Www Tax Ny GovpdfcurrentformsDepartment of Taxation and Finance Instructions for Form CT 3 2021

Understanding the CT-3 Form

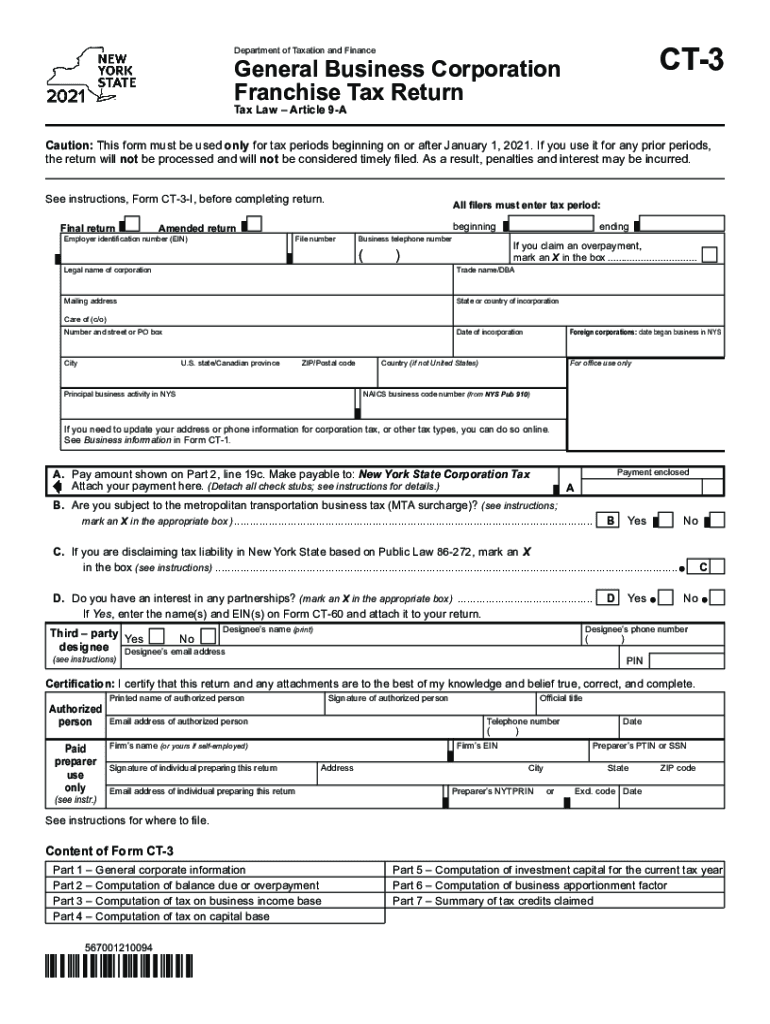

The CT-3 form, also known as the New York Corporation Franchise Tax Return, is essential for corporations operating in New York. This form is used to report income, calculate taxes owed, and ensure compliance with state tax regulations. It is crucial for corporations to file this form accurately to avoid penalties and maintain good standing with the New York State Department of Taxation and Finance.

Steps to Complete the CT-3 Form

Completing the CT-3 form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine the appropriate tax rate based on your corporation's income level.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any discrepancies before submission.

- Submit the form electronically or via mail by the designated deadline.

Filing Deadlines for the CT-3 Form

Corporations must be aware of important filing deadlines to avoid penalties. The CT-3 form is typically due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is essential to file for an extension before the original deadline.

Required Documents for Filing the CT-3 Form

When preparing to file the CT-3 form, corporations should have the following documents ready:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Previous tax returns for reference.

- Any supporting documentation for deductions or credits claimed.

Legal Use of the CT-3 Form

The CT-3 form is legally binding and must be completed in accordance with New York State tax laws. Accurate reporting is essential, as any misrepresentation can lead to audits, penalties, or legal repercussions. Corporations are encouraged to consult tax professionals to ensure compliance and proper filing.

Digital vs. Paper Version of the CT-3 Form

Corporations have the option to file the CT-3 form either digitally or on paper. The digital version offers several advantages, including faster processing times and reduced risk of errors. Electronic filing is also more secure and allows for easier tracking of submission status. However, some corporations may prefer the traditional paper method for record-keeping purposes.

Penalties for Non-Compliance with the CT-3 Form

Failure to file the CT-3 form on time or inaccuracies in reporting can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action. It is vital for corporations to adhere to filing requirements to avoid these consequences and maintain their good standing with the state.

Quick guide on how to complete wwwtaxnygovpdfcurrentformsdepartment of taxation and finance instructions for form ct 3

Effortlessly Complete Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3 with Ease

- Obtain Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3 and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misdirected documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3 to ensure efficient communication at every stage of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovpdfcurrentformsdepartment of taxation and finance instructions for form ct 3

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxnygovpdfcurrentformsdepartment of taxation and finance instructions for form ct 3

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What is ct 3 in airSlate SignNow?

ct 3 refers to the comprehensive signing and document management solution offered by airSlate SignNow. It provides an intuitive platform for eSigning documents and streamlining workflows, making it easier for businesses to manage their paperwork efficiently.

-

How much does it cost to use airSlate SignNow with ct 3?

The pricing for airSlate SignNow with ct 3 varies based on the chosen plan. We offer flexible subscription options that cater to different business needs, ensuring that you receive a cost-effective solution for managing your documents with ease.

-

What are the key features of ct 3?

ct 3 includes advanced features such as eSign capabilities, customizable templates, and automated workflows. These features simplify the signing process and enhance productivity, allowing you to focus on what matters most in your business.

-

How can ct 3 benefit my business?

By utilizing ct 3, your business can reduce the time spent on document management and increase efficiency. The user-friendly interface and integrated tools help improve collaboration, leading to faster turnaround times and happier clients.

-

Does ct 3 integrate with other applications?

Yes, ct 3 can seamlessly integrate with a variety of third-party applications such as CRM systems and cloud storage services. This feature allows for a more cohesive workflow, enabling you to manage your documents alongside your existing tools.

-

Is it easy to switch to ct 3 from another eSignature solution?

Absolutely! Transitioning to ct 3 from another eSignature solution is designed to be smooth and hassle-free. Our support team provides assistance throughout the migration process, ensuring that all your documents and workflows are securely transferred.

-

Can I customize templates in ct 3?

Yes, ct 3 allows you to customize document templates easily. This feature ensures that your branding is consistent across all documents, and it helps expedite the signing process by pre-filling necessary fields.

Get more for Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3

Find out other Www tax ny govpdfcurrentformsDepartment Of Taxation And Finance Instructions For Form CT 3

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online