Nys Dtf Ct 2023

What is the NYS DTF CT?

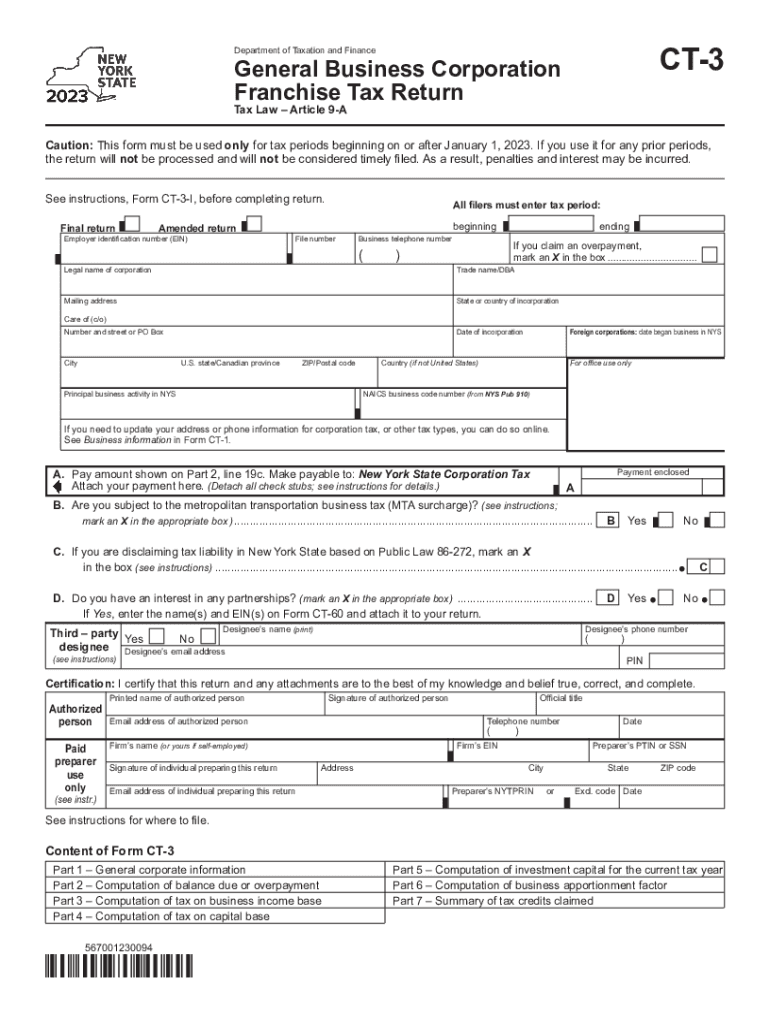

The New York State Department of Taxation and Finance (NYS DTF) CT-3 form is a crucial document used by corporations to report their income, deductions, and credits for state tax purposes. This form is specifically designed for general business corporations, and it helps in calculating the tax liability owed to the state. Understanding the CT-3 form is essential for compliance with New York tax laws and regulations.

Steps to Complete the NYS DTF CT

Completing the NYS DTF CT-3 form involves several steps to ensure accurate reporting. Here’s a brief overview of the process:

- Gather all necessary financial documents, including income statements, expense reports, and previous tax returns.

- Begin filling out the form by entering your corporation's identifying information, such as name and taxpayer identification number.

- Report total income and allowable deductions in the designated sections of the form.

- Calculate the tax based on the applicable rates and ensure all credits are applied.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the NYS DTF CT-3 form to avoid penalties. Typically, the form must be filed within a specific timeframe after the end of your corporation's fiscal year. For most corporations, the deadline is the fifteenth day of the fourth month following the close of the fiscal year. Keeping track of these dates is essential for timely compliance.

Required Documents

When preparing to file the NYS DTF CT-3 form, certain documents are necessary to support your reported figures. These may include:

- Financial statements, including balance sheets and income statements.

- Documentation of any deductions claimed, such as receipts or invoices.

- Previous tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The NYS DTF CT-3 form can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate address as specified in the instructions.

- In-person filing at designated tax offices, if necessary.

Legal Use of the NYS DTF CT

The NYS DTF CT-3 form is legally required for corporations operating in New York. It serves as the official means of reporting income and tax liability to the state. Failing to file or submitting inaccurate information can result in penalties and interest charges. Therefore, understanding the legal implications of this form is crucial for maintaining compliance with state tax laws.

Quick guide on how to complete nys dtf ct

Complete Nys Dtf Ct effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without hassles. Manage Nys Dtf Ct on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Nys Dtf Ct with ease

- Locate Nys Dtf Ct and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Nys Dtf Ct to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys dtf ct

Create this form in 5 minutes!

How to create an eSignature for the nys dtf ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the new york form ct 3 instructions 2023?

The New York Form CT-3 instructions for 2023 provide essential guidelines on how to complete the Corporation Franchise Tax Return. This form is crucial for corporations operating in New York, outlining requirements for income reporting, deductions, and credits.

-

How can I access the new york form ct 3 instructions 2023?

You can access the New York Form CT-3 instructions for 2023 on the New York State Department of Taxation and Finance website. The instructions are available in PDF format, making it easy to download and refer to while preparing your tax return.

-

Are there any updates in the new york form ct 3 instructions 2023 compared to the previous year?

Yes, the New York Form CT-3 instructions for 2023 include several updates and changes, such as revised deduction limits and new tax credit options. It's important to review these modifications to ensure compliance and optimize your tax return.

-

How much does it cost to file using the new york form ct 3 instructions 2023?

Filing with the New York Form CT-3 instructions for 2023 does not incur a filing fee, but any taxes owed are based on your taxable income. However, if you choose to use software or hire a tax professional to assist with the filing process, those services may come with a cost.

-

What features does airSlate SignNow offer for completing the new york form ct 3 instructions 2023?

airSlate SignNow offers features that simplify the completion of the New York Form CT-3 instructions for 2023, including eSignature capabilities and document templates. These tools help businesses streamline their tax preparation process and ensure that documents are signed and filed on time.

-

How can airSlate SignNow help with compliance regarding the new york form ct 3 instructions 2023?

By using airSlate SignNow, businesses can maintain compliance with the New York Form CT-3 instructions for 2023 through secure document management and electronic signatures. This ensures that all necessary documents are accurately completed and submitted as required by state regulations.

-

What are the benefits of using airSlate SignNow for the new york form ct 3 instructions 2023?

Using airSlate SignNow for the New York Form CT-3 instructions for 2023 offers several benefits, including time-saving document workflows and cost-efficient eSigning solutions. It enhances collaboration among team members, making the process of filing taxes much simpler and more efficient.

Get more for Nys Dtf Ct

- Federal bank deposit slip form

- Witness form

- Examples of ballet studio registration forms

- Bt f kmfd form

- Montgomery county food truck permit form

- Oath of office minnesota association of townships mntownships form

- A letter from a selma alabama jail form

- Name of court form 17b case at conference brief for court

Find out other Nys Dtf Ct

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now