Revenue Regulations Bureau of Internal Revenue 2018-2026

What is the Bureau of Internal Revenue?

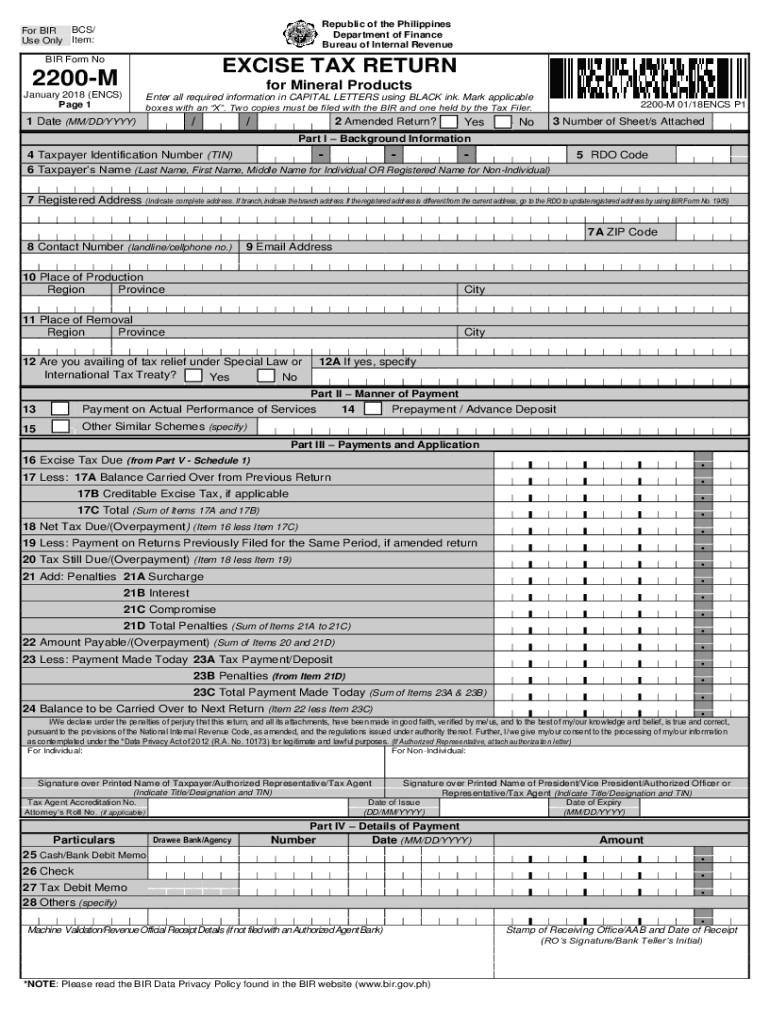

The Bureau of Internal Revenue (BIR) is the government agency responsible for the administration and enforcement of tax laws in the United States. Its primary role includes the collection of taxes, the enforcement of tax regulations, and the issuance of tax-related forms, such as the 2200m bir form. The BIR ensures compliance with federal tax laws and provides guidance to taxpayers regarding their obligations. This agency plays a crucial role in maintaining the integrity of the tax system and facilitating the smooth operation of tax collection.

Steps to Complete the 2200m Bir Form

Completing the 2200m bir form requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather Required Information: Collect all necessary information, including your taxpayer identification number, details of taxable transactions, and any relevant financial documents.

- Fill Out the Form: Accurately enter the required information in the designated fields of the 2200m form. Ensure all figures are correct and reflect your actual tax liabilities.

- Review for Accuracy: Double-check all entries for errors or omissions. This step is critical to avoid potential penalties or delays in processing.

- Sign and Date: Ensure that you sign and date the form as required. An unsigned form may be deemed invalid.

- Submit the Form: Choose your submission method, whether online or by mail, and ensure it is sent to the appropriate BIR office.

Legal Use of the 2200m Bir Form

The 2200m bir form is legally binding when completed and submitted in accordance with the BIR's regulations. To ensure its legal validity, it must be filled out accurately and submitted by the designated deadlines. The form is used for reporting excise taxes and must comply with the relevant tax laws. Electronic signatures, when used in conjunction with a reliable eSignature solution, provide additional legal assurance, as they meet the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the 2200m bir form are critical to avoid penalties. Typically, the form must be submitted on or before the last day of the month following the end of the taxable quarter. It is essential to stay informed about any changes to these deadlines, as they may vary based on specific circumstances or legislative updates. Mark your calendar with important dates to ensure timely submission.

Required Documents

To complete the 2200m bir form, you will need several documents to support your entries. These may include:

- Taxpayer Identification Number (TIN)

- Records of taxable transactions

- Invoices and receipts related to excise taxes

- Previous tax returns, if applicable

Having these documents ready will facilitate a smoother completion process and help ensure compliance with tax regulations.

Form Submission Methods

The 2200m bir form can be submitted through various methods to accommodate taxpayer preferences. Options typically include:

- Online Submission: Many taxpayers choose to file electronically through the BIR's online portal, which offers a streamlined process.

- Mail Submission: Alternatively, the form can be printed and mailed to the appropriate BIR office. Ensure that you use the correct address and send it well before the deadline.

- In-Person Submission: Taxpayers may also submit the form in person at designated BIR offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete revenue regulations bureau of internal revenue

Prepare Revenue Regulations Bureau Of Internal Revenue effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and sign your documents swiftly without complications. Manage Revenue Regulations Bureau Of Internal Revenue on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and sign Revenue Regulations Bureau Of Internal Revenue stress-free

- Acquire Revenue Regulations Bureau Of Internal Revenue and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, either via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form navigation, and errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and sign Revenue Regulations Bureau Of Internal Revenue and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue regulations bureau of internal revenue

Create this form in 5 minutes!

How to create an eSignature for the revenue regulations bureau of internal revenue

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the bir form 2200m?

The bir form 2200m is a tax form used in the Philippines for the registration of a business. This form is essential for compliance with the Bureau of Internal Revenue regulations and must be properly filled out to avoid penalties. Understanding how to fill out the bir form 2200m accurately can save time and ensure your business stays in good standing.

-

How can airSlate SignNow help with bir form 2200m?

airSlate SignNow streamlines the process of filling out and eSigning the bir form 2200m. Our platform allows you to easily upload, edit, and sign documents digitally, which simplifies tax submission. This reduces the risk of errors and ensures that your forms are completed quickly and accurately.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. You can choose from monthly or annual subscriptions based on your needs. Our pricing ensures you have all the necessary tools to manage documents like the bir form 2200m effectively without breaking the bank.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure cloud storage. These features enable users to manage their bir form 2200m and other documents efficiently. By utilizing these tools, businesses can enhance productivity and maintain compliance with regulatory requirements.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow allows seamless integration with various software applications like CRM and accounting systems. By integrating with these platforms, businesses can automate their workflows and enhance efficiency, especially when handling important documents like the bir form 2200m. This connectivity makes it easier to access and manage your documents in one place.

-

Is airSlate SignNow secure for sending sensitive documents?

Absolutely! Security is a top priority at airSlate SignNow. We offer features like advanced encryption, secure access controls, and audit trails to protect sensitive documents such as the bir form 2200m. You can trust our platform for secure document handling, ensuring your information remains confidential.

-

What are the benefits of eSigning the bir form 2200m?

eSigning the bir form 2200m provides multiple benefits including speed, convenience, and reduced paperwork. With airSlate SignNow, you can sign documents electronically from anywhere, eliminating delays associated with physical paperwork. This not only saves time but also helps businesses stay organized and compliant.

Get more for Revenue Regulations Bureau Of Internal Revenue

- Form it 196 new york resident nonresident and part yearform it 196 new york resident nonresident and part yearit 196 form 2019

- Schedule sb form 1 fill online printable pdffiller

- F120 115 000 statewide payee registration and w 9 f120 115 000 statewide payee registration and w 9 form

- Protocols for office worksites appendix d form

- You may use this form to revoke an appointment of agent for property tax matters

- Miscellaneous texas tax forms 66 102 texas battery sales fee report

- Govtexasgovuploadsfilesap 152 application for texas identification number greg abbott form

- Comptrollertexasgovforms50 283property owners affidavit of evidence

Find out other Revenue Regulations Bureau Of Internal Revenue

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online