403b Withdrawal Request Form MetLife 2020-2026

Understanding the Brighthouse Withdrawal Form

The Brighthouse withdrawal form is a crucial document for individuals looking to access funds from their Brighthouse financial products, such as annuities or retirement accounts. This form is specifically designed to facilitate the withdrawal process, ensuring that all necessary information is collected and processed efficiently. Completing this form accurately is essential to avoid delays or complications in accessing your funds.

Steps to Complete the Brighthouse Withdrawal Form

Completing the Brighthouse withdrawal form involves several key steps to ensure that your request is processed smoothly. Begin by gathering all necessary personal information, including your account number and identification details. Next, clearly indicate the amount you wish to withdraw and the reason for the withdrawal. After filling out the form, review all entries for accuracy. Finally, sign and date the form, ensuring that it meets all submission requirements.

Required Documents for Submission

When submitting the Brighthouse withdrawal form, certain documents may be required to validate your request. Commonly required documents include a government-issued ID, proof of your relationship to the account (if applicable), and any additional forms specific to your withdrawal type. Ensure that all documents are current and clearly legible to prevent processing delays.

Submission Methods for the Brighthouse Withdrawal Form

The Brighthouse withdrawal form can typically be submitted through various methods, including online submission via the Brighthouse website, mailing the completed form to their processing center, or delivering it in person at a designated location. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Legal Considerations for the Brighthouse Withdrawal Form

Understanding the legal implications of the Brighthouse withdrawal form is essential for ensuring compliance with relevant regulations. The form must be filled out in accordance with federal and state laws governing withdrawals from financial products. This includes adhering to tax implications and understanding any penalties associated with early withdrawals, particularly for retirement accounts such as 403b plans.

Eligibility Criteria for Withdrawals

Eligibility to withdraw funds using the Brighthouse withdrawal form may vary based on the type of account and the specific terms of your financial product. Generally, factors such as age, account type, and the length of time the funds have been held will influence your eligibility. It is advisable to review your account details and consult with a financial advisor if needed to ensure that you meet all criteria before submitting your request.

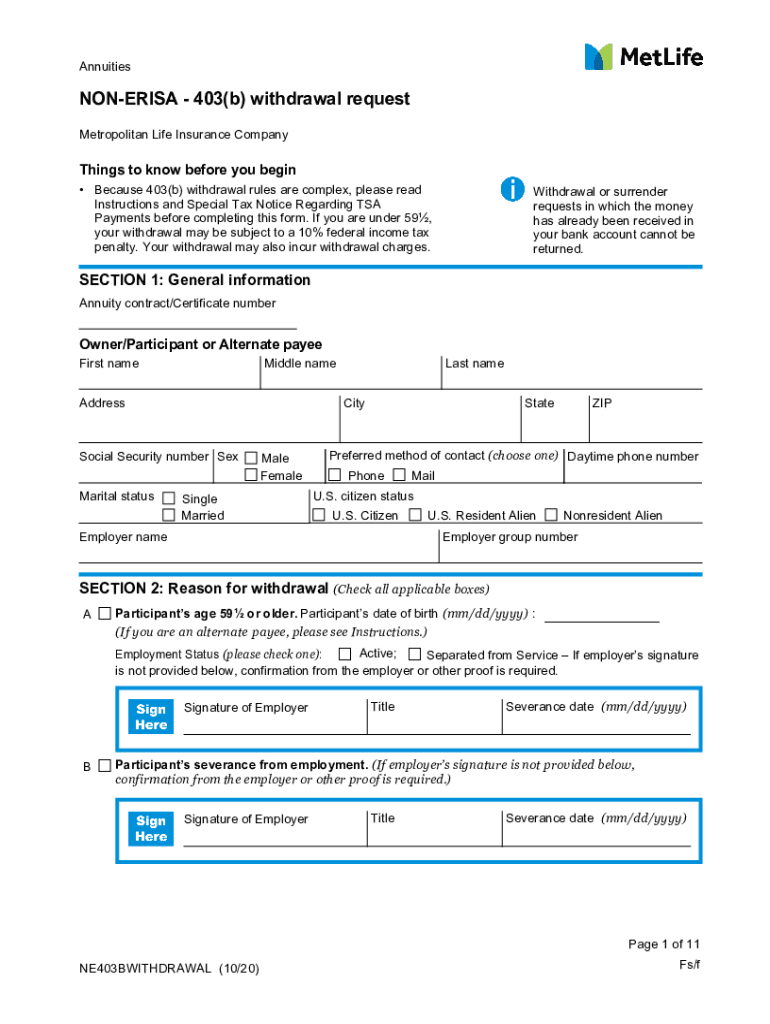

Quick guide on how to complete 403b withdrawal request form metlife

Finalize 403b Withdrawal Request Form MetLife seamlessly on any device

Web-based document management has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 403b Withdrawal Request Form MetLife on any device with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign 403b Withdrawal Request Form MetLife with ease

- Locate 403b Withdrawal Request Form MetLife and click Obtain Form to get started.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Complete button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 403b Withdrawal Request Form MetLife to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 403b withdrawal request form metlife

Create this form in 5 minutes!

People also ask

-

What is a Brighthouse Financial withdrawal form?

A Brighthouse Financial withdrawal form is a document that policyholders must complete to request a withdrawal from their investment account. This form ensures that all necessary information is provided to process the request smoothly and efficiently.

-

How do I access the Brighthouse Financial withdrawal form?

You can easily access the Brighthouse Financial withdrawal form through the official Brighthouse Financial website or by contacting customer support. Additionally, airSlate SignNow allows you to receive and sign the document electronically, streamlining the process.

-

What information is needed to fill out the Brighthouse Financial withdrawal form?

To complete the Brighthouse Financial withdrawal form, you'll typically need personal information such as your account number, contact details, and the amount you wish to withdraw. Providing accurate information is crucial to avoid delays in processing your request.

-

Can I make withdrawals online using airSlate SignNow?

Yes, by using airSlate SignNow, you can fill out and eSign the Brighthouse Financial withdrawal form online. This digital solution makes it easy to manage your withdrawal requests without the hassle of printing or mailing paper documents.

-

Are there any fees associated with the Brighthouse Financial withdrawal form?

Fees related to withdrawals may vary based on your specific policy terms and conditions. It's essential to review your investment plan or contact Brighthouse Financial customer service for detailed information regarding any potential fees tied to the withdrawal process.

-

How long does it take to process the Brighthouse Financial withdrawal form?

The processing time for the Brighthouse Financial withdrawal form can vary based on several factors, including the method of submission and internal processing times. Typically, you can expect a response within a few business days when submitted through airSlate SignNow.

-

What are the benefits of using airSlate SignNow for my withdrawal form?

Using airSlate SignNow to manage your Brighthouse Financial withdrawal form offers several advantages, including electronic signature capabilities, reduced processing times, and enhanced document security. This user-friendly platform allows for a more efficient and convenient way to handle important transactions.

Get more for 403b Withdrawal Request Form MetLife

- Legal last will and testament form for divorced person not remarried with no children colorado

- Legal last will and testament form for divorced person not remarried with minor children colorado

- Legal last will and testament form for domestic partner with adult children colorado

- Legal last will and testament form for a domestic partner with no children colorado

- Colorado last will testament form

- Legal last will and testament form for divorced person not remarried with adult and minor children colorado

- Colorado will create 497300835 form

- Legal last will and testament form for a married person with no children colorado

Find out other 403b Withdrawal Request Form MetLife

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors