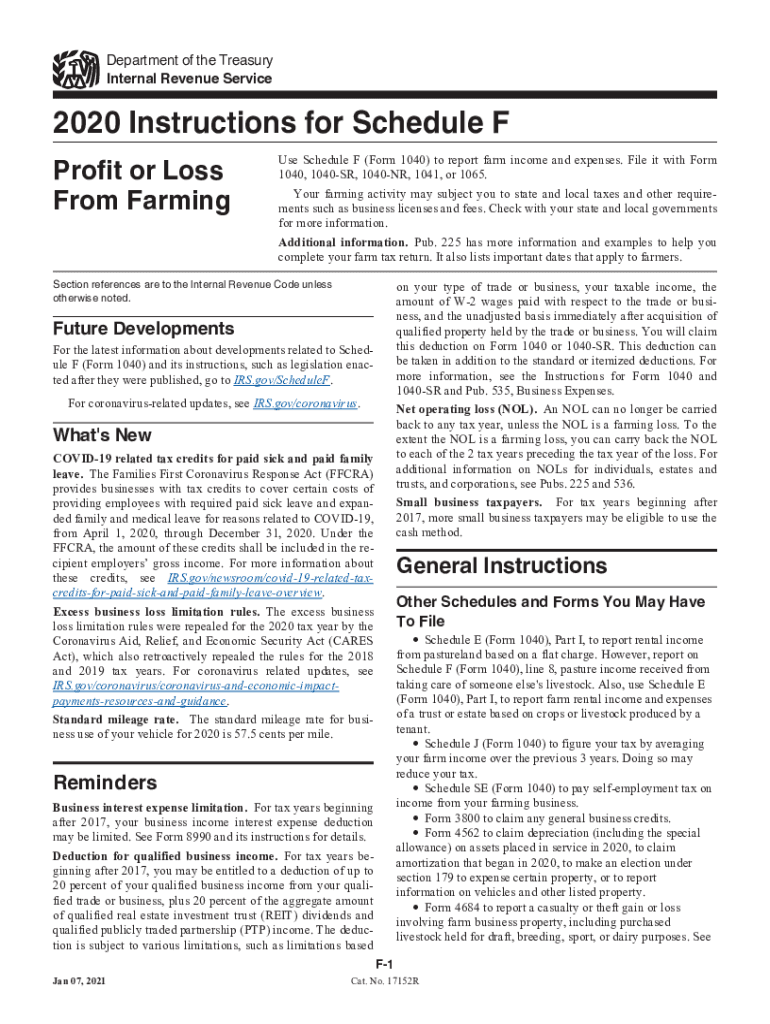

Instructions for Schedule F Internal Revenue Service 2020

What is the Instructions For Schedule F Internal Revenue Service

The Instructions for Schedule F are essential guidelines provided by the Internal Revenue Service (IRS) for farmers and ranchers to report income and expenses related to their farming activities. This form is part of the individual income tax return, Form 1040, and is specifically designed for those who earn income from farming. It helps taxpayers calculate their net profit or loss from farming operations, which is then reported on their tax return. Understanding these instructions is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Instructions For Schedule F Internal Revenue Service

Using the Instructions for Schedule F involves several steps to ensure accurate completion of the form. First, gather all necessary financial documents, including records of income, expenses, and any relevant receipts. Next, follow the detailed instructions provided in the form to categorize your income and expenses correctly. The instructions outline various sections, including gross income, expenses, and deductions specific to farming. It is important to read through each section carefully to ensure that all applicable information is included. Finally, review your completed Schedule F for accuracy before submitting it with your Form 1040.

Steps to complete the Instructions For Schedule F Internal Revenue Service

Completing the Instructions for Schedule F involves a systematic approach:

- Gather all relevant financial records, including income statements and expense receipts.

- Fill out the gross income section, detailing all income earned from farming activities.

- List all allowable expenses, such as operating costs, equipment purchases, and maintenance.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Ensure that all entries are accurate and reflect your actual farming activities.

- Attach the completed Schedule F to your Form 1040 before submission.

Key elements of the Instructions For Schedule F Internal Revenue Service

Key elements of the Instructions for Schedule F include:

- Gross Income: This section requires reporting all income derived from farming activities.

- Expenses: Detailed categories for expenses such as feed, fertilizer, labor, and depreciation.

- Deductions: Information on potential deductions available to farmers, which can reduce taxable income.

- Net Profit or Loss Calculation: Instructions on how to calculate the final net profit or loss from farming operations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Instructions for Schedule F. Generally, the deadline for submitting your Form 1040, including Schedule F, is April 15 of each year. However, if you are unable to meet this deadline, you may file for an extension, which typically allows an additional six months. Keep in mind that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Penalties for Non-Compliance

Failure to comply with the Instructions for Schedule F can result in various penalties. If the IRS determines that income has been underreported or expenses have been improperly claimed, taxpayers may face additional taxes owed, interest on unpaid amounts, and potential penalties for negligence. In severe cases, willful disregard of tax laws can lead to criminal charges. It is crucial to follow the instructions carefully to avoid such consequences and ensure accurate reporting.

Quick guide on how to complete 2019 instructions for schedule f internal revenue service

Prepare Instructions For Schedule F Internal Revenue Service effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the correct form and keep it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Instructions For Schedule F Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Instructions For Schedule F Internal Revenue Service with ease

- Locate Instructions For Schedule F Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all your information and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form hunting, or mistakes that require reprinting new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Instructions For Schedule F Internal Revenue Service to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for schedule f internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for schedule f internal revenue service

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What are the IRS Schedule F instructions for 1040?

The IRS Schedule F instructions for 1040 provide guidelines for reporting farm income and expenses. This form is used by farmers to calculate their net profit or loss from farming operations, which then impacts their overall tax liability on their 1040 return. Following these instructions diligently can help ensure compliance and maximize potential deductions.

-

How can airSlate SignNow help with IRS Schedule F documentation?

AirSlate SignNow simplifies the process of preparing and signing necessary documents for IRS Schedule F. With an easy-to-use interface, users can securely send, sign, and store their farming-related documents, ensuring they are organized and accessible when filing. This efficiency allows users to focus more on their farming business rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers a cost-effective pricing model tailored for various business needs. The pricing plans are designed to accommodate both small and large businesses, providing flexibility depending on the number and type of documents handled, including those related to IRS Schedule F instructions for 1040.

-

What features does airSlate SignNow offer for eSigning IRS-related documents?

AirSlate SignNow offers robust features for eSigning IRS-related documents, such as customizable templates, in-person signing, and secure cloud storage. These tools ensure that documents related to IRS Schedule F instructions for 1040 can be handled efficiently and securely. Moreover, the software integrates seamlessly with various applications, enhancing overall productivity.

-

Can airSlate SignNow assist with IRS Schedule F if I'm a new farmer?

Absolutely! AirSlate SignNow is designed to support users of all experience levels, including new farmers. With its intuitive interface, comprehensive features, and access to documentation related to IRS Schedule F instructions for 1040, even those unfamiliar with tax forms can navigate their requirements with ease.

-

What integrations does airSlate SignNow offer for accounting software?

AirSlate SignNow integrates with popular accounting software like QuickBooks and Xero, making it easy to manage your farm's finances alongside your eSigning needs. This helps streamline the process of organizing documents necessary for IRS Schedule F instructions for 1040. Such integrations enable seamless data sharing and enhance overall efficiency.

-

How does airSlate SignNow ensure the security of my IRS Schedule F documents?

AirSlate SignNow prioritizes the security of user documents, employing advanced encryption and access control measures. This ensures that sensitive information related to IRS Schedule F instructions for 1040 remains protected throughout the eSigning process. Users can rest assured that their data is secure and compliant with industry standards.

Get more for Instructions For Schedule F Internal Revenue Service

Find out other Instructions For Schedule F Internal Revenue Service

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT