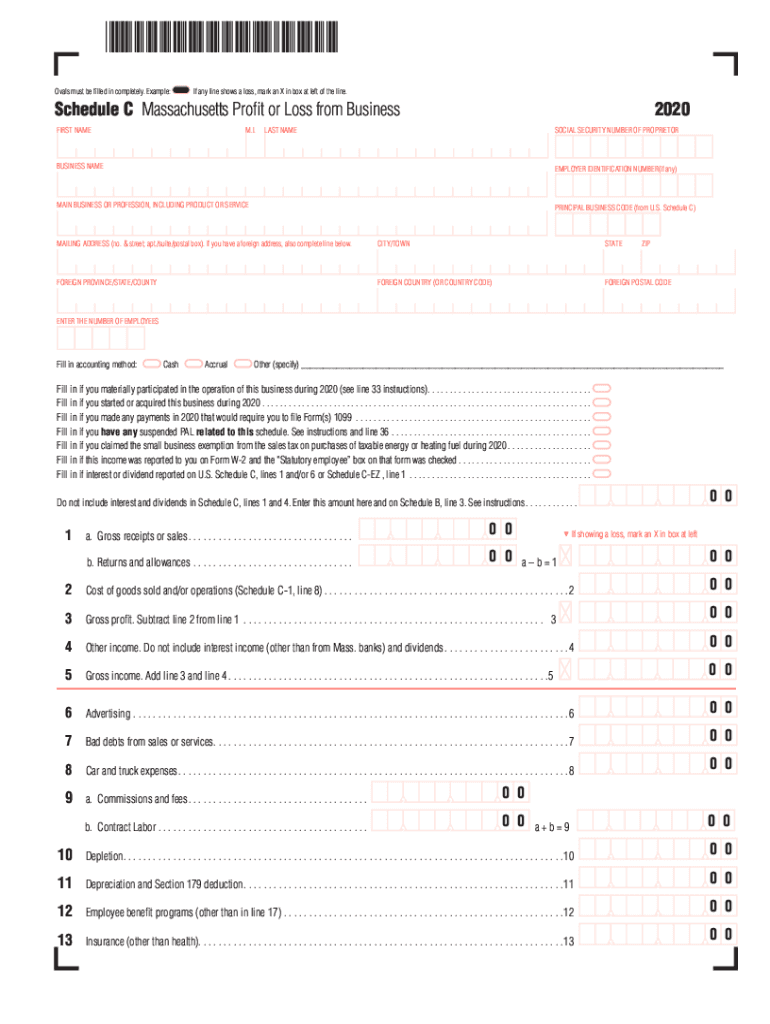

Schedule C Massachusetts Profit or Loss from Business 2020

What is the Schedule C Massachusetts Profit Or Loss From Business

The Schedule C Massachusetts Profit or Loss From Business is a tax form used by self-employed individuals and business owners in Massachusetts to report income and expenses related to their business activities. This form is essential for calculating the net profit or loss from a business, which is then reported on the individual's personal income tax return. It captures various financial details, including gross receipts, cost of goods sold, and operating expenses, allowing for a comprehensive overview of the business's financial performance.

How to use the Schedule C Massachusetts Profit Or Loss From Business

To effectively use the Schedule C Massachusetts Profit or Loss From Business, individuals must gather all relevant financial records, including income statements, receipts, and invoices. The form is divided into sections that require detailed information about income, expenses, and deductions. For instance, business owners should accurately report all sources of income and categorize expenses, such as advertising, utilities, and employee wages. Properly completing this form helps ensure compliance with tax regulations and maximizes potential deductions.

Steps to complete the Schedule C Massachusetts Profit Or Loss From Business

Completing the Schedule C Massachusetts Profit or Loss From Business involves several key steps:

- Gather all necessary financial documents, including income records and expense receipts.

- Fill out the business information section, including the business name and address.

- Report gross receipts and any returns or allowances to determine total income.

- List all business expenses in the appropriate categories, ensuring accuracy and completeness.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Schedule C Massachusetts Profit Or Loss From Business

The Schedule C Massachusetts Profit or Loss From Business is legally recognized as a valid document for reporting business income and expenses to the state tax authorities. To ensure its legal standing, the form must be completed accurately and submitted by the appropriate deadline. Additionally, it is important to maintain supporting documentation for all reported figures, as these may be required in the event of an audit or review by tax authorities.

Filing Deadlines / Important Dates

The filing deadlines for the Schedule C Massachusetts Profit or Loss From Business typically align with the federal tax return deadlines. Generally, individual taxpayers must file their returns by April 15 each year. If additional time is needed, an extension may be requested, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule C Massachusetts Profit or Loss From Business, individuals should prepare the following documents:

- Income statements detailing all sources of business income.

- Receipts for business expenses, including operating costs and capital expenditures.

- Bank statements and financial records that support reported income and expenses.

- Any previous tax returns that may provide context for current filings.

Quick guide on how to complete schedule c massachusetts profit or loss from business 2020

Complete Schedule C Massachusetts Profit Or Loss From Business effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule C Massachusetts Profit Or Loss From Business on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Schedule C Massachusetts Profit Or Loss From Business without hassle

- Find Schedule C Massachusetts Profit Or Loss From Business and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or mask sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Schedule C Massachusetts Profit Or Loss From Business and guarantee outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c massachusetts profit or loss from business 2020

Create this form in 5 minutes!

How to create an eSignature for the schedule c massachusetts profit or loss from business 2020

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 2019 MA schedule for airSlate SignNow?

The 2019 MA schedule refers to the timelines and deadlines associated with document processing and e-signing through airSlate SignNow. This schedule ensures users adhere to important dates for compliance and documentation. By following the 2019 MA schedule, businesses can streamline their operations and avoid delays.

-

How does airSlate SignNow improve my productivity with the 2019 MA schedule?

airSlate SignNow enhances productivity by automating the workflows outlined in the 2019 MA schedule. With easy-to-use templates and e-signature capabilities, teams can quickly complete and send documents without manual errors. This efficiency allows businesses to focus on core operations instead of administrative tasks.

-

What pricing plans does airSlate SignNow offer for the 2019 MA schedule?

airSlate SignNow provides several flexible pricing plans to accommodate different business needs while managing the 2019 MA schedule. These plans range from basic options for small businesses to advanced features for larger enterprises. Contact our sales team to find a plan that aligns with your requirements and budget.

-

Can I integrate airSlate SignNow with other tools while following the 2019 MA schedule?

Yes, airSlate SignNow offers seamless integrations with various tools such as CRMs, project management software, and cloud storage services. This feature enables users to manage the 2019 MA schedule effectively while leveraging existing workflows. Integrating airSlate SignNow with your favorite tools enhances collaboration and streamlines processes.

-

What are the key features of airSlate SignNow that assist with the 2019 MA schedule?

Key features of airSlate SignNow that support the 2019 MA schedule include customizable templates, bulk sending options, and real-time tracking of document statuses. These tools allow users to manage their document workflows efficiently and ensure compliance with the established timelines. Together, these features simplify the e-signing process.

-

How secure is airSlate SignNow when dealing with the 2019 MA schedule?

airSlate SignNow prioritizes security, employing advanced encryption and security protocols to protect your documents within the framework of the 2019 MA schedule. This ensures that all data remains confidential and secure during the signing process. Users can confidently send and receive documents, knowing they are protected against unauthorized access.

-

What benefits does airSlate SignNow provide specifically related to the 2019 MA schedule?

The benefits of using airSlate SignNow in relation to the 2019 MA schedule include reduced turnaround times, improved compliance, and enhanced workflow efficiency. Users can meet critical deadlines more easily, ensuring that all necessary documentation is signed and processed in a timely manner. These advantages lead to better customer satisfaction and retention.

Get more for Schedule C Massachusetts Profit Or Loss From Business

Find out other Schedule C Massachusetts Profit Or Loss From Business

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple