Vt Form in 113 2018

What is the Vt Form In 113

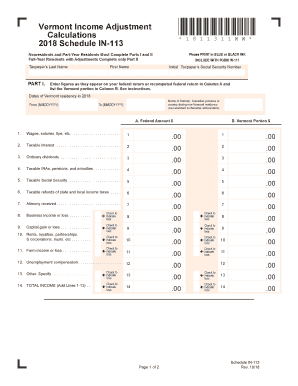

The Vt Form In 113 is a tax form used by residents of Vermont to report income and calculate their state tax obligations. This form is essential for individuals and businesses to ensure compliance with state tax laws. It captures various income sources and deductions, allowing taxpayers to determine their tax liability accurately. Understanding the purpose of this form is crucial for maintaining proper tax records and fulfilling state requirements.

Steps to complete the Vt Form In 113

Completing the Vt Form In 113 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and previous tax returns. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy. After completing the form, review it for any errors before submitting it to the Vermont Department of Taxes.

Legal use of the Vt Form In 113

The legal use of the Vt Form In 113 is governed by Vermont tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Electronic signatures are acceptable, provided they comply with eSignature laws, ensuring that the document is legally binding. It is essential to retain a copy of the completed form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Vt Form In 113 are critical for taxpayers to observe. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, such as filing for an extension to submit the form later in the year. Keeping track of these important dates helps avoid penalties and interest on unpaid taxes.

Who Issues the Form

The Vt Form In 113 is issued by the Vermont Department of Taxes. This state agency is responsible for administering tax laws and ensuring compliance among residents and businesses. The department provides resources and guidance for taxpayers to understand their obligations and navigate the filing process effectively. For any questions regarding the form or tax regulations, the Vermont Department of Taxes is the authoritative source of information.

Required Documents

To complete the Vt Form In 113, certain documents are required to substantiate the information provided. These may include W-2 forms, 1099 forms, and any other income statements relevant to your financial situation. Additionally, documentation for deductions, such as receipts and statements for business expenses, should be gathered. Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete vt in 113 2018 2019 form

Complete Vt Form In 113 effortlessly on any gadget

Online document management has become a favored choice for businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without any holdups. Manage Vt Form In 113 on any gadget with airSlate SignNow’s Android or iOS applications and simplify any document-centric task today.

The simplest way to edit and electronically sign Vt Form In 113 without any difficulty

- Find Vt Form In 113 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the exact legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Alter and electronically sign Vt Form In 113 and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vt in 113 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the vt in 113 2018 2019 form

How to create an eSignature for the Vt In 113 2018 2019 Form online

How to make an electronic signature for your Vt In 113 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the Vt In 113 2018 2019 Form in Gmail

How to generate an electronic signature for the Vt In 113 2018 2019 Form straight from your smartphone

How to make an electronic signature for the Vt In 113 2018 2019 Form on iOS devices

How to generate an electronic signature for the Vt In 113 2018 2019 Form on Android

People also ask

-

What is the official Vermont schedule in 113 2018 schedule and how does it apply to businesses?

The official Vermont schedule in 113 2018 schedule outlines essential deadlines and compliance dates for various business operations in Vermont. Understanding this schedule helps businesses stay on track with regulatory obligations while using tools like airSlate SignNow to manage documents efficiently.

-

How can airSlate SignNow assist in managing the official Vermont schedule in 113 2018 schedule?

With airSlate SignNow, businesses can securely send and eSign documents related to the official Vermont schedule in 113 2018 schedule. This streamlined process helps ensure that all necessary documentation is completed timely and accurately, facilitating better compliance.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business sizes and needs. Whether you're a small startup or a larger corporation, you can select a plan that suits your budget while ensuring access to features that can help with the official Vermont schedule in 113 2018 schedule.

-

What key features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, templates, team collaboration, and workflow automation. These functionalities allow businesses to manage the official Vermont schedule in 113 2018 schedule effectively, simplifying the process of preparing and signing necessary documents.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow integrates seamlessly with various platforms, including CRM and document management systems. This capability enhances usability for businesses looking to manage the official Vermont schedule in 113 2018 schedule alongside their existing tools.

-

What benefits does airSlate SignNow provide for document eSigning?

airSlate SignNow offers a range of benefits, including fast document turnaround times and enhanced security. By utilizing these features, businesses can respond quickly to the official Vermont schedule in 113 2018 schedule requirements while keeping sensitive information safe.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with electronic signatures?

Absolutely! airSlate SignNow is designed with ease of use in mind. Even individuals unfamiliar with electronic signatures can navigate the system to manage documents effectively, especially those related to the official Vermont schedule in 113 2018 schedule.

Get more for Vt Form In 113

- Ryanair travel insurance claim form

- Essential super withdrawal form

- Seacare thrift pte ltd form

- Angel broking poa form

- Evaluation forms cal ripken

- Veterans clearance formpdf old dominion university odu

- Veteran application honor flight houston honorflighthouston form

- Payment voucher form update payment voucher baruch cuny

Find out other Vt Form In 113

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online