Hall Individual Income Tax Return Hall Individual Income Tax Return 2020-2026

What is the Hall Individual Income Tax Return?

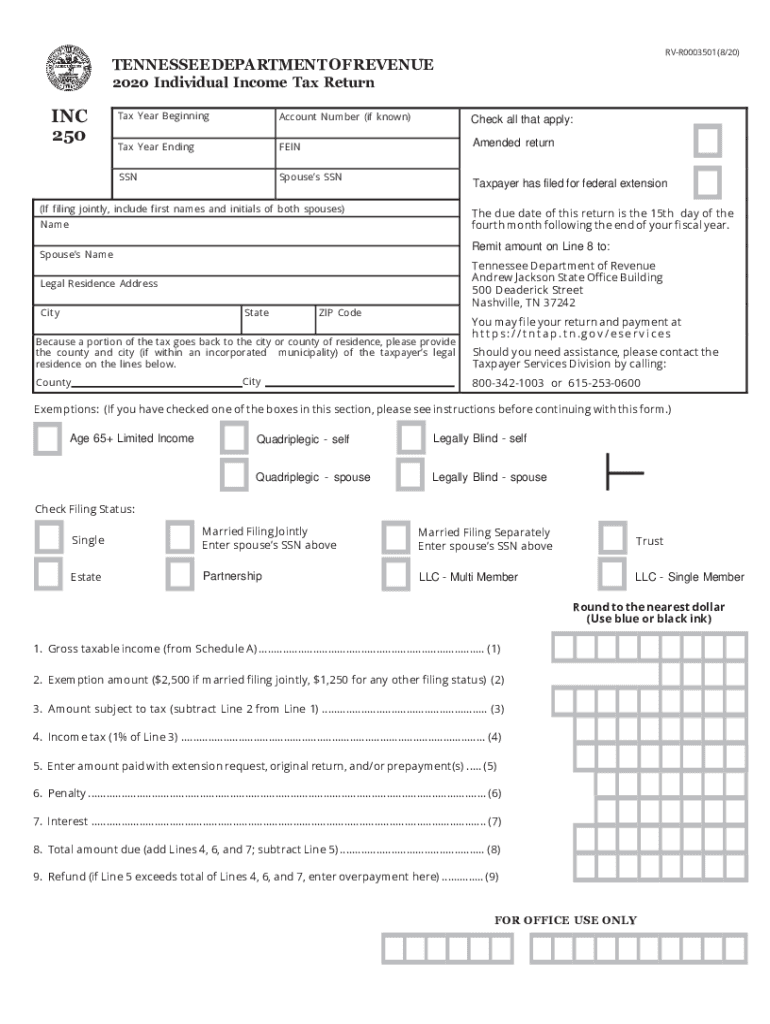

The Hall Individual Income Tax Return is a tax form used by residents of Tennessee to report their individual income for state tax purposes. This form is essential for calculating the amount of tax owed to the state and ensuring compliance with Tennessee revenue tax laws. It captures various sources of income, including wages, dividends, and interest, and allows taxpayers to claim deductions and credits applicable to their situation.

Steps to Complete the Hall Individual Income Tax Return

Completing the Hall Individual Income Tax Return involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can impact your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring that all income sources are reported and deductions are claimed.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or by mail, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines to avoid penalties. The typical deadline for submitting the Hall Individual Income Tax Return is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be mindful of any changes in deadlines announced by the Tennessee Department of Revenue.

Required Documents

To complete the Hall Individual Income Tax Return, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical bills or charitable contributions

- Any previous year tax returns for reference

Penalties for Non-Compliance

Failure to file the Hall Individual Income Tax Return or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state. It is essential to file on time and ensure all information is accurate to avoid these consequences.

Digital vs. Paper Version

Taxpayers have the option to file the Hall Individual Income Tax Return either digitally or on paper. Filing electronically can expedite the process and reduce the likelihood of errors. Digital submissions are often processed faster, allowing for quicker refunds. However, some individuals may prefer the traditional paper method for various reasons, including familiarity or lack of access to technology.

Quick guide on how to complete hall individual income tax return hall individual income tax return

Effortlessly prepare Hall Individual Income Tax Return Hall Individual Income Tax Return on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to retrieve the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Handle Hall Individual Income Tax Return Hall Individual Income Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Hall Individual Income Tax Return Hall Individual Income Tax Return with ease

- Locate Hall Individual Income Tax Return Hall Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or cover sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Hall Individual Income Tax Return Hall Individual Income Tax Return to ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hall individual income tax return hall individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the hall individual income tax return hall individual income tax return

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the importance of managing TN revenue tax documents efficiently?

Managing TN revenue tax documents efficiently is crucial for businesses to ensure compliance with state regulations. Using an eSignature solution like airSlate SignNow simplifies this process, allowing for quick and secure signing of tax-related documents. This not only saves time but also reduces the risk of human error in documentation.

-

How does airSlate SignNow help with TN revenue tax filing?

airSlate SignNow streamlines the TN revenue tax filing process by enabling users to send and sign documents electronically. This feature ensures that all necessary tax forms are completed and submitted on time, helping to avoid potential penalties. With templates and automated workflows, users can efficiently manage multiple filings.

-

What are the pricing options for airSlate SignNow regarding TN revenue tax management?

airSlate SignNow offers several pricing plans that cater to businesses of all sizes looking to manage TN revenue tax documents. With competitive pricing, users can access a range of features designed for efficient document management. The flexible subscription models allow businesses to choose a plan that best fits their needs.

-

Can airSlate SignNow integrate with accounting software for TN revenue tax purposes?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software. This integration allows users to sync their TN revenue tax documents directly, making it easier to track and manage tax-related information. Efficient integration supports a smoother workflow for businesses when filing their taxes.

-

What features does airSlate SignNow offer for handling TN revenue tax documents?

airSlate SignNow provides features such as customizable templates, audit trails, and bulk sending for TN revenue tax documents. These features enhance the overall efficiency of document management, ensuring that businesses can sign and store tax-related paperwork securely. The platform is designed to simplify the eSigning process.

-

How does airSlate SignNow ensure the security of TN revenue tax documents?

airSlate SignNow prioritizes security for TN revenue tax documents with advanced encryption and two-factor authentication. These measures protect sensitive information while allowing for secure eSigning. Businesses can trust that their tax-related documents are handled with the utmost care.

-

What benefits do users gain from using airSlate SignNow for TN revenue tax?

Using airSlate SignNow for TN revenue tax provides numerous benefits, such as increased efficiency and reduced processing time. Businesses can eliminate paper-based processes, which helps lower costs associated with printing and storing physical documents. Additionally, the user-friendly interface enhances the overall experience for teams.

Get more for Hall Individual Income Tax Return Hall Individual Income Tax Return

- Form 52 pdf download

- Gauteng department of education forms

- Yurtd adres beyan formu doldurulmu rnei

- Pnb csp account opening form

- All flesh must be eaten character sheet form

- Salary receipt for domestic helper form

- Dresden files character sheet form

- Timeframe for filing a claimworkers compensation form

Find out other Hall Individual Income Tax Return Hall Individual Income Tax Return

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed