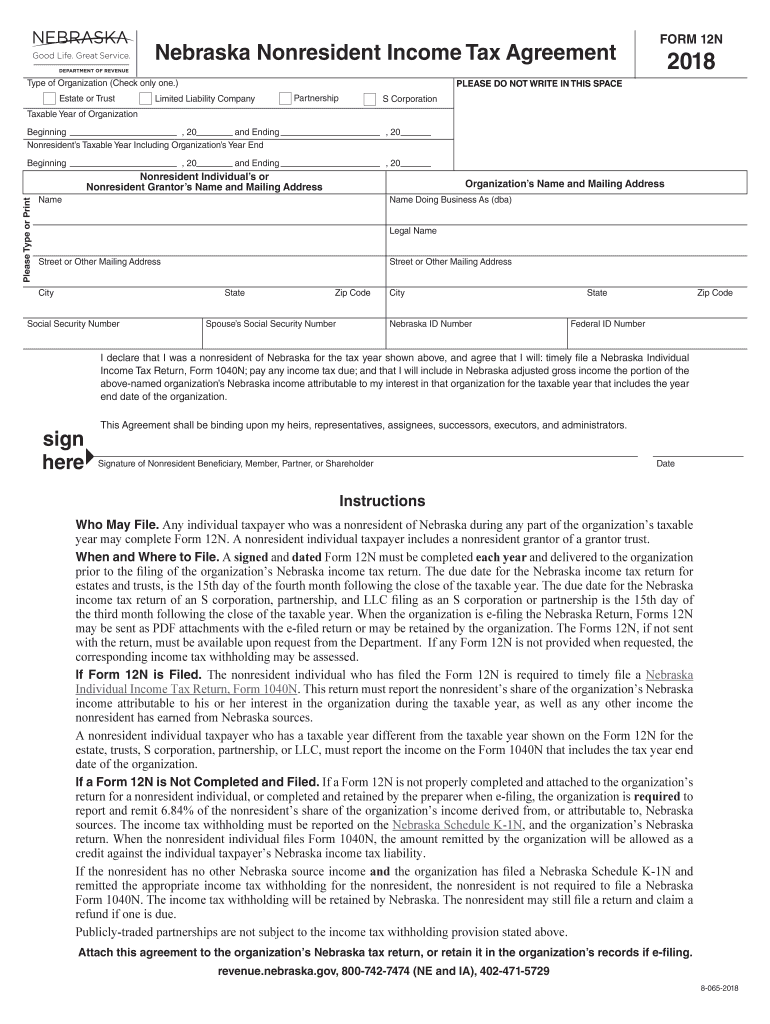

The Nebraska 12n form, officially known as the Nebraska Nonresident Income Tax Agreement Form 12n, is a crucial document for nonresident individuals who earn income in Nebraska. This form is used to report income earned by nonresidents and to determine the tax obligations for that income. It is essential for ensuring compliance with Nebraska tax laws while allowing nonresidents to accurately report their earnings and pay the appropriate taxes. Understanding the purpose of the Nebraska 12n form is vital for anyone engaging in work or business activities within the state.

How to use the Nebraska 12n Form

Using the Nebraska 12n form involves several straightforward steps. First, you need to gather all relevant income information, including wages, salaries, and any other earnings sourced from Nebraska. Next, fill out the form by providing your personal details, such as your name, address, and Social Security number. It is important to accurately report your income and any deductions you may qualify for. After completing the form, review it for accuracy before submitting it to ensure that all information is correct and compliant with state tax regulations.

Steps to complete the Nebraska 12n Form

Completing the Nebraska 12n form requires careful attention to detail. Follow these steps to ensure a smooth process:

- Gather all necessary documents, including W-2s and any other income statements.

- Enter your personal information accurately at the top of the form.

- Report your total income earned in Nebraska, ensuring you include all relevant sources.

- Calculate any eligible deductions and credits that apply to your situation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the Nebraska 12n Form

The Nebraska 12n form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed by the taxpayer, and all information provided must be truthful and accurate. Utilizing a reliable electronic signature tool can enhance the legal standing of the form, as it complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. This compliance assures that the form is recognized by the state and can be used in legal contexts if necessary.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska 12n form are crucial to avoid penalties. Typically, nonresidents must submit their forms by the same deadline as residents, which is usually April 15 for the previous tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to stay informed about any changes to these dates to ensure timely compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska 12n form can be submitted through various methods to accommodate different preferences. Nonresidents have the option to file online through the Nebraska Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office, or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline.

Quick guide on how to complete 2020 nebraska 12n form

Effortlessly Prepare Nebraska 12n Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Nebraska 12n Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Nebraska 12n Form with Ease

- Locate Nebraska 12n Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Nebraska 12n Form to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 nebraska 12n form

Create this form in 5 minutes!

How to create an eSignature for the 2020 nebraska 12n form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the benefits of using airSlate SignNow for a Nebraska nonresident?

AirSlate SignNow provides a seamless eSigning experience for Nebraska nonresidents, enabling easy document management and signing from anywhere. The platform is designed for simplicity and cost-effectiveness, allowing users to save time and reduce paperwork. With the ability to customize workflows, Nebraska nonresidents can cater to specific business needs effortlessly.

-

How does pricing work for Nebraska nonresidents using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suitable for Nebraska nonresidents, allowing you to choose a plan that fits your budget and needs. Each plan provides access to essential features like unlimited eSigning and document storage. Additionally, Nebraska nonresidents can take advantage of a free trial period to explore the platform before making a commitment.

-

Can a Nebraska nonresident integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications, making it ideal for Nebraska nonresidents who want to streamline their workflows. You can connect with popular platforms like Google Drive, Salesforce, and more to enhance productivity. These integrations help Nebraska nonresidents to keep their processes organized and efficient.

-

Is airSlate SignNow secure for Nebraska nonresidents?

Absolutely, airSlate SignNow prioritizes security for all users, including Nebraska nonresidents. The platform employs advanced encryption and authentication measures to ensure that your documents are safe from unauthorized access. Nebraska nonresidents can confidently manage sensitive documents knowing their information is protected.

-

What features does airSlate SignNow offer to Nebraska nonresidents?

AirSlate SignNow offers a variety of features specifically designed for Nebraska nonresidents, including customizable templates, automated workflows, and in-person signing options. These features help enhance usability and efficiency for those who need a reliable eSigning solution. Nebraska nonresidents can take full advantage of these tools to streamline their document processes.

-

How can Nebraska nonresidents access customer support for airSlate SignNow?

Nebraska nonresidents have multiple options for customer support when using airSlate SignNow. The platform provides comprehensive resources such as guides and FAQs on their website. Additionally, Nebraska nonresidents can signNow out to support via email or live chat for immediate assistance with any issues they may encounter.

-

Does airSlate SignNow support mobile access for Nebraska nonresidents?

Yes, airSlate SignNow has a mobile-friendly platform that allows Nebraska nonresidents to access their documents on the go. With the mobile app, users can sign, send, and manage documents from their smartphones or tablets, making it extremely convenient. This flexibility ensures that Nebraska nonresidents can handle important tasks anytime and anywhere.

Get more for Nebraska 12n Form

- Assignment of lease package vermont form

- Vermont purchase form

- Satisfaction cancellation or release of mortgage package vermont form

- Premarital agreements package vermont form

- Painting contractor package vermont form

- Framing contractor package vermont form

- Foundation contractor package vermont form

- Plumbing contractor package vermont form

Find out other Nebraska 12n Form

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe