Forms and Instructions Vermont Department of Taxes 2022-2026

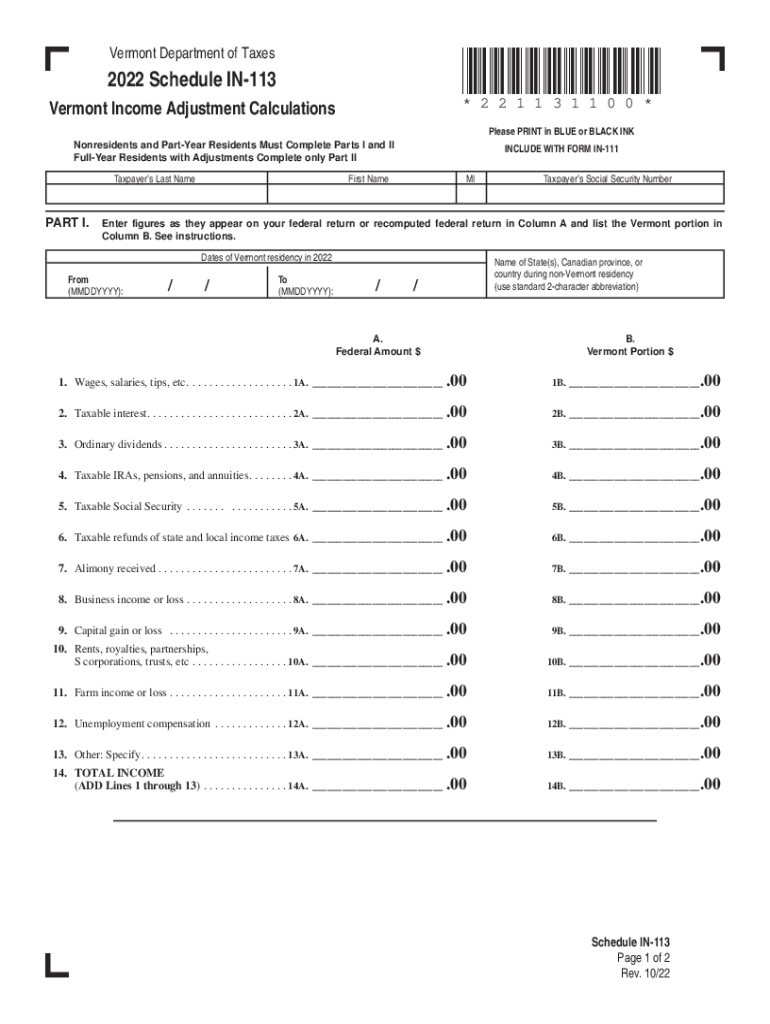

What is the Vermont tax form in 113?

The Vermont tax form in 113, also known as the Vermont Schedule IN-113, is a crucial document used by residents to report and calculate their income tax adjustments. This form is specifically designed for individuals who need to make modifications to their taxable income, ensuring that all relevant deductions and credits are accurately reflected. By completing this form, taxpayers can adjust their income tax liability based on various factors, such as changes in income or eligibility for specific tax credits.

Steps to complete the Vermont tax form in 113

Completing the Vermont tax form in 113 involves several key steps that ensure accuracy and compliance with state tax regulations. First, gather all necessary documents, including your W-2s, 1099s, and any other income statements. Next, carefully fill out the form, providing details about your income, deductions, and any adjustments you wish to claim. Make sure to double-check your entries for accuracy. After completing the form, review it against the instructions provided by the Vermont Department of Taxes to ensure all required information is included. Finally, submit the form either electronically or by mail, following the guidelines for submission.

Legal use of the Vermont tax form in 113

The Vermont tax form in 113 is legally binding when filled out correctly and submitted according to state regulations. To ensure the form is recognized as valid, it must be signed and dated by the taxpayer. The use of electronic signatures is permitted, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This legal framework ensures that electronically signed documents hold the same weight as traditional handwritten signatures, allowing for a smooth filing process.

Filing deadlines for the Vermont tax form in 113

Filing deadlines for the Vermont tax form in 113 are critical to avoid penalties and interest on unpaid taxes. Typically, the form must be submitted by April 15 of the tax year, aligning with federal tax deadlines. However, it is important to check for any extensions or changes in deadlines that may occur due to special circumstances, such as natural disasters or state-specific regulations. Taxpayers should stay informed about these dates to ensure timely submission of their forms.

Required documents for the Vermont tax form in 113

To accurately complete the Vermont tax form in 113, taxpayers must gather several essential documents. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for any deductions or credits being claimed

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Form submission methods for the Vermont tax form in 113

Taxpayers have multiple options for submitting the Vermont tax form in 113. The form can be filed electronically through the Vermont Department of Taxes' online portal, which allows for quicker processing and confirmation of receipt. Alternatively, taxpayers may choose to submit the form by mail. If opting for mail submission, it is advisable to send the form via certified mail to ensure it is tracked and received by the tax department. In-person submission may also be available at designated tax offices.

Quick guide on how to complete forms and instructions vermont department of taxes

Easily Prepare Forms And Instructions Vermont Department Of Taxes on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without any holdups. Manage Forms And Instructions Vermont Department Of Taxes on any device using the airSlate SignNow applications available for Android or iOS and streamline your document-related processes today.

The Simplest Method to Edit and eSign Forms And Instructions Vermont Department Of Taxes Effortlessly

- Locate Forms And Instructions Vermont Department Of Taxes and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Forms And Instructions Vermont Department Of Taxes to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms and instructions vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the forms and instructions vermont department of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Vermont tax form in 113?

The Vermont tax form in 113 is a document used by residents for various tax reporting purposes. It is important for ensuring accurate state tax filings and may involve income, property, or other relevant tax calculations.

-

How can airSlate SignNow help with the Vermont tax form in 113?

airSlate SignNow simplifies the process of filling out and signing the Vermont tax form in 113. With our user-friendly platform, you can easily edit, sign, and send documents securely, saving you time and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for Vermont tax form in 113?

Yes, there is a subscription fee to access airSlate SignNow’s services, but it is competitively priced compared to other e-signature solutions. Our plans are designed to offer businesses an affordable way to manage documents like the Vermont tax form in 113.

-

What features does airSlate SignNow offer for the Vermont tax form in 113?

AirSlate SignNow includes features such as electronic signatures, document templates, and cloud storage which are essential for managing the Vermont tax form in 113. These tools help streamline the filing process, making it efficient and secure.

-

Can I integrate airSlate SignNow with other software for my Vermont tax form in 113?

Absolutely! airSlate SignNow provides seamless integrations with numerous applications, enhancing your ability to manage the Vermont tax form in 113 alongside your existing software tools. This interoperability helps maintain workflow efficiency.

-

What are the benefits of using airSlate SignNow for the Vermont tax form in 113?

Using airSlate SignNow for the Vermont tax form in 113 provides key benefits such as time savings, improved accuracy, and enhanced security. Our digital solution allows you to complete and submit forms without the hassle of physical paperwork.

-

Is it easy to collaborate with others using airSlate SignNow for the Vermont tax form in 113?

Yes, airSlate SignNow makes collaboration easy when dealing with the Vermont tax form in 113. You can invite multiple users to review, sign, and collaborate on documents, ensuring everyone involved can contribute.

Get more for Forms And Instructions Vermont Department Of Taxes

- Ex parte 497329114 form

- Buy agreement partnership 497329115 form

- Motion to prohibit electronic and photographic coverage form

- Employment medical company form

- Motion bar 497329118 form

- Recording agreement and contract with publisher for exploitation of musical compositions form

- Motion prior form

- Contract to organize and speak at seminar or similar such event form

Find out other Forms And Instructions Vermont Department Of Taxes

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF