Where to File Your Taxes for Form 1120 SInternal Revenue Service 2022

What is the Where To File Your Taxes For Form 1120 S

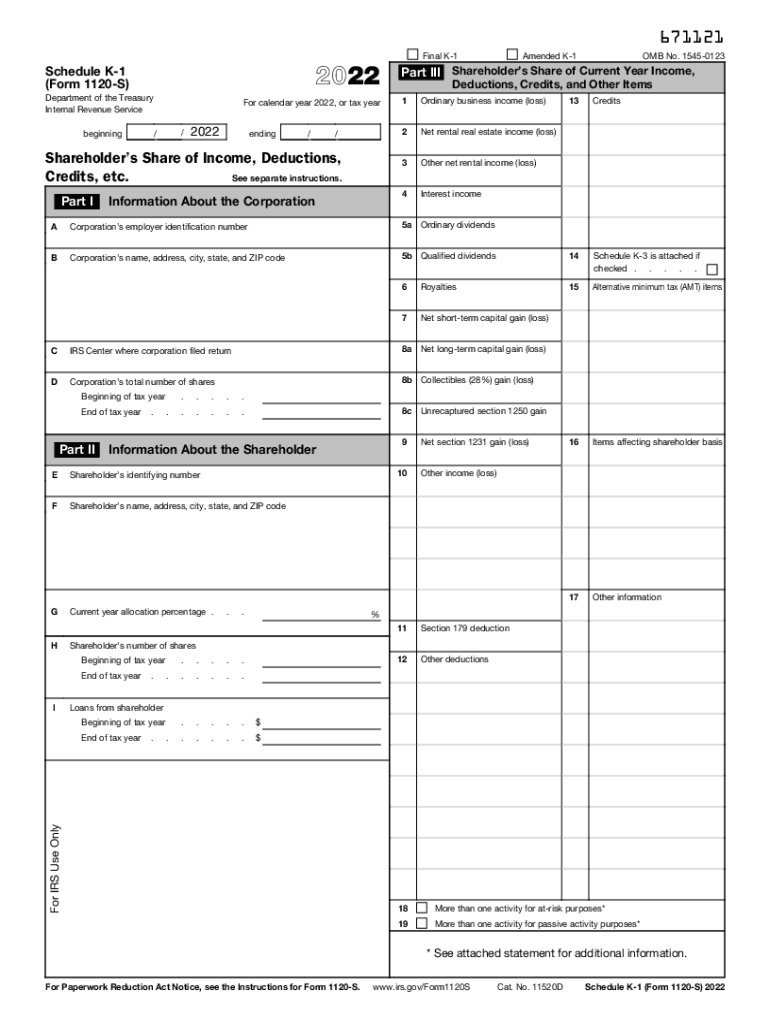

The Where To File Your Taxes For Form 1120 S refers to the specific addresses designated by the Internal Revenue Service (IRS) for submitting the S Corporation tax return. This form is essential for S Corporations, allowing them to report income, deductions, and credits. Understanding where to file is crucial for ensuring timely and accurate submissions, which can impact a corporation's tax obligations and compliance status.

Steps to complete the Where To File Your Taxes For Form 1120 S

Completing the Where To File Your Taxes For Form 1120 S involves several key steps:

- Determine the correct IRS address based on your business location and whether you are enclosing a payment.

- Gather all necessary documentation, including financial statements and previous tax returns.

- Complete Form 1120 S accurately, ensuring all income, deductions, and credits are reported.

- Review the form for errors before submission to avoid delays or penalties.

- Submit the form either electronically or via mail, depending on your preference and IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines for filing Form 1120 S, including detailed instructions on eligibility, required documentation, and deadlines. It is essential to review these guidelines to ensure compliance with federal tax laws. The IRS updates these guidelines periodically, so staying informed is vital for accurate filings.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 S are critical for compliance. Generally, S Corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this typically falls on March 15. Understanding these deadlines helps businesses avoid penalties and interest on late filings.

Form Submission Methods (Online / Mail / In-Person)

Form 1120 S can be submitted through various methods, including:

- Online: Filing electronically through IRS-approved software is often the fastest method.

- Mail: Forms can be mailed to the appropriate IRS address based on your location and payment status.

- In-Person: While not common, some taxpayers may choose to deliver their forms directly to local IRS offices.

Penalties for Non-Compliance

Failure to file Form 1120 S on time can result in significant penalties. The IRS may impose a late filing penalty, which can accumulate daily until the form is submitted. Additionally, inaccuracies on the form can lead to audits and further penalties. Understanding these consequences emphasizes the importance of timely and accurate filings.

Quick guide on how to complete where to file your taxes for form 1120 sinternal revenue service

Effortlessly Prepare Where To File Your Taxes For Form 1120 SInternal Revenue Service on Any Device

The management of online documents is increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Where To File Your Taxes For Form 1120 SInternal Revenue Service across any platform using airSlate SignNow’s Android or iOS applications and enhance your document-related workflow today.

How to Edit and Electronically Sign Where To File Your Taxes For Form 1120 SInternal Revenue Service with Ease

- Locate Where To File Your Taxes For Form 1120 SInternal Revenue Service and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for such tasks.

- Create your electronic signature using the Sign tool, which takes only a few seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Where To File Your Taxes For Form 1120 SInternal Revenue Service to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct where to file your taxes for form 1120 sinternal revenue service

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it use ki?

airSlate SignNow is a comprehensive eSignature solution designed for businesses. It leverages ki technology to streamline the document signing process, making it faster and more efficient. With user-friendly features, it enhances workflow and reduces paperwork.

-

What are the key features of airSlate SignNow's ki technology?

The ki technology in airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage. These capabilities enable users to manage their signing processes effectively. With ki, businesses can also track document status in real-time.

-

How does ki contribute to the cost-effectiveness of airSlate SignNow?

Ki technology minimizes the time and resources spent on paper-based document management, thus enhancing cost-effectiveness. By reducing printing and mailing costs, airSlate SignNow allows businesses to allocate their budgets more efficiently. This makes it an affordable eSignature solution for organizations of all sizes.

-

Can I integrate airSlate SignNow with other applications using ki?

Yes, airSlate SignNow supports integrations with various applications through ki technology. You can seamlessly connect with platforms like Google Drive, Dropbox, and CRM systems to enhance your document management. This integration capability helps streamline your workflow and saves time.

-

Is airSlate SignNow secure, and how does ki enhance its security measures?

Absolutely, airSlate SignNow employs robust security measures, and ki technology enhances these protocols further. With features like encryption and two-factor authentication, your documents are protected throughout the signing process. This ensures that sensitive information remains safe and secure.

-

What benefits does ki offer to users of airSlate SignNow?

Ki technology enhances user experience by making document signing fast and easy. Users benefit from simplified workflows, increased efficiency, and improved tracking of signatures. This versatility helps businesses manage their document processes efficiently.

-

What pricing plans are available for airSlate SignNow with ki?

airSlate SignNow offers flexible pricing plans that cater to different business needs, all utilizing ki technology. Whether you're a small startup or a large enterprise, there's a plan that fits your requirements. The pricing structure is transparent, allowing you to choose the best option for your budget.

Get more for Where To File Your Taxes For Form 1120 SInternal Revenue Service

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration ohio form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497322301 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement ohio form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase ohio form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants ohio form

- Shut off notice 497322305 form

- Letter tenant about sample 497322306 form

- Notice commence 497322308 form

Find out other Where To File Your Taxes For Form 1120 SInternal Revenue Service

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online