NY CT 3 a Fill Out Tax Template OnlineUS Legal Forms 2020

Understanding the NY CT 3 Form

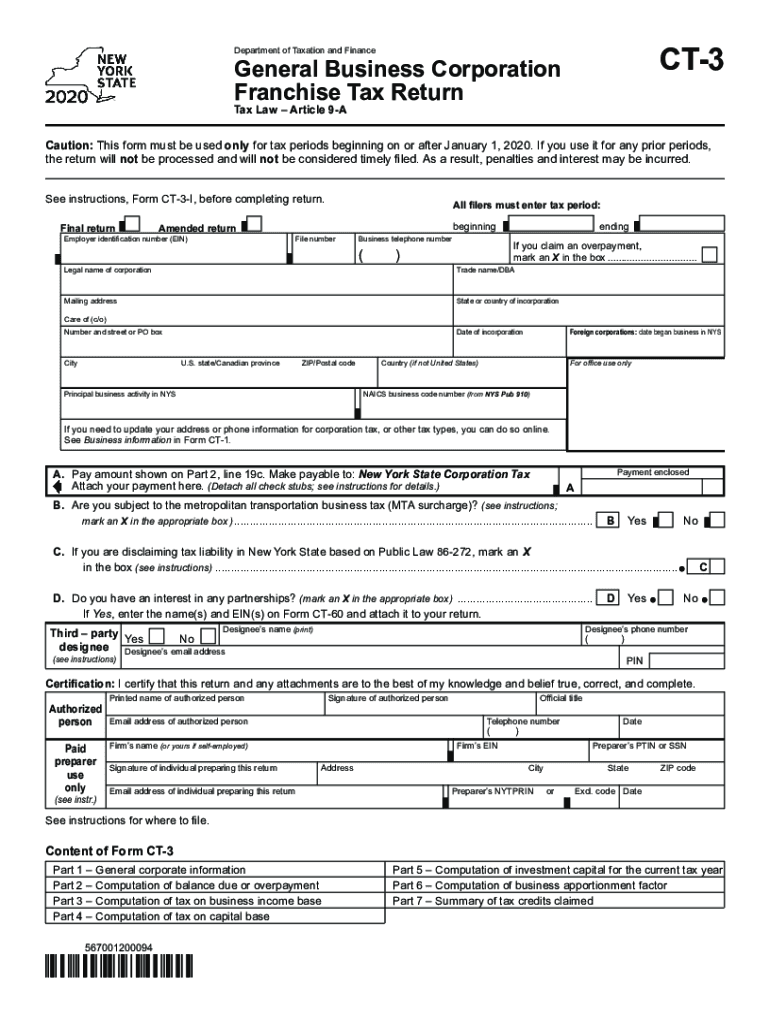

The NY CT 3 form, also known as the New York State Corporation Franchise Tax Return, is essential for corporations operating in New York. This form is used to report a corporation's income, calculate the franchise tax owed, and ensure compliance with state tax regulations. It is crucial for businesses to accurately complete the form to avoid penalties and ensure proper tax reporting.

Steps to Complete the NY CT 3 Form

Completing the NY CT 3 form involves several key steps:

- Gather necessary financial records, including income statements and balance sheets.

- Fill out the identification section, including the corporation's name, address, and federal employer identification number (EIN).

- Report total income and deductions accurately to determine the taxable income.

- Calculate the franchise tax based on the applicable rate and the corporation's income.

- Review the completed form for accuracy before submission.

Filing Deadlines for the NY CT 3 Form

Corporations must adhere to specific filing deadlines for the NY CT 3 form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is important to file on time to avoid late fees and penalties.

Legal Use of the NY CT 3 Form

The NY CT 3 form serves as a legal document that corporations must file to comply with New York tax laws. Proper completion and submission of this form are vital for maintaining good standing with state authorities. Failure to file can result in penalties, interest on unpaid taxes, and potential legal repercussions.

Form Submission Methods

Corporations have various options for submitting the NY CT 3 form:

- Online: Many corporations choose to file electronically through the New York State Department of Taxation and Finance website.

- By Mail: Corporations can also print the completed form and mail it to the appropriate address provided by the state.

- In-Person: Some businesses may prefer to submit the form in person at designated tax offices.

Key Elements of the NY CT 3 Form

The NY CT 3 form includes several critical components that must be completed accurately:

- Corporate Information: Name, address, and EIN of the corporation.

- Income Reporting: Total income, deductions, and taxable income calculations.

- Tax Calculation: The franchise tax owed based on the corporation's income.

- Signature: An authorized representative must sign the form to validate it.

Quick guide on how to complete ny ct 3 a 2019 fill out tax template onlineus legal forms

Complete NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Manage NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms with ease

- Find NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize critical sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny ct 3 a 2019 fill out tax template onlineus legal forms

Create this form in 5 minutes!

How to create an eSignature for the ny ct 3 a 2019 fill out tax template onlineus legal forms

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the purpose of the form ct nys?

The form ct nys is a Connecticut state tax form that businesses need to file to report their business income and expenses. It is essential for maintaining compliance with state tax regulations and ensuring accurate tax reporting. Using airSlate SignNow to eSign and send your form ct nys makes the process quick and efficient.

-

How can airSlate SignNow help with filling out the form ct nys?

With airSlate SignNow, you can easily upload and fill out your form ct nys online. The platform offers user-friendly tools to ensure that all required fields are completed correctly. Additionally, you can use templates to streamline your future tax form submissions.

-

What are the pricing options for airSlate SignNow when filing the form ct nys?

airSlate SignNow offers several pricing plans based on the number of users and features needed. Regardless of the plan you choose, you’ll have access to comprehensive tools for eSigning documents, including the form ct nys. Check our website for current pricing details and choose the plan that best fits your business needs.

-

Is it secure to eSign my form ct nys using airSlate SignNow?

Yes, airSlate SignNow provides top-notch security measures to protect your sensitive information, including the form ct nys. We use encryption and multi-factor authentication to ensure that your eSignatures and documents are safe. You can complete your forms with peace of mind knowing that your data is secure.

-

Can I integrate airSlate SignNow with other tools for managing the form ct nys?

Absolutely! airSlate SignNow offers a wide range of integrations with popular applications and services, making it easy to manage your form ct nys alongside other business processes. Whether you use CRM platforms or accounting software, you can streamline your workflow by connecting these tools with airSlate SignNow.

-

What are the benefits of using airSlate SignNow for the form ct nys?

Using airSlate SignNow for your form ct nys allows for faster processing, reduced paper usage, and improved accuracy in your submissions. The platform’s ease of use and efficiency can save you time and effort, making tax season less stressful. Customers appreciate the convenience of eSigning documents from anywhere, at any time.

-

Can I track the status of my form ct nys after sending it with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your form ct nys after you send it. You will receive notifications when the document is viewed, signed, or completed. This feature ensures transparency and keeps you informed about your document's progress.

Get more for NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms

- Staff supervision template word form

- Police oral board scoring sheet form

- Statement of financial resources kaist form

- Peo founders day activies form

- Qcpp incident report form

- How to write a tv show review form

- Impaired driver education program nh form

- Cancer family history questionnaire pineview gynecology form

Find out other NY CT 3 A Fill Out Tax Template OnlineUS Legal Forms

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement