Vt in 113 Form 2017

What is the Vt In 113 Form

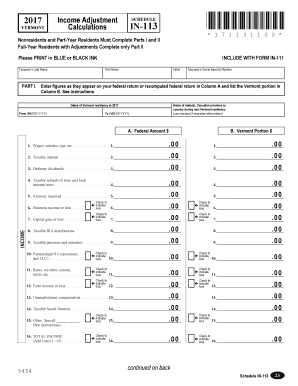

The Vt In 113 Form is a specific document used in the state of Vermont for tax purposes. It is primarily utilized by businesses and individuals to report certain financial information to the state tax authorities. This form is essential for ensuring compliance with state tax regulations and is often required for various tax filings. Understanding its purpose and requirements is crucial for accurate reporting and avoiding potential penalties.

How to use the Vt In 113 Form

Using the Vt In 113 Form involves several key steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all sections are completed with accurate data. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of filing.

Steps to complete the Vt In 113 Form

Completing the Vt In 113 Form requires a systematic approach:

- Collect all necessary financial documents, such as income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand each section's requirements.

- Fill out the form, ensuring that all information is accurate and up-to-date.

- Double-check for any errors or omissions before finalizing the document.

- Submit the form by the designated deadline, either online or by mailing it to the appropriate tax authority.

Legal use of the Vt In 113 Form

The legal use of the Vt In 113 Form is governed by state tax laws. It is crucial for individuals and businesses to ensure that the form is filled out correctly to maintain compliance with these laws. Failure to use the form as required can result in penalties, including fines or additional taxes owed. Therefore, understanding the legal implications and requirements associated with this form is essential for all taxpayers in Vermont.

Filing Deadlines / Important Dates

Filing deadlines for the Vt In 113 Form can vary based on the taxpayer's specific situation. Generally, the form must be submitted by the state’s tax deadline, which is typically aligned with the federal tax filing date. It is important to stay informed about any changes to these deadlines to avoid late filing penalties. Taxpayers should mark their calendars and plan accordingly to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Vt In 113 Form can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file online, which is often the fastest and most efficient way to submit the form. Alternatively, the form can be mailed to the appropriate state tax office. In some cases, in-person submission may also be available, allowing for direct interaction with tax officials. Each method has its advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete vt in 113 2017 2019 form

Complete Vt In 113 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Vt In 113 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Vt In 113 Form without stress

- Obtain Vt In 113 Form and then click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize important sections of your documents or conceal sensitive data using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Vt In 113 Form and ensure clear communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vt in 113 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the vt in 113 2017 2019 form

How to create an eSignature for your Vt In 113 2017 2019 Form online

How to generate an eSignature for the Vt In 113 2017 2019 Form in Chrome

How to generate an eSignature for signing the Vt In 113 2017 2019 Form in Gmail

How to generate an electronic signature for the Vt In 113 2017 2019 Form right from your smart phone

How to generate an electronic signature for the Vt In 113 2017 2019 Form on iOS devices

How to create an electronic signature for the Vt In 113 2017 2019 Form on Android devices

People also ask

-

What is the Vt In 113 Form and why is it important?

The Vt In 113 Form is a crucial document for businesses filing their tax returns in Vermont. This form helps ensure compliance with state regulations and simplifies the process of reporting income. Using the Vt In 113 Form correctly can streamline your tax preparation and prevent costly errors.

-

How does airSlate SignNow facilitate the Vt In 113 Form submission?

airSlate SignNow allows you to easily create, sign, and send the Vt In 113 Form digitally. With our platform, you can ensure that your document is securely signed and submitted in a timely manner, reducing the risk of missing filings. The user-friendly interface allows for a smooth experience throughout the process.

-

What features does airSlate SignNow offer for the Vt In 113 Form?

airSlate SignNow provides a variety of features for handling the Vt In 113 Form, including customizable templates, secure eSigning, and document storage. Our cloud-based solution ensures that you can access your documents from anywhere, streamlining your workspace. Additionally, you can track the status of your Vt In 113 Form submissions in real-time.

-

Is airSlate SignNow cost-effective for small businesses using the Vt In 113 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing to manage their Vt In 113 Form submissions efficiently. Our cost-effective solution eliminates the need for paper-based processes, saving you both time and money. With various plans available, you can choose one that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software for the Vt In 113 Form?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, making it easier to incorporate the Vt In 113 Form into your existing workflows. This integration allows you to sync data automatically, reducing the chances of errors and creating a more efficient document management process.

-

How secure is my information when using airSlate SignNow for the Vt In 113 Form?

Your security is our top priority at airSlate SignNow. We employ advanced encryption methods to protect your data while you prepare and submit the Vt In 113 Form. Additionally, we adhere to industry standards and regulations to ensure that your information stays confidential and secure throughout the entire process.

-

What are the benefits of using airSlate SignNow for eSigning the Vt In 113 Form?

Using airSlate SignNow for eSigning the Vt In 113 Form means faster processing times and enhanced accuracy. You can eliminate the hassle of printing, signing, and scanning paperwork, allowing for a more efficient workflow. This digital approach not only saves time but also helps maintain a permanent, verifiable record of your signed documents.

Get more for Vt In 113 Form

Find out other Vt In 113 Form

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online