2 Business Income Tax SC Department of Revenue 2017

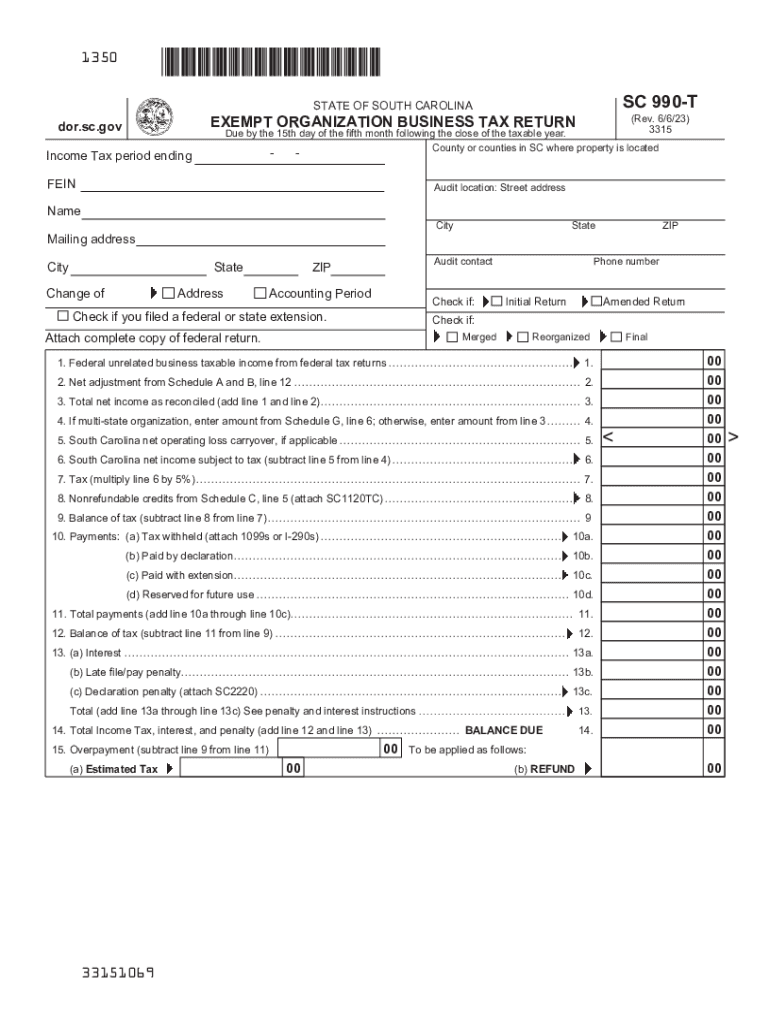

Understanding the SC 990 Form

The SC 990 form is a crucial document for businesses operating in South Carolina that are required to report their income and pay taxes. This form is specifically designed for entities that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. It serves as a state-level income tax return, providing the South Carolina Department of Revenue with essential financial information about the organization’s activities and income.

Steps to Complete the SC 990 Form

Filling out the SC 990 form involves several key steps to ensure compliance with state tax regulations. First, gather all necessary financial documents, including income statements, balance sheets, and any supporting schedules. Next, accurately report total income, expenses, and any applicable deductions. Be sure to include all required attachments, such as copies of federal tax returns and any additional documentation that supports your claims. Finally, review the completed form for accuracy before submitting it to the South Carolina Department of Revenue.

Filing Deadlines for the SC 990 Form

Timely submission of the SC 990 form is essential to avoid penalties. The form is typically due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For entities operating on a calendar year, this means the form is due by May 15. If additional time is needed, organizations can file for an extension using the SC 990 T extension form, which grants an additional six months for filing.

Required Documents for the SC 990 Form

When preparing to file the SC 990 form, several documents are necessary to ensure a complete submission. These include:

- Federal Form 990 or 990-EZ

- Financial statements, including income and balance sheets

- Schedule A, detailing public charity status

- Any additional schedules or documents that support your financial claims

Having these documents ready will streamline the filing process and help avoid delays or complications.

Penalties for Non-Compliance with the SC 990 Form

Failure to file the SC 990 form on time can result in significant penalties. The South Carolina Department of Revenue may impose fines based on the length of the delay and the amount of tax owed. Organizations that do not comply may also face additional scrutiny during audits, which can lead to further repercussions. It is essential to stay informed about filing requirements to avoid these penalties.

Who Issues the SC 990 Form

The SC 990 form is issued by the South Carolina Department of Revenue. This state agency oversees the administration of tax laws and ensures compliance among businesses operating within its jurisdiction. Organizations must adhere to the guidelines set forth by the department to maintain their tax-exempt status and fulfill their reporting obligations.

Eligibility Criteria for Filing the SC 990 Form

To be eligible to file the SC 990 form, organizations must meet specific criteria. Primarily, they must be recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. Additionally, they should operate primarily for charitable, educational, or religious purposes. Organizations that do not meet these criteria may be required to file different tax forms, such as the SC 1120 or SC 1065, depending on their structure and activities.

Quick guide on how to complete 2 business income tax sc department of revenue

Complete 2 Business Income Tax SC Department Of Revenue effortlessly on any device

Online document handling has become popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage 2 Business Income Tax SC Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign 2 Business Income Tax SC Department Of Revenue with ease

- Obtain 2 Business Income Tax SC Department Of Revenue and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you choose. Edit and electronically sign 2 Business Income Tax SC Department Of Revenue to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2 business income tax sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2 business income tax sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 990 form?

The SC 990 form is a document used for reporting to the IRS, typically required for certain tax-exempt organizations. It provides essential financial information, allowing transparency and compliance with federal regulations. Understanding how to complete and file the SC 990 form is crucial for maintaining your organization's tax-exempt status.

-

How can airSlate SignNow help with the SC 990 form?

AirSlate SignNow offers a seamless e-signature solution that simplifies the process of signing and submitting the SC 990 form. With our platform, you can easily send the form to multiple stakeholders for quick electronic signatures, ensuring a faster turnaround. This efficiency helps you stay compliant and focused on your organization's mission.

-

Is there a cost associated with using airSlate SignNow for the SC 990 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, ensuring you find a suitable option for processing the SC 990 form. Our plans are designed to be cost-effective while providing robust features that enhance document management and e-signature processes. Explore our pricing page to find the plan that fits your budget.

-

What features does airSlate SignNow provide for managing the SC 990 form?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure storage to streamline the handling of the SC 990 form. You can create reusable templates for common documents, ensuring consistency and saving time on future filings. Our platform also provides a secure environment for storing sensitive information.

-

Can I integrate airSlate SignNow with other software for the SC 990 form?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of software solutions such as CRM systems, document management tools, and cloud storage services, facilitating smooth workflows related to the SC 990 form. This integration capability ensures that you can manage all your documents efficiently and keep everything organized in one place.

-

How secure is airSlate SignNow when handling the SC 990 form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the SC 990 form. We employ robust encryption methods, multi-factor authentication, and compliance with industry standards to protect your data. You can trust that your information is safe and secure while using our platform.

-

Can multiple users collaborate on the SC 990 form via airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration among multiple users when working on the SC 990 form. You can invite team members to review and sign the document, making it ideal for organizations with several stakeholders involved in the filing process. This collaboration feature enhances efficiency and helps ensure accuracy.

Get more for 2 Business Income Tax SC Department Of Revenue

- Discovery interrogatories from plaintiff to defendant with production requests maine form

- Maine notice form

- Discovery interrogatories from defendant to plaintiff with production requests maine form

- Maine divorce form

- Maine disclosure hearing form

- Statement of claim maine form

- Heirship affidavit descent maine form

- Notice of furnishing absent contract corporation or llc maine form

Find out other 2 Business Income Tax SC Department Of Revenue

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free