Quick Guide to Completing Form CT 3, General Business Corporation 2022

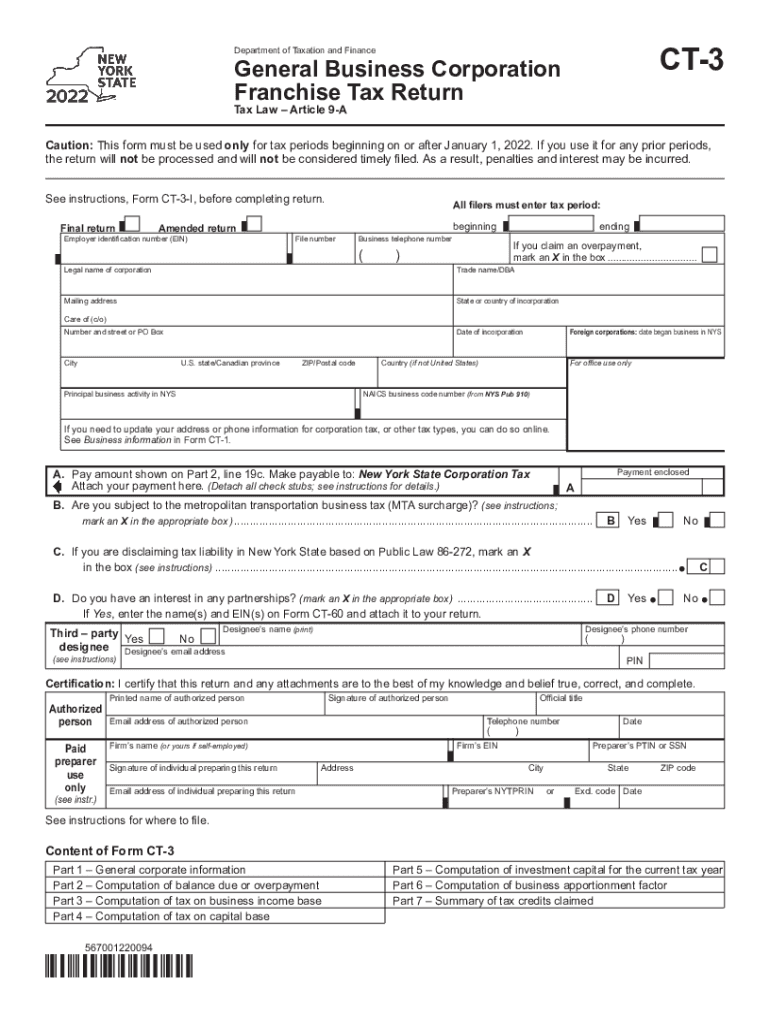

What is Form CT-3, General Business Corporation?

Form CT-3 is the New York State tax form used by general business corporations to report their franchise tax. This form is essential for corporations operating in New York, as it provides the necessary information regarding income, deductions, and credits. The completion of Form CT-3 is required to determine the corporation's tax liability based on its business activities within the state.

Steps to Complete Form CT-3

Completing Form CT-3 involves several key steps that ensure accurate reporting of your corporation's financial activities. Here is a simplified process:

- Gather financial records, including income statements and balance sheets.

- Complete the identification section, providing your corporation's name, address, and employer identification number (EIN).

- Report total income, including gross receipts and other income sources.

- Calculate allowable deductions, such as business expenses and losses.

- Determine the tax base and apply the appropriate tax rate to calculate your franchise tax liability.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form CT-3 to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the close of your corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they require timely submission of a request.

Required Documents for Form CT-3

To successfully complete Form CT-3, you will need several supporting documents, including:

- Financial statements for the tax year.

- Records of all income received and expenses incurred.

- Documentation for any tax credits being claimed.

- Prior year tax returns for reference.

Penalties for Non-Compliance

Failure to file Form CT-3 on time can result in significant penalties. These may include:

- Late filing penalties, which can accumulate quickly.

- Interest on any unpaid taxes.

- Potential legal action for continued non-compliance.

Who Issues Form CT-3?

Form CT-3 is issued by the New York State Department of Taxation and Finance. This agency is responsible for the administration of tax laws and ensures compliance among corporations operating in New York. It is important to stay updated with any changes to the form or filing requirements as dictated by the department.

Quick guide on how to complete quick guide to completing form ct 3 general business corporation

Complete Quick Guide To Completing Form CT 3, General Business Corporation seamlessly on any device

Online document organization has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documentation, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, adjust, and electronically sign your documents rapidly without hindrances. Manage Quick Guide To Completing Form CT 3, General Business Corporation on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to adjust and electronically sign Quick Guide To Completing Form CT 3, General Business Corporation with ease

- Locate Quick Guide To Completing Form CT 3, General Business Corporation and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click the Done button to save your updates.

- Choose how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device of your choosing. Adjust and electronically sign Quick Guide To Completing Form CT 3, General Business Corporation to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quick guide to completing form ct 3 general business corporation

Create this form in 5 minutes!

How to create an eSignature for the quick guide to completing form ct 3 general business corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct3 in relation to airSlate SignNow?

ct3 is a key feature of airSlate SignNow that enhances your eSigning experience. It streamlines document workflows, making it easier for users to send and sign documents quickly. With ct3, businesses can ensure compliance and security while maintaining efficiency in their operations.

-

How does pricing work for the ct3 feature?

The ct3 feature is included in airSlate SignNow's subscription plans, which are designed to be cost-effective for businesses of all sizes. Pricing tiers offer flexibility based on user needs, and the ct3 functionality enhances the overall value. Check our pricing page to find the best plan that includes ct3 for your organization.

-

What are the key benefits of using ct3 with airSlate SignNow?

Using ct3 with airSlate SignNow offers numerous benefits, including improved document turnaround times and enhanced user collaboration. This feature helps streamline operations, reduce errors, and improve customer satisfaction. By incorporating ct3, businesses can achieve greater efficiency and productivity in their document workflows.

-

What features does the ct3 offer?

ct3 offers advanced document management features, including template creation, mobile functionality, and real-time tracking. You can customize workflows and automate repetitive tasks, simplifying your eSigning process. With ct3, airSlate SignNow ensures a comprehensive solution for all your document needs.

-

Can I integrate ct3 with other applications?

Yes, ct3 can be easily integrated with various applications, enhancing its functionality within the airSlate SignNow ecosystem. Popular integrations include CRM systems, project management tools, and cloud storage services. This connectivity allows for a seamless flow of information, further optimizing your document workflows.

-

How does ct3 enhance security in document signing?

ct3 enhances the security of document signing by utilizing advanced encryption protocols and authentication methods. airSlate SignNow ensures that all data transmitted is secure, and you can track user actions for added accountability. With ct3, you can feel confident in the safety and integrity of your signed documents.

-

Is there a trial available for evaluating the ct3 feature?

Yes, airSlate SignNow offers a free trial for users to explore the capabilities of the ct3 feature without any commitment. This trial allows potential customers to test the functionality and see how ct3 can benefit their document signing processes. Sign up today to discover the advantages of integrating ct3 into your workflows.

Get more for Quick Guide To Completing Form CT 3, General Business Corporation

- Rhode island unsecured installment payment promissory note for fixed rate rhode island form

- Ri note form

- Rhode island note form

- Rhode island note 497325322 form

- Notice of option for recording rhode island form

- Life documents planning package including will power of attorney and living will rhode island form

- Essential legal life documents for baby boomers rhode island form

- Essential legal life documents for newlyweds rhode island form

Find out other Quick Guide To Completing Form CT 3, General Business Corporation

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form