Tax Year Personal Income Tax Forms Department of 2020

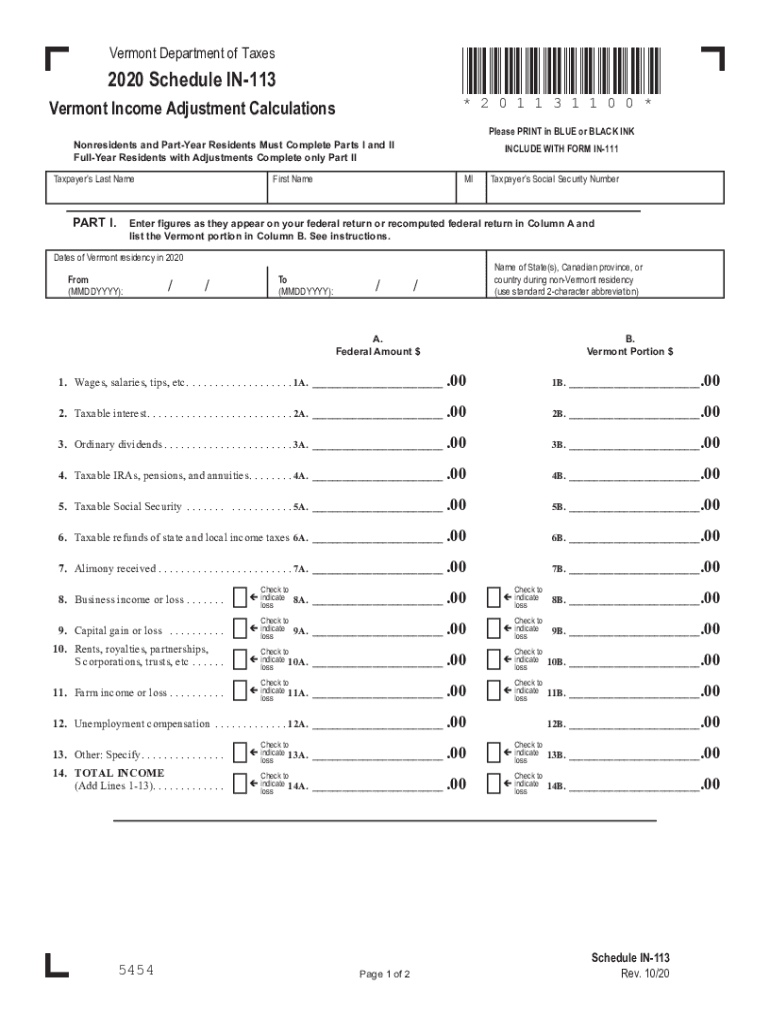

Understanding the Vermont 113 Form

The Vermont 113 form is a crucial document used for reporting personal income tax in the state of Vermont. This form allows residents to declare their income, calculate their tax liability, and determine any credits or deductions they may be eligible for. It is essential for ensuring compliance with state tax laws and for accurately assessing one's financial obligations.

Steps to Complete the Vermont 113 Form

Completing the Vermont 113 form involves several key steps:

- Gather Required Information: Collect all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Provide your name, address, Social Security number, and other identifying details at the top of the form.

- Report Income: Accurately enter all sources of income, including wages, self-employment income, and interest.

- Calculate Deductions and Credits: Identify any deductions or credits you qualify for, which can reduce your overall tax liability.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it.

Filing Deadlines for the Vermont 113 Form

It is important to be aware of the filing deadlines associated with the Vermont 113 form. Typically, the form must be submitted by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Timely submission helps avoid penalties and interest on any taxes owed.

Form Submission Methods

The Vermont 113 form can be submitted through multiple methods, providing flexibility for taxpayers:

- Online: Many residents choose to file electronically through the Vermont Department of Taxes website, which offers a secure and efficient way to submit forms.

- By Mail: Taxpayers can also print the completed form and mail it to the appropriate address provided by the Vermont Department of Taxes.

- In-Person: For those who prefer face-to-face interactions, forms can be submitted in person at designated state tax offices.

Key Elements of the Vermont 113 Form

Understanding the key elements of the Vermont 113 form is essential for accurate completion. Important sections include:

- Income Reporting: This section requires detailed reporting of all income sources.

- Deductions: Taxpayers can list various deductions, such as medical expenses or mortgage interest.

- Tax Calculation: This part outlines how to calculate the total tax owed based on reported income and applicable rates.

Penalties for Non-Compliance

Failure to file the Vermont 113 form on time or inaccurately reporting income can lead to significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax may be charged for each month the return is late.

- Interest Charges: Interest accrues on any unpaid taxes, increasing the total amount owed over time.

Quick guide on how to complete tax year 2020 personal income tax forms department of

Effortlessly Prepare Tax Year Personal Income Tax Forms Department Of on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the proper form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Tax Year Personal Income Tax Forms Department Of on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

An Easy Approach to Edit and eSign Tax Year Personal Income Tax Forms Department Of

- Locate Tax Year Personal Income Tax Forms Department Of and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight signNow sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Recheck all the details and click the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Year Personal Income Tax Forms Department Of and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 2020 personal income tax forms department of

Create this form in 5 minutes!

How to create an eSignature for the tax year 2020 personal income tax forms department of

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Vermont 113 form and why is it used?

The Vermont 113 form is a tax document used for various reporting purposes in Vermont. It is essential for businesses and individuals to accurately report income and tax liabilities. Understanding its requirements can help ensure compliance with state regulations.

-

How can airSlate SignNow help with the Vermont 113 form?

airSlate SignNow simplifies the process of completing and eSigning the Vermont 113 form. Our platform allows users to fill out the form electronically, ensuring all necessary information is easily accessible and submitted efficiently. This streamlines your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the Vermont 113 form?

AirSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a solo entrepreneur or part of a larger organization, our cost-effective solutions make it easy to handle the Vermont 113 form without breaking the bank.

-

What features does airSlate SignNow provide for the Vermont 113 form?

With airSlate SignNow, you can effortlessly fill out, edit, and eSign the Vermont 113 form. Features include document templates, secure storage, and automated workflows that can help you manage your tax documentation efficiently and minimize errors.

-

Are there any integrations available to enhance my experience with the Vermont 113 form?

Yes, airSlate SignNow integrates seamlessly with various business tools, such as CRM systems and cloud storage solutions. These integrations ensure that your Vermont 113 form can be managed alongside other important documents, streamlining your overall workflow.

-

Can I access the Vermont 113 form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and complete the Vermont 113 form on your smartphones and tablets. This flexibility means you can manage your documents on the go, ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for tax documents like the Vermont 113 form?

Using airSlate SignNow for the Vermont 113 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform's electronic signature capabilities help expedite the signing process, making tax management simpler and more efficient.

Get more for Tax Year Personal Income Tax Forms Department Of

Find out other Tax Year Personal Income Tax Forms Department Of

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed