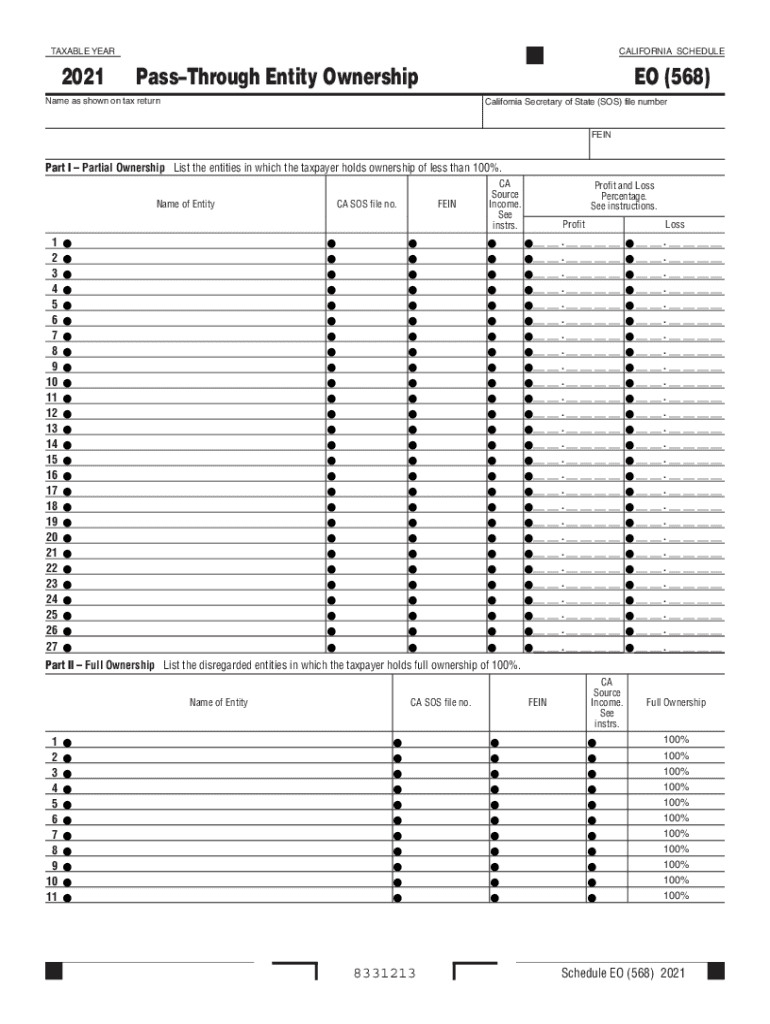

Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership 2021

What is the Schedule EO 568 PassThrough Entity Ownership

The Schedule EO 568 PassThrough Entity Ownership is a tax form used by entities that operate as pass-through organizations, such as partnerships, S corporations, and limited liability companies (LLCs). This form allows these entities to report ownership interests and allocate income, deductions, and credits to their owners. It is essential for ensuring that all stakeholders are accurately informed about their share of the entity's financial activities and tax obligations.

Steps to complete the Schedule EO 568 PassThrough Entity Ownership

Completing the Schedule EO 568 PassThrough Entity Ownership involves several key steps:

- Gather necessary information about the entity, including its legal structure and ownership details.

- Identify each owner's share of the entity's income, deductions, and credits.

- Fill out the form accurately, ensuring that all figures are correct and reflect the entity's financial activities.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate tax authority by the designated deadline.

Legal use of the Schedule EO 568 PassThrough Entity Ownership

The Schedule EO 568 PassThrough Entity Ownership is legally recognized when completed and submitted in accordance with IRS guidelines. It serves as an official record of ownership interests and financial allocations among partners or shareholders. Proper use of this form helps ensure compliance with tax laws and regulations, reducing the risk of penalties or disputes with tax authorities.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Schedule EO 568 PassThrough Entity Ownership. These guidelines outline the required information, filing procedures, and deadlines. It is important for entities to adhere to these guidelines to maintain compliance and avoid potential issues during audits or reviews.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule EO 568 PassThrough Entity Ownership typically align with the tax return deadlines for the entity. For most pass-through entities, this means the form is due on the fifteenth day of the third month following the end of the tax year. Entities should be aware of these dates to ensure timely submission and avoid late filing penalties.

Required Documents

To complete the Schedule EO 568 PassThrough Entity Ownership, several documents may be required, including:

- Previous tax returns for the entity and its owners.

- Financial statements reflecting income and expenses.

- Ownership agreements or partnership agreements.

- Any relevant documentation supporting deductions or credits claimed.

Quick guide on how to complete 2021 schedule eo 568 passthrough entity ownership 2021 schedule eo 568 passthrough entity ownership

Complete Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership on any platform with airSlate SignNow's Android or iOS apps and enhance any document-based workflow today.

How to modify and electronically sign Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership with ease

- Obtain Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form—by email, SMS, or invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or inaccuracies that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule eo 568 passthrough entity ownership 2021 schedule eo 568 passthrough entity ownership

Create this form in 5 minutes!

People also ask

-

What is Schedule EO 568 PassThrough Entity Ownership?

Schedule EO 568 PassThrough Entity Ownership is a form used by businesses to report the ownership structures of pass-through entities for tax purposes. Understanding this schedule is essential for compliance and accurate tax filing.

-

How does airSlate SignNow help with Schedule EO 568 PassThrough Entity Ownership?

airSlate SignNow streamlines the process of document preparation and signing for Schedule EO 568 PassThrough Entity Ownership forms. Our platform ensures that all signatures are captured electronically, making tax compliance easier and faster.

-

What features does airSlate SignNow offer for managing Schedule EO 568 PassThrough Entity Ownership documents?

Our platform includes customizable templates, secure eSigning, and real-time tracking, which are crucial for managing Schedule EO 568 PassThrough Entity Ownership documents efficiently. Additionally, it allows for easy sharing and collaboration among stakeholders.

-

Is there a cost associated with using airSlate SignNow for Schedule EO 568 PassThrough Entity Ownership?

Yes, airSlate SignNow offers various pricing plans suitable for different business sizes and needs when it comes to handling Schedule EO 568 PassThrough Entity Ownership. We provide a cost-effective solution that offers great value and comprehensive features.

-

Can I integrate airSlate SignNow with other software for Schedule EO 568 PassThrough Entity Ownership management?

Absolutely! airSlate SignNow offers integrations with numerous applications, which facilitates the management of Schedule EO 568 PassThrough Entity Ownership along with other business processes. Whether it's accounting or CRM systems, we make it easy to connect.

-

What benefits does airSlate SignNow offer for handling Schedule EO 568 PassThrough Entity Ownership?

By using airSlate SignNow for Schedule EO 568 PassThrough Entity Ownership, you gain efficiency through automation, compliance with legal standards, and enhanced security for your documents. This not only saves time but also mitigates risks associated with manual handling.

-

Is airSlate SignNow user-friendly for completing Schedule EO 568 PassThrough Entity Ownership forms?

Yes, airSlate SignNow is designed with user experience in mind, making the completion of Schedule EO 568 PassThrough Entity Ownership forms simple and straightforward. Our intuitive interface ensures that users at all skill levels can easily navigate the platform.

Get more for Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership

- Request for release of funds corporation or llc ohio form

- Ohio notice form 497322342

- Business credit application ohio form

- Ohio notice of commencement form

- Individual credit application ohio form

- Commence suit form

- Interrogatories to plaintiff for motor vehicle occurrence ohio form

- Interrogatories to defendant for motor vehicle accident ohio form

Find out other Schedule EO 568 PassThrough Entity Ownership Schedule EO 568 PassThrough Entity Ownership

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document