Form 1120 C U S Income Tax Return for Cooperative Associations

What is the Form 1120 C U S Income Tax Return For Cooperative Associations

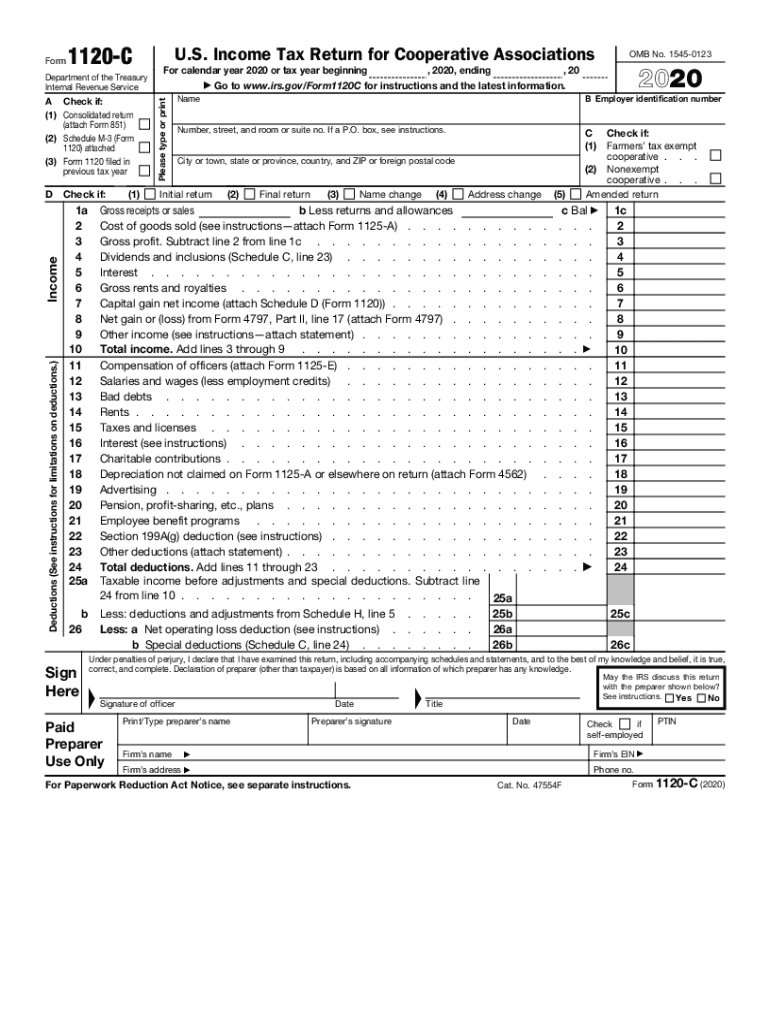

The Form 1120 C is a U.S. income tax return specifically designed for cooperative associations. This form is utilized by organizations that operate as cooperatives, allowing them to report their income, deductions, and credits to the Internal Revenue Service (IRS). Cooperative associations are unique in that they are owned and operated by their members, who share in the profits and benefits. The Form 1120 C ensures compliance with federal tax regulations while providing a clear framework for reporting cooperative income.

Steps to Complete the Form 1120 C U S Income Tax Return For Cooperative Associations

Completing the Form 1120 C involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any relevant supporting documentation. Next, fill out the form, which includes sections for reporting income, deductions, and credits. It is crucial to accurately calculate the taxable income and ensure that all figures are supported by documentation. After completing the form, review it for errors before submission. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail.

Legal Use of the Form 1120 C U S Income Tax Return For Cooperative Associations

The legal use of the Form 1120 C is essential for cooperative associations to maintain compliance with federal tax laws. This form must be filed annually, and failure to do so can result in penalties and interest charges. The form serves as a declaration of the cooperative's income and expenses, ensuring that it meets its tax obligations. Additionally, using the form correctly helps protect the cooperative's tax-exempt status, if applicable, and provides transparency in financial reporting to members and regulatory bodies.

Filing Deadlines / Important Dates

Cooperative associations must adhere to specific filing deadlines for the Form 1120 C. Generally, the form is due on the fifteenth day of the third month following the end of the cooperative's tax year. For associations operating on a calendar year, this typically means a due date of March 15. It is important to note that extensions may be available, but they must be requested in advance. Keeping track of these deadlines is crucial to avoid late fees and ensure timely compliance with IRS regulations.

Required Documents

To complete the Form 1120 C, cooperative associations must prepare several required documents. These typically include:

- Financial statements detailing income and expenses

- Records of any deductions and credits claimed

- Previous year's tax return for reference

- Documentation supporting any special deductions or credits

Having these documents organized and readily available will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Form 1120 C can be submitted to the IRS through various methods. Cooperative associations have the option to file electronically, which is often the most efficient method, allowing for quicker processing and confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address based on the association's location. In-person submissions are generally not available for this form. It is important to choose the submission method that best fits the cooperative's needs and to keep a copy of the submitted form for record-keeping purposes.

Quick guide on how to complete 2020 form 1120 c us income tax return for cooperative associations

Prepare Form 1120 C U S Income Tax Return For Cooperative Associations seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Handle Form 1120 C U S Income Tax Return For Cooperative Associations on any device via airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 1120 C U S Income Tax Return For Cooperative Associations effortlessly

- Locate Form 1120 C U S Income Tax Return For Cooperative Associations and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1120 C U S Income Tax Return For Cooperative Associations and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1120 c us income tax return for cooperative associations

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is form 1120c, and who needs to file it?

Form 1120c is a tax return specifically designed for certain types of corporations in the United States. Businesses that elect to be treated as a small business corporation need to file this form to report their income and pay taxes accordingly. Using airSlate SignNow can simplify the process of preparing and submitting form 1120c.

-

How can airSlate SignNow help with filing form 1120c?

airSlate SignNow offers a seamless way to electronically sign and send documents, including form 1120c. By utilizing our platform, users can ensure that all necessary signatures are collected promptly and that the document is securely submitted to the IRS. This efficiency reduces the hassle associated with traditional filing methods.

-

Is there a cost associated with using airSlate SignNow for form 1120c?

Yes, airSlate SignNow operates on a subscription model, offering multiple pricing plans to accommodate different business needs. Each plan provides access to essential features that can aid in the preparation and signing of form 1120c, making it a cost-effective solution. We encourage interested users to check our pricing page for more specific details.

-

What features of airSlate SignNow can assist in preparing form 1120c?

airSlate SignNow offers features such as templates, automated workflows, and eSignature capabilities that streamline the preparation of form 1120c. These tools help ensure accuracy and compliance by allowing users to create, edit, and finalize their documents efficiently. Additionally, our platform provides document tracking to monitor the progress of signatures.

-

Can I integrate airSlate SignNow with other accounting software for form 1120c?

Yes, airSlate SignNow allows for integrations with various accounting and tax preparation software, enhancing your ability to manage form 1120c efficiently. This interoperability ensures that data can flow smoothly between systems, reducing errors and saving time. Check our integration options to see compatible software for your business.

-

What security measures does airSlate SignNow have for form 1120c submissions?

AirSlate SignNow takes security seriously, utilizing encryption and secure storage to protect sensitive information contained in form 1120c submissions. Our platform follows industry-standard compliance protocols to ensure that your data remains confidential. Users can have peace of mind knowing their tax documents are secure throughout the signing process.

-

How does airSlate SignNow enhance the workflow for businesses filing form 1120c?

By using airSlate SignNow, businesses can enhance their workflow for filing form 1120c through automated document routing and real-time collaboration. These features decrease turnaround times and improve efficiency in collecting required signatures and submitting forms. Ultimately, this leads to a more streamlined filing process, freeing up valuable time for your business.

Get more for Form 1120 C U S Income Tax Return For Cooperative Associations

- Tenant registration form dove valley ranch hoa located in

- Property owners consent form springville city

- Background history form bh 3

- Business license application city of lathrop ci lathrop ca form

- Dog licensethe city of santa anadog license feessanta cruz county animal shelteranimal licenseslos angeles animal form

- Greenport form

- Wwwfloridaprofessionallicenseattorneycomwpstate of florida department of business and professional form

- Trophy club txofficial websitetrophy club txofficial websitetrophy club txofficial website form

Find out other Form 1120 C U S Income Tax Return For Cooperative Associations

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast