Application for Voluntary Clearance, Form C2001 Use This Form to Tell HMRC About Voluntary Underpayments Arising on Import of Go 2019-2026

Understanding the Application for Voluntary Clearance, Form C2001

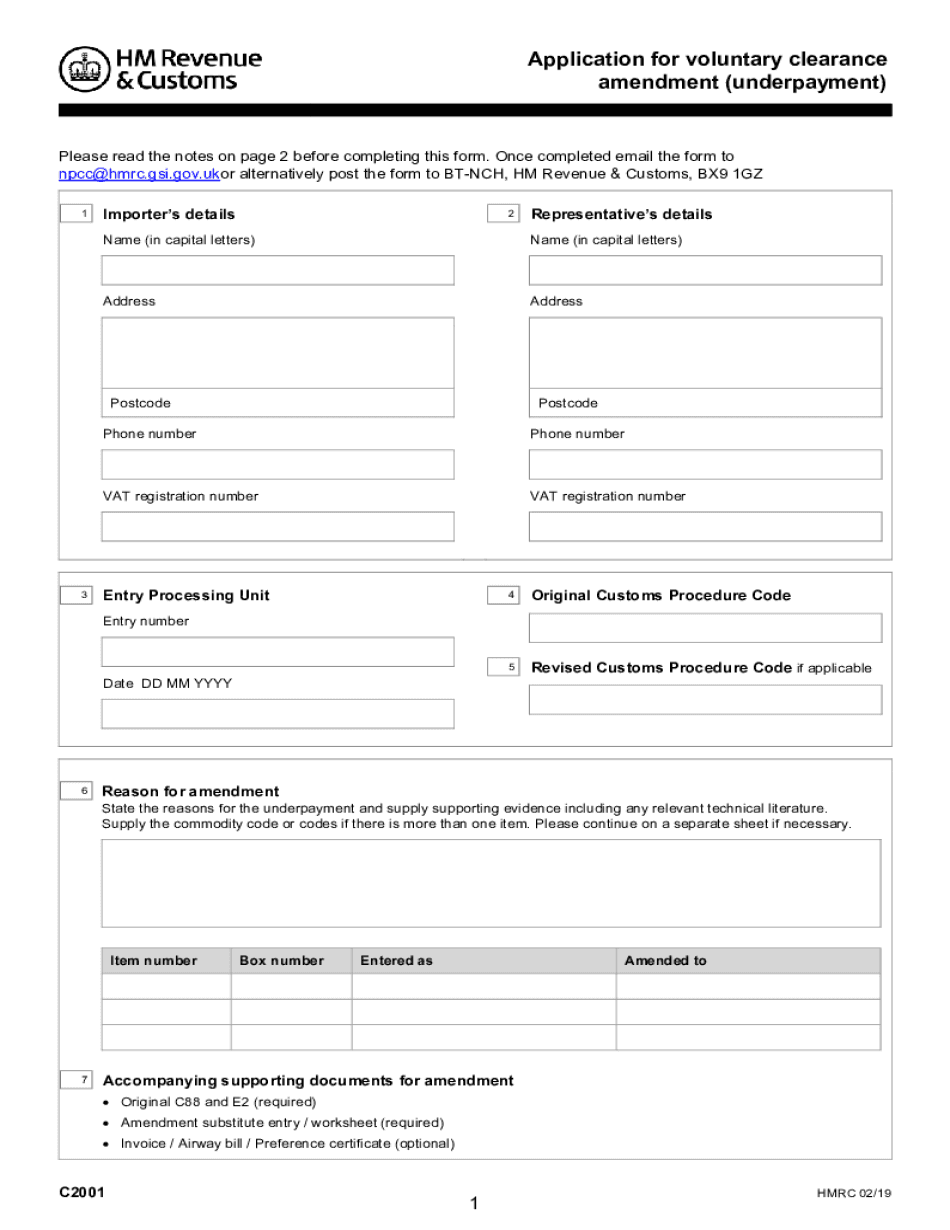

The Application for Voluntary Clearance, known as Form C2001, is designed for individuals and businesses to inform HMRC about voluntary underpayments that occur during the importation of goods using the CHIEF system. This form is essential for those who wish to rectify any discrepancies in their import duties and ensure compliance with UK customs regulations. By submitting this form, applicants can clarify their tax obligations and avoid potential penalties associated with underpayment.

Steps to Complete Form C2001

Completing Form C2001 involves several key steps to ensure that all necessary information is accurately provided. First, gather all relevant documents related to the importation of goods, including invoices and shipping details. Next, fill out the form with precise information regarding the goods imported, the nature of the underpayment, and any other required details. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form to HMRC through the appropriate channels, ensuring that you keep a copy for your records.

Key Elements of Form C2001

Form C2001 includes several critical elements that must be addressed to ensure its validity. These elements typically include:

- Personal Information: Name, address, and contact details of the applicant.

- Import Details: Description of the goods imported and the relevant customs codes.

- Underpayment Explanation: A clear statement outlining the reasons for the voluntary underpayment.

- Financial Information: Details of the amounts underpaid and any relevant calculations.

Providing comprehensive and accurate information in these sections helps facilitate a smoother review process by HMRC.

Legal Use of Form C2001

Form C2001 serves a legal purpose in the context of UK customs law. It allows individuals and businesses to proactively address underpayment issues, which can prevent more severe legal consequences. By submitting this form, applicants demonstrate their commitment to compliance and transparency, which is viewed favorably by HMRC. It is essential to adhere to all legal guidelines when filling out and submitting the form, as inaccuracies or omissions can lead to penalties or further scrutiny.

Eligibility Criteria for Form C2001

To be eligible to use Form C2001, applicants must be involved in the importation of goods into the UK and have identified an underpayment of customs duties. This form is particularly relevant for businesses and individuals who have imported goods through the CHIEF system and need to correct their tax obligations. It is important to ensure that all eligibility criteria are met before proceeding with the application to avoid unnecessary complications.

Form Submission Methods for C2001

Form C2001 can be submitted to HMRC through various methods, depending on the applicant's preference and the nature of the submission. Common methods include:

- Online Submission: Using HMRC's online services for a quicker and more efficient process.

- Mail: Sending a printed copy of the completed form to the designated HMRC address.

- In-Person Submission: Visiting an HMRC office to submit the form directly, if necessary.

Choosing the appropriate submission method can help streamline the process and ensure timely processing of the application.

Quick guide on how to complete application for voluntary clearance form c2001 use this form to tell hmrc about voluntary underpayments arising on import of

Effortlessly Prepare Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

Easily Edit and Electronically Sign Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go

- Find Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Accentuate important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go and ensure effective communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for voluntary clearance form c2001 use this form to tell hmrc about voluntary underpayments arising on import of

Create this form in 5 minutes!

How to create an eSignature for the application for voluntary clearance form c2001 use this form to tell hmrc about voluntary underpayments arising on import of

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the c2001 form and how is it used in airSlate SignNow?

The c2001 form is a crucial document that can be easily created, signed, and managed using airSlate SignNow. This form facilitates quick electronic signatures and ensures compliance with legal standards. With SignNow, users can streamline their document workflows involving the c2001 form.

-

How much does it cost to use airSlate SignNow for the c2001 form?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost for using airSlate SignNow for the c2001 form starts at a competitive rate, making it accessible for businesses of all sizes. You can choose a plan that fits your requirements and budget.

-

What features does airSlate SignNow offer for the c2001 form?

airSlate SignNow provides an array of features to enhance the use of the c2001 form, including customizable templates, secure electronic signing, and real-time tracking. These features help users manage their document processes more efficiently. The app also supports integrations with popular software to further streamline your workflows.

-

Can the c2001 form be customized in airSlate SignNow?

Yes, the c2001 form can be fully customized in airSlate SignNow. Users can modify the template to include necessary fields, branding, and other personalized elements. This customization ensures that the form meets specific business requirements and enhances user experience.

-

Is airSlate SignNow secure for signing the c2001 form?

Absolutely! airSlate SignNow employs top-notch security measures to protect the integrity and confidentiality of the c2001 form. With encryption, secure cloud storage, and compliance with leading security standards, you can trust that your documents are safe during the signing process.

-

What integrations are available with airSlate SignNow for the c2001 form?

airSlate SignNow supports numerous integrations, allowing users to link other applications seamlessly with their c2001 form workflows. Popular integrations include CRM systems, project management tools, and cloud storage services. This connectivity enhances efficiency and helps maintain a smooth workflow.

-

How long does it take to complete the c2001 form using airSlate SignNow?

Completing the c2001 form with airSlate SignNow is quick and straightforward. Users can fill out, sign, and send the form within minutes, signNowly reducing the turnaround time compared to traditional methods. This efficiency is one of the key benefits of using airSlate SignNow.

Get more for Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go

- Arkusz spisu z natury wzordoc arkusz spisu z natury form

- Pleading guilty by letter mauritius form

- Tesco application form

- Wwwuniteddogsportsnneorgcoursing entry formofficial united kennel club coursing entry form

- Wwwcheggcomhomework helpquestions andsolved t h e r e a r e m a n y a p p l i c a t i o ncheggcom form

- Ukc nosework official judge apprentice form

- Wwwukcdogscomsitemapagility forms rulesagility forms and rulesunited kennel club ukc

- Sollicitatieformulier voorbeeld pdf

Find out other Application For Voluntary Clearance, Form C2001 Use This Form To Tell HMRC About Voluntary Underpayments Arising On Import Of Go

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document