S Corporation SC Department of Revenue 2022-2026

What is the S Corporation SC Department Of Revenue

The S Corporation SC Department of Revenue refers to the state-specific regulations and guidelines governing S Corporations in South Carolina. An S Corporation is a type of business entity that allows income, deductions, and tax credits to pass through to shareholders, avoiding double taxation at the corporate level. This classification is particularly beneficial for small businesses, as it provides limited liability protection while allowing for the tax advantages of pass-through taxation.

Steps to complete the S Corporation SC Department Of Revenue

Completing the S Corporation form with the South Carolina Department of Revenue involves several key steps:

- Gather necessary information about your business, including its legal name, address, and federal employer identification number (EIN).

- Ensure that your business meets the eligibility criteria for S Corporation status, such as having a limited number of shareholders and being a domestic corporation.

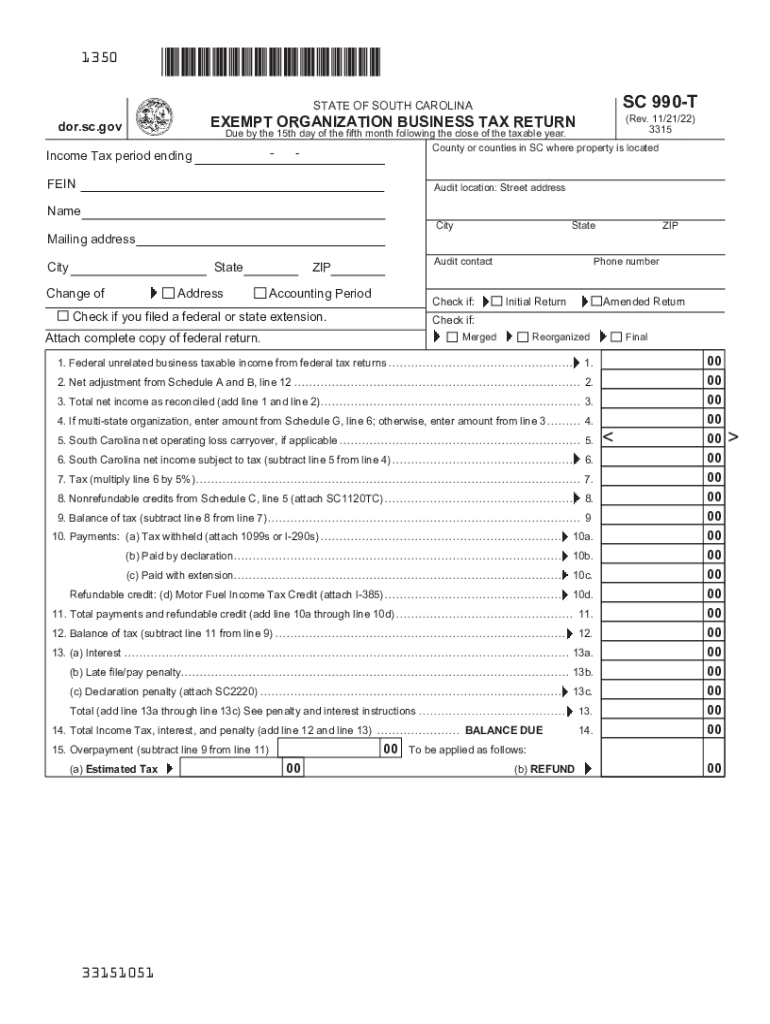

- Fill out the required forms accurately, including the SC 990 T, which details the income and deductions of the S Corporation.

- Review the completed forms for accuracy and compliance with state regulations.

- Submit the forms either online, by mail, or in person, depending on your preference and the options available.

Legal use of the S Corporation SC Department Of Revenue

The legal use of the S Corporation SC Department of Revenue involves adhering to specific state and federal regulations. This includes maintaining proper documentation, filing annual tax returns, and ensuring that all shareholders meet the eligibility requirements. Compliance with the South Carolina tax code is crucial for maintaining S Corporation status and avoiding penalties. Additionally, understanding the implications of S Corporation status on personal liability and taxation is essential for business owners.

Filing Deadlines / Important Dates

Filing deadlines for the S Corporation SC Department of Revenue are critical for compliance. Typically, the deadline for filing the SC 990 T is the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is March 15. It is important to stay informed about any changes to these deadlines and to plan accordingly to avoid late penalties.

Required Documents

When filing as an S Corporation with the South Carolina Department of Revenue, several documents are required to ensure a complete submission. These include:

- The SC 990 T form, which outlines the corporation's income and deductions.

- Federal tax return (Form 1120S) to provide a complete view of the corporation's financial situation.

- Any supporting documentation that verifies income, expenses, and other relevant financial information.

Eligibility Criteria

To qualify as an S Corporation in South Carolina, businesses must meet specific eligibility criteria. These include:

- Being a domestic corporation, meaning it is incorporated in the United States.

- Having no more than one hundred shareholders, all of whom must be individuals, estates, or certain trusts.

- Having only one class of stock, ensuring that all shares have identical rights to distribution and liquidation proceeds.

- Not being a financial institution or insurance company.

Quick guide on how to complete s corporation sc department of revenue

Complete S Corporation SC Department Of Revenue seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documentation, as you can access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without obstacles. Manage S Corporation SC Department Of Revenue on any device using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign S Corporation SC Department Of Revenue effortlessly

- Locate S Corporation SC Department Of Revenue and click Get Form to begin.

- Use the tools we offer to finalize your document.

- Highlight essential parts of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds equal legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign S Corporation SC Department Of Revenue while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation sc department of revenue

Create this form in 5 minutes!

How to create an eSignature for the s corporation sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC 990 T form and why is it important?

The SC 990 T form is a tax form used by nonprofit organizations to report unrelated business income. Filing this form is crucial to maintaining compliance with IRS regulations, ensuring that your organization can continue to operate without penalties. Using airSlate SignNow simplifies the electronic signing of your SC 990 T form, making it easier to stay compliant.

-

How can airSlate SignNow help with the SC 990 T form?

AirSlate SignNow offers a user-friendly platform for eSigning documents, including the SC 990 T form. By streamlining the document signing process, airSlate SignNow allows organizations to expedite their filing, helping to ensure that the SC 990 T form can be submitted on time. This efficiency reduces the risk of errors and enhances overall workflow.

-

What are the pricing options for using airSlate SignNow for SC 990 T eSigning?

AirSlate SignNow provides a range of pricing plans tailored to meet different business needs. Whether you require a basic plan for individual use or a comprehensive plan for teams, you can find an affordable option that supports your SC 990 T documentation needs. Pricing is competitive, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing SC 990 T documents?

AirSlate SignNow comes equipped with features that make managing your SC 990 T documents simple and efficient. Key features include customizable templates, bulk sending options, and secure cloud storage. These tools not only enhance your eSigning experience but also ensure that your SC 990 T forms are easily accessible and organized.

-

Can airSlate SignNow integrate with other apps for handling SC 990 T processes?

Yes, airSlate SignNow offers seamless integrations with a variety of applications that can facilitate the handling of SC 990 T processes. These integrations help to streamline workflows, allowing users to connect their document management systems and financial software easily. By integrating with other tools, you can enhance the overall efficiency of preparing and filing your SC 990 T form.

-

How secure is the eSigning process for the SC 990 T form using airSlate SignNow?

The eSigning process for the SC 990 T form using airSlate SignNow prioritizes security and compliance. The platform employs advanced encryption technologies to protect sensitive data and ensures that all signatures are legally binding. With airSlate SignNow, you can confidently manage your SC 990 T forms without compromising on security.

-

Are there any customer support options available for questions about SC 990 T?

Absolutely! AirSlate SignNow provides robust customer support options for users needing assistance with the SC 990 T form. Whether you have questions about eSigning, integrations, or pricing, expert support is available via various channels, including chat and email. This ensures that you can get help quickly whenever you need it.

Get more for S Corporation SC Department Of Revenue

Find out other S Corporation SC Department Of Revenue

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy