Ovals Must Be Filled in Completely Example If an 2024-2026

Understanding the Massachusetts Schedule C

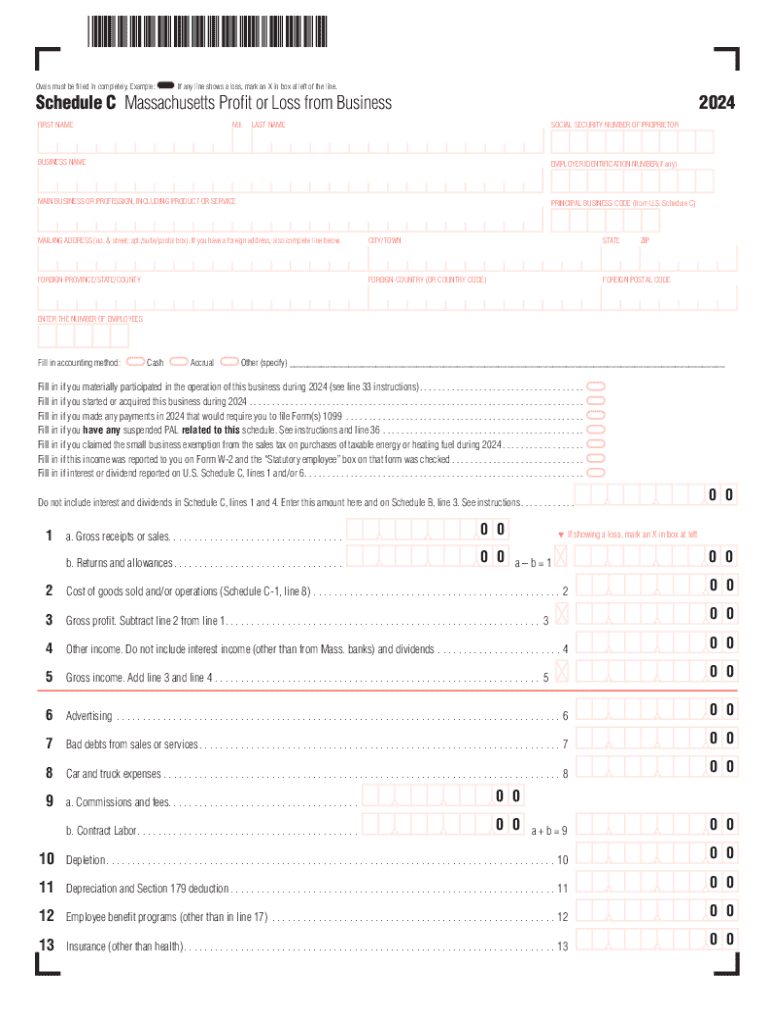

The Massachusetts Schedule C is a crucial form for self-employed individuals and sole proprietors in the state. It is used to report income or loss from a business operated as a sole proprietorship. This form allows taxpayers to detail their business income and expenses, which ultimately affects their overall tax liability. Completing the Massachusetts Schedule C accurately is essential for ensuring compliance with state tax laws.

Steps to Complete the Massachusetts Schedule C

Filling out the Massachusetts Schedule C involves several key steps:

- Gather all necessary documentation, including income records and receipts for expenses.

- Begin by entering your business name and address at the top of the form.

- Report your total income from the business in the designated section.

- Itemize your business expenses, categorizing them as necessary, such as advertising, utilities, and supplies.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Required Documents for the Massachusetts Schedule C

To complete the Massachusetts Schedule C, you will need several documents, including:

- Income statements, such as 1099 forms or sales receipts.

- Expense receipts for all business-related costs.

- Bank statements that reflect business transactions.

- Any prior year tax returns for reference.

Filing Deadlines for the Massachusetts Schedule C

The filing deadline for the Massachusetts Schedule C typically aligns with the federal tax deadline. For most taxpayers, this means the form is due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to stay informed about any changes to deadlines to avoid penalties.

Penalties for Non-Compliance with the Massachusetts Schedule C

Failing to file the Massachusetts Schedule C or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which increases the total amount owed.

- Potential audits by the Massachusetts Department of Revenue, which can lead to further scrutiny of your tax filings.

Digital vs. Paper Version of the Massachusetts Schedule C

Taxpayers have the option to file the Massachusetts Schedule C digitally or via paper submission. The digital version is often more efficient, allowing for quicker processing and immediate confirmation of receipt. However, some individuals may prefer the paper version for its tangible nature. Regardless of the method chosen, ensuring accuracy is paramount to avoid complications.

Create this form in 5 minutes or less

Find and fill out the correct ovals must be filled in completely example if an

Create this form in 5 minutes!

How to create an eSignature for the ovals must be filled in completely example if an

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts schedule for using airSlate SignNow?

The Massachusetts schedule for using airSlate SignNow is flexible and designed to accommodate your business needs. You can send and eSign documents at any time, ensuring that your workflow remains uninterrupted. Our platform allows you to manage your documents efficiently, regardless of your schedule.

-

How much does airSlate SignNow cost for Massachusetts businesses?

The pricing for airSlate SignNow varies based on the features you choose and the size of your business. For Massachusetts businesses, we offer competitive pricing plans that cater to different needs. You can select a plan that fits your budget while still benefiting from our robust eSigning capabilities.

-

What features does airSlate SignNow offer for managing documents in Massachusetts?

airSlate SignNow provides a range of features tailored for managing documents in Massachusetts. These include customizable templates, secure eSigning, and real-time tracking of document status. Our platform is designed to streamline your document management process, making it easier for you to stay organized.

-

Can airSlate SignNow integrate with other tools commonly used in Massachusetts?

Yes, airSlate SignNow offers seamless integrations with various tools that are popular among Massachusetts businesses. You can connect our platform with CRM systems, cloud storage services, and productivity applications to enhance your workflow. This integration capability ensures that you can manage your documents efficiently within your existing ecosystem.

-

What are the benefits of using airSlate SignNow for Massachusetts businesses?

Using airSlate SignNow provides numerous benefits for Massachusetts businesses, including increased efficiency and reduced turnaround times for document signing. Our user-friendly interface allows for quick adoption, ensuring that your team can start using the platform immediately. Additionally, our secure eSigning process helps maintain compliance with state regulations.

-

Is airSlate SignNow compliant with Massachusetts eSignature laws?

Absolutely! airSlate SignNow is fully compliant with Massachusetts eSignature laws, ensuring that your electronically signed documents are legally binding. We prioritize security and compliance, so you can trust that your documents meet all necessary legal standards. This compliance gives you peace of mind when managing your documents.

-

How can I get support for airSlate SignNow in Massachusetts?

For support with airSlate SignNow in Massachusetts, you can access our dedicated customer service team through various channels. We offer live chat, email support, and a comprehensive knowledge base to assist you. Our team is committed to helping you resolve any issues quickly and efficiently.

Get more for Ovals Must Be Filled In Completely Example If An

- Prior authorization preferred drug list papdl for proton pump inhibitor ppi capsules and tablets form

- Dcf orientation form

- Dcf f cf s0149a e form

- Dcf f cfs0847 e form

- Wv peia enrollment form

- Verification form alabama board of nursing alabamagov abn alabama

- Healthy lifestyle prescription pad contract alabama department of form

- Sample letter for hardship drivers license arkansas form

Find out other Ovals Must Be Filled In Completely Example If An

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template