Form 1 NRPY Mass NonresidentPart Year Resident Tax 2023

What is the Form 1 NRPY Mass Nonresident Part Year Resident Tax

The Form 1 NRPY is specifically designed for nonresidents and part-year residents of Massachusetts to report their income and calculate their tax obligations. This form allows individuals who do not reside in Massachusetts for the entire tax year to accurately declare their income earned within the state. It is essential for ensuring compliance with state tax laws while providing a clear framework for reporting income that is subject to taxation in Massachusetts.

How to use the Form 1 NRPY Mass Nonresident Part Year Resident Tax

To effectively use the Form 1 NRPY, individuals must first gather all necessary documentation, including W-2s, 1099s, and any other income statements relevant to the tax year. Once the form is obtained, taxpayers should fill out their personal information, including name, address, and Social Security number. Next, they must report their total income earned in Massachusetts and any applicable deductions. After completing the form, it should be reviewed for accuracy before submission to ensure compliance with Massachusetts tax regulations.

Steps to complete the Form 1 NRPY Mass Nonresident Part Year Resident Tax

Completing the Form 1 NRPY involves several key steps:

- Gather all income documentation, including forms from employers and other income sources.

- Fill in personal information accurately, including your residency status and Social Security number.

- Report all income earned in Massachusetts, ensuring to separate it from income earned outside the state.

- Apply any relevant deductions or credits to reduce taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either electronically or by mail.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1 NRPY. Typically, the deadline for submitting this form is the fifteenth day of the fourth month following the end of the tax year. For example, for the tax year ending December 31, the deadline would be April 15 of the following year. Taxpayers should also be mindful of any extensions that may apply and ensure timely submission to avoid penalties.

Required Documents

When preparing to file the Form 1 NRPY, several documents are necessary to ensure accurate reporting. These include:

- W-2 forms from all employers for income earned during the tax year.

- 1099 forms for any freelance or contract work completed.

- Records of any other income sources, such as rental income or interest earned.

- Documentation for any deductions or credits claimed, such as receipts for business expenses.

Penalties for Non-Compliance

Failure to comply with the filing requirements of the Form 1 NRPY can result in significant penalties. These may include fines for late submission or inaccuracies in reporting income. Additionally, interest may accrue on any unpaid taxes, increasing the total amount owed. It is essential for taxpayers to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 1 nrpy mass nonresidentpart year resident tax

Complete Form 1 NRPY Mass NonresidentPart Year Resident Tax effortlessly on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It presents a superb eco-conscious alternative to traditional printed and signed papers, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form 1 NRPY Mass NonresidentPart Year Resident Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to edit and electronically sign Form 1 NRPY Mass NonresidentPart Year Resident Tax hassle-free

- Obtain Form 1 NRPY Mass NonresidentPart Year Resident Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1 NRPY Mass NonresidentPart Year Resident Tax to ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 nrpy mass nonresidentpart year resident tax

Create this form in 5 minutes!

How to create an eSignature for the form 1 nrpy mass nonresidentpart year resident tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

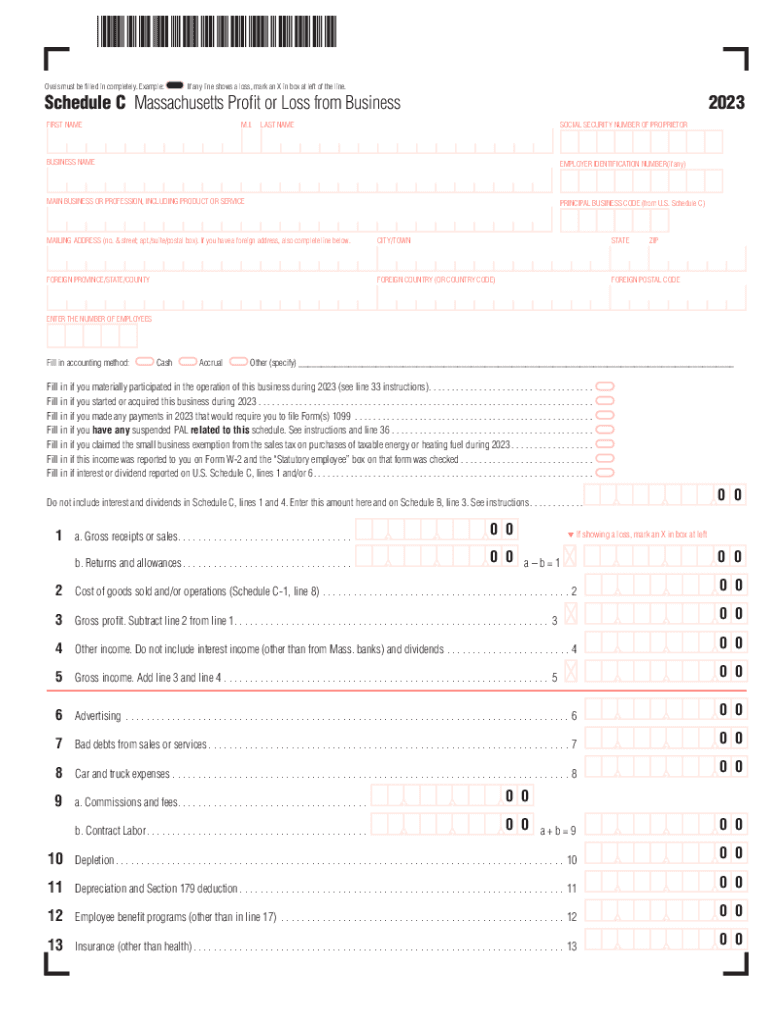

What is Massachusetts Schedule C and why is it important?

Massachusetts Schedule C is a tax form used to report income or loss from a business operated as a sole proprietorship. Understanding this form is crucial for accurate tax filing and compliance, allowing you to maximize your deductions and minimize your tax liabilities. airSlate SignNow can help streamline the document signing process, making it easier to manage your Schedule C paperwork efficiently.

-

How does airSlate SignNow assist with filling out the Massachusetts Schedule C?

airSlate SignNow offers an intuitive interface that simplifies the process of filling out and signing your Massachusetts Schedule C. With our platform, you can easily create, edit, and eSign your tax documents, ensuring all necessary information is accurately captured. This eliminates confusion and reduces the risk of errors in your tax filings.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides several pricing plans to accommodate different business sizes and needs. Each plan offers essential features for document management, including eSigning functionality which is useful when dealing with forms like the Massachusetts Schedule C. Additionally, you can take advantage of a free trial to explore our services before making a commitment.

-

Can airSlate SignNow integrate with accounting software for Massachusetts Schedule C?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, which can simplify the process of preparing your Massachusetts Schedule C. By connecting your apps, you can easily share documents and data, ensuring everything is in sync and reducing manual entry errors. This integration streamlines your workflow and helps keep your business organized.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a suite of features designed for effective tax document management, including customizable templates, templates for Massachusetts Schedule C, and secure storage. These features make it easy to create and distribute your tax documents while ensuring compliance and security. The platform also allows for efficient collaboration with your accountant or tax preparer.

-

Is airSlate SignNow secure for signing important documents like the Massachusetts Schedule C?

Absolutely! airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your sensitive documents such as the Massachusetts Schedule C. We ensure that every eSign process meets legal standards, giving you peace of mind when signing your tax forms online. Your data's security is our top priority.

-

How can I ensure my Massachusetts Schedule C is accurate before submission?

Using airSlate SignNow, you can leverage our document review features to ensure your Massachusetts Schedule C is accurate and complete before submission. Our platform allows you to collaborate with team members for additional checks and balances. This collaborative approach can help identify and rectify potential discrepancies, ensuring your submission is error-free.

Get more for Form 1 NRPY Mass NonresidentPart Year Resident Tax

- Justia medical certificate guardianship massachusetts form

- Notarized and verified consent form

- Certificate of service of form

- After hearing on the motion for appointment of temporary conservators form

- Of the powers of a guardian form

- Of the powers of a conservator form

- Decree and order of appointment of guardian for an form

- Fillable online mass decree and order of resignation form

Find out other Form 1 NRPY Mass NonresidentPart Year Resident Tax

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now