Sc 990 Form 2019

What is the SC 990 Form

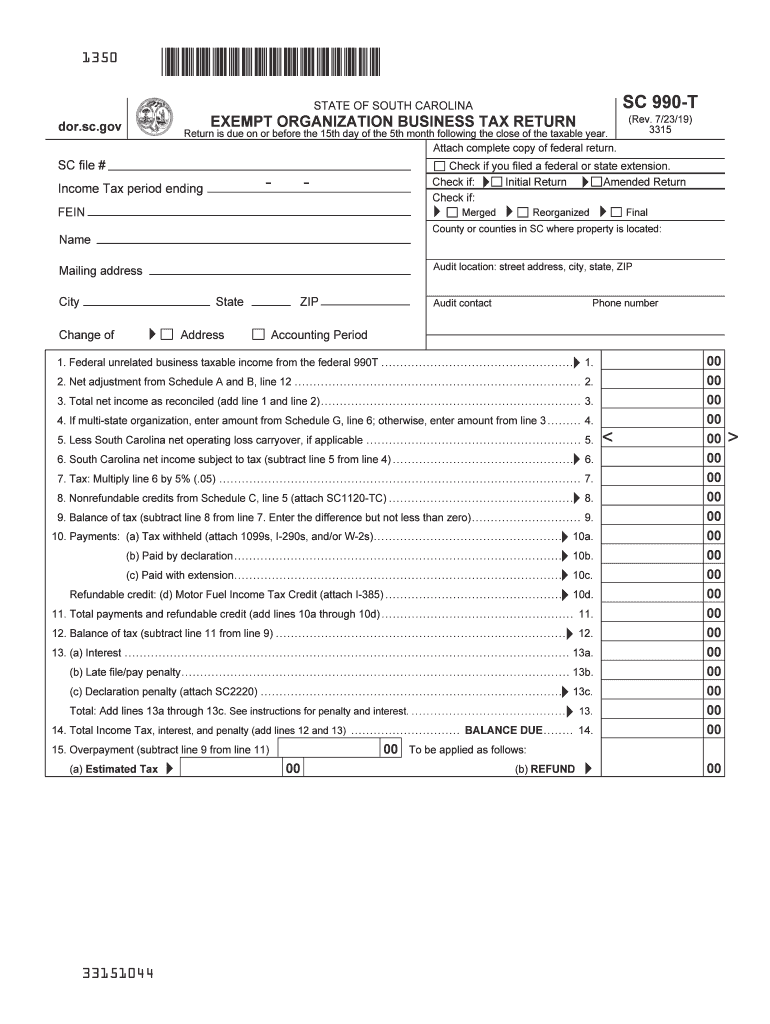

The SC 990 form is a tax document used primarily by organizations in the United States to report their financial activities and ensure compliance with federal tax regulations. This form is essential for tax-exempt organizations, including charities and non-profits, as it provides the IRS with critical information about their income, expenditures, and overall financial health. The SC 990 form helps maintain transparency and accountability within the non-profit sector, allowing the IRS to assess whether these organizations are adhering to the rules governing tax-exempt status.

How to use the SC 990 Form

Using the SC 990 form involves several steps that ensure accurate reporting of financial information. First, organizations must gather relevant financial documents, including income statements, balance sheets, and previous tax returns. Once the necessary information is compiled, organizations can begin filling out the form, paying close attention to each section and ensuring all data is accurate. After completing the form, it must be reviewed for any errors before submission to the IRS. Organizations can file the SC 990 form electronically or by mail, depending on their preference and compliance requirements.

Steps to complete the SC 990 Form

Completing the SC 990 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather financial records, including income statements and expense reports.

- Begin filling out the form, starting with basic organizational information such as name, address, and tax identification number.

- Detail revenue sources, including donations, grants, and any other income.

- List expenses, categorizing them into operational costs, salaries, and other expenditures.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or by mail, adhering to the filing deadlines set by the IRS.

Legal use of the SC 990 Form

The SC 990 form serves a legal purpose by ensuring that tax-exempt organizations comply with federal regulations. When filled out correctly, it provides a legal record of an organization’s financial activities, which can be reviewed by the IRS during audits. It is crucial for organizations to maintain compliance with the requirements associated with the SC 990 form to avoid penalties and potential loss of tax-exempt status. Understanding the legal implications of this form is essential for maintaining transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the SC 990 form are critical for organizations to remain compliant with IRS regulations. Typically, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. It is important to note that organizations can apply for an extension if needed, but they must still ensure that all required information is submitted by the extended deadline to avoid penalties.

Who Issues the Form

The SC 990 form is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, ensuring that organizations understand their reporting obligations. By following the IRS guidelines, organizations can ensure that they are accurately reporting their financial activities and maintaining their tax-exempt status.

Quick guide on how to complete sc 990

Prepare Sc 990 Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Sc 990 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Sc 990 Form with ease

- Obtain Sc 990 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Sc 990 Form to ensure optimal communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc 990

Create this form in 5 minutes!

How to create an eSignature for the sc 990

How to make an eSignature for your Sc 990 in the online mode

How to generate an eSignature for the Sc 990 in Google Chrome

How to create an eSignature for signing the Sc 990 in Gmail

How to create an electronic signature for the Sc 990 straight from your mobile device

How to generate an eSignature for the Sc 990 on iOS devices

How to generate an electronic signature for the Sc 990 on Android devices

People also ask

-

What is the SC 990 Form and why is it important?

The SC 990 Form is a critical document for non-profit organizations in South Carolina, required for tax-exempt status. It helps ensure compliance with state regulations and provides transparency to stakeholders. Completing the SC 990 Form accurately is essential for maintaining your organization’s credibility and tax benefits.

-

How can airSlate SignNow help with completing the SC 990 Form?

airSlate SignNow simplifies the process of completing the SC 990 Form by allowing users to easily fill out, sign, and send documents electronically. Our platform provides templates and intuitive tools that streamline document management, ensuring that your SC 990 Form is completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for filing the SC 990 Form?

Yes, airSlate SignNow offers a cost-effective solution for organizations needing to file the SC 990 Form. With various pricing plans tailored to fit different organizational sizes, you can choose a plan that meets your budget while benefiting from our comprehensive eSigning and document management features.

-

What features does airSlate SignNow offer for managing the SC 990 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and easy document sharing to facilitate the management of the SC 990 Form. Additionally, our platform ensures compliance with legal standards, making it easier for non-profits to focus on their mission rather than paperwork.

-

Can I integrate airSlate SignNow with other software for the SC 990 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for streamlined data transfer and document management when handling the SC 990 Form. Whether you use accounting software or CRM systems, our integrations enhance efficiency and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for the SC 990 Form?

Using airSlate SignNow for the SC 990 Form brings numerous benefits, including increased efficiency, reduced turnaround time for document processing, and improved accuracy. Our user-friendly interface and secure platform ensure that your important documents are handled with care and precision.

-

Is electronic filing of the SC 990 Form allowed?

Yes, electronic filing of the SC 990 Form is allowed in South Carolina, and airSlate SignNow provides a secure way to do so. By using our platform, you can electronically sign and submit your form, making the process faster and more convenient for your organization.

Get more for Sc 990 Form

Find out other Sc 990 Form

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile