WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 Xft 2020

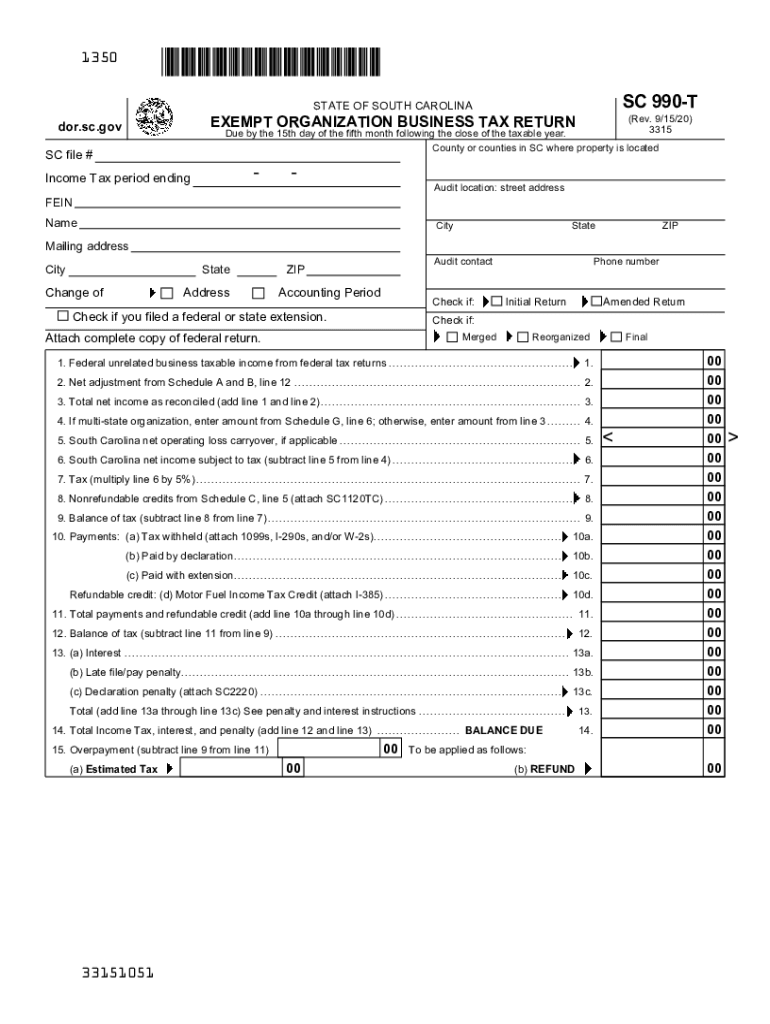

What is the SC990 T tax form?

The SC990 T tax form, also known as the South Carolina Form SC 990 T, is a tax return specifically designed for certain tax-exempt organizations in South Carolina. This form is used to report unrelated business income (UBI) and calculate the tax owed on that income. Nonprofit organizations, such as charities and educational institutions, may engage in activities that generate income not directly related to their exempt purpose. The SC990 T ensures that these organizations comply with state tax regulations while maintaining their tax-exempt status.

Steps to complete the SC990 T tax form

Completing the SC990 T tax form involves several key steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary information: Collect financial statements, including income and expenses related to the unrelated business activities.

- Fill out the form: Begin by entering the organization's basic information, including name, address, and federal employer identification number (EIN).

- Report income: Detail all unrelated business income earned during the tax year on the appropriate lines of the form.

- Deduct expenses: List any allowable expenses directly related to the generation of unrelated business income.

- Calculate tax liability: Use the provided tax rates to determine the amount of tax owed based on the net income from unrelated business activities.

- Review and sign: Ensure all information is accurate before signing and dating the form.

Filing deadlines for the SC990 T tax form

It is crucial for organizations to be aware of the filing deadlines associated with the SC990 T tax form. Generally, the form is due on the 15th day of the fifth month following the end of the organization's fiscal year. For organizations operating on a calendar year, this typically means a deadline of May 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely submission helps avoid potential penalties and maintains compliance with state tax laws.

Required documents for filing the SC990 T tax form

When preparing to file the SC990 T tax form, organizations should gather several key documents to ensure a complete and accurate submission. These documents may include:

- Financial statements: Profit and loss statements that detail income and expenses related to unrelated business activities.

- Form 990: The organization’s annual information return, which may provide context for the unrelated business income reported.

- Supporting schedules: Any additional schedules or documentation that explain the nature of the unrelated business activities and the associated income and expenses.

Legal use of the SC990 T tax form

The SC990 T tax form is legally binding when properly completed and submitted according to South Carolina tax laws. Organizations must ensure that they accurately report all unrelated business income and comply with the guidelines set forth by the South Carolina Department of Revenue. Failure to file the SC990 T or inaccuracies in reporting can lead to penalties, loss of tax-exempt status, or other legal repercussions. It is advisable for organizations to consult with a tax professional to ensure compliance and proper handling of the form.

IRS guidelines for unrelated business income

The Internal Revenue Service (IRS) provides guidelines on what constitutes unrelated business income and how it should be reported. According to IRS regulations, income is considered unrelated if it is derived from a trade or business that is regularly carried on and not substantially related to the organization’s exempt purpose. Organizations must also be aware of specific deductions and exemptions that may apply to their unrelated business income. Understanding these guidelines is essential for accurately completing the SC990 T tax form and maintaining compliance with both state and federal tax laws.

Quick guide on how to complete wformstestdevelopmentsc990t3315sc990t331502xft

Prepare WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft effortlessly

- Obtain WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wformstestdevelopmentsc990t3315sc990t331502xft

Create this form in 5 minutes!

How to create an eSignature for the wformstestdevelopmentsc990t3315sc990t331502xft

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the SC990 T tax form and who needs to file it?

The SC990 T tax form is used by certain tax-exempt organizations in South Carolina to report unrelated business income. If your organization earns income that does not directly relate to its exempt purpose, you may need to file this form. It's important to understand your tax obligations to maintain your tax-exempt status.

-

How can airSlate SignNow help with filing the SC990 T tax form?

AirSlate SignNow streamlines the document preparation necessary for filing the SC990 T tax form. With eSignature capabilities, you can easily sign and send documents securely. This simplifies the process and allows for quick collaboration between team members and accountants.

-

Are there any costs associated with using airSlate SignNow for the SC990 T tax form?

AirSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. The cost-effective solution allows you to efficiently manage document signing, including the SC990 T tax form, without breaking the bank. Depending on your needs, you can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the SC990 T tax form?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and automated reminders for deadlines. These tools ensure that your SC990 T tax form is prepared and submitted on time. Additionally, the platform supports multiple users to facilitate teamwork and collaboration.

-

How do I integrate airSlate SignNow with my existing software for the SC990 T tax form?

Integrating airSlate SignNow with your existing software is seamless, thanks to its various integrations with popular platforms. Whether you're using accounting software or project management tools, you can streamline the process of managing the SC990 T tax form. Visit our integration page to find detailed instructions and supported applications.

-

Is my data secure when using airSlate SignNow for the SC990 T tax form?

Yes, your data is secure when using airSlate SignNow. We utilize advanced encryption and security measures to protect sensitive information, ensuring that your SC990 T tax form and any associated documents remain confidential. Compliance with industry standards means you can trust us with your important data.

-

Can I access previous submissions of the SC990 T tax form using airSlate SignNow?

Absolutely! AirSlate SignNow provides you with a centralized dashboard where you can access previous submissions of the SC990 T tax form. This feature helps you keep track of past filings for easy reference and ensures that you have all necessary documentation organized.

Get more for WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft

- Cvr 4 form pdf

- To whom it may concern certificate form

- Distance and displacement lab activity answer key form

- Sasseta online registration form

- Manatee county homestead exemption form

- Scrabble cheat sheet form

- Translation practice worksheet answers pdf form

- D03 01 street name sign mutcd fhwa dot form

Find out other WFORMSTESTDEVELOPMENTSC990T3315SC990T331502 xft

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF