Co Sales Tax Return 2019

What is the Colorado Sales Tax Return?

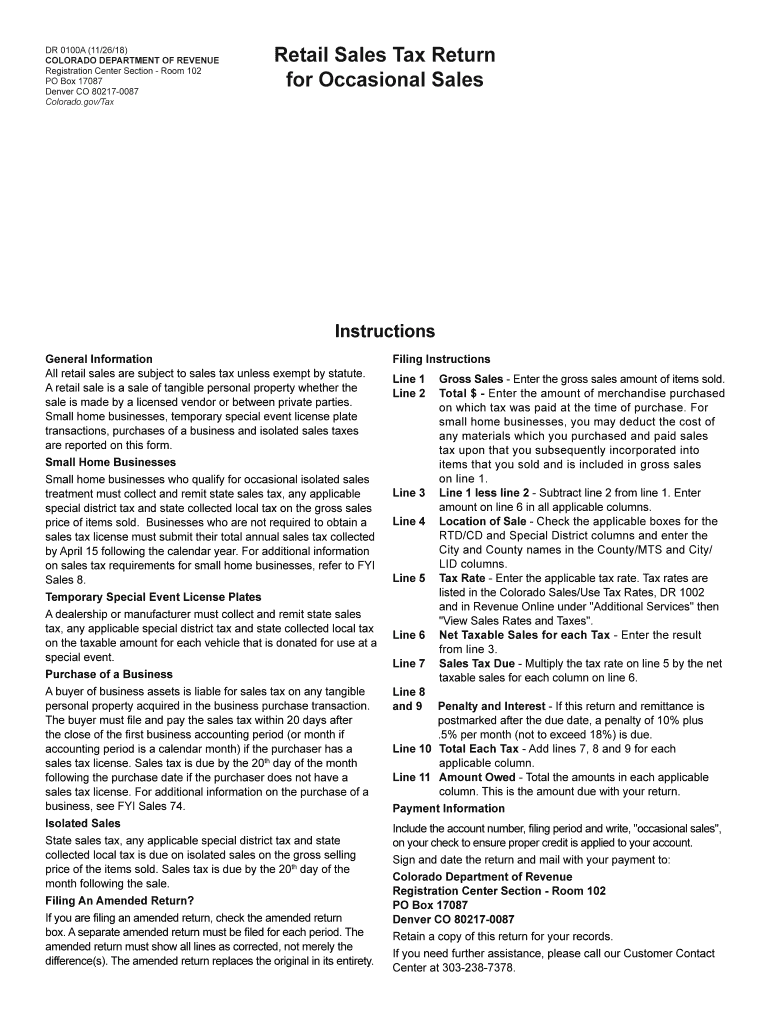

The Colorado Sales Tax Return, commonly referred to as the Colorado form DR 0100A, is a document used by businesses to report and remit sales tax collected on taxable sales. This form is essential for compliance with state tax laws, ensuring that businesses accurately report their sales tax liabilities to the Colorado Department of Revenue. The form captures details such as total sales, taxable sales, and the amount of sales tax due. Understanding the purpose of this form helps businesses maintain compliance and avoid penalties.

Steps to Complete the Colorado Sales Tax Return

Completing the Colorado Sales Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including receipts and invoices, to determine total sales and taxable sales. Next, calculate the total sales tax collected during the reporting period. Then, fill out the form DR 0100A by entering the required information, such as your business identification number, sales figures, and tax amounts. After reviewing the completed form for accuracy, submit it to the Colorado Department of Revenue either online, by mail, or in person. Keeping a copy of the submitted form for your records is also advisable.

Legal Use of the Colorado Sales Tax Return

The Colorado Sales Tax Return is legally binding when completed and submitted according to state regulations. It serves as an official record of sales tax obligations and payments made by businesses. To ensure its legal standing, businesses must comply with the requirements set forth by the Colorado Department of Revenue, including accurate reporting of sales figures and timely submission of the form. Failure to adhere to these regulations can result in penalties, making it crucial for businesses to understand their responsibilities when using this form.

Form Submission Methods

The Colorado Sales Tax Return can be submitted through various methods to accommodate different business needs. Businesses can file the form online using the Colorado Department of Revenue's e-filing system, which offers a convenient and efficient way to submit returns. Alternatively, the form can be mailed directly to the department or submitted in person at designated locations. Each method has its own advantages, such as immediate processing for online submissions or the ability to retain physical copies when mailed.

Filing Deadlines / Important Dates

Timely submission of the Colorado Sales Tax Return is crucial to avoid penalties. The filing deadlines depend on the frequency of your sales tax reporting, which can be monthly, quarterly, or annually. Businesses that collect significant sales tax typically file monthly, while smaller businesses may file quarterly or annually. It is essential to be aware of these deadlines to ensure compliance with state regulations and avoid late fees. Regularly checking the Colorado Department of Revenue's official calendar for updates and changes to filing dates is advisable.

Key Elements of the Colorado Sales Tax Return

The Colorado Sales Tax Return includes several key elements that businesses must complete accurately. These elements typically encompass the business identification number, total sales, taxable sales, and the amount of sales tax collected. Additionally, the form may require information about any exemptions claimed or adjustments made. Understanding these components is vital for ensuring that the return is filed correctly and reflects the business's true tax obligations.

Quick guide on how to complete co sales tax return

Effortlessly Prepare Co Sales Tax Return on Any Device

Web-based document management has become favored by both corporations and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Co Sales Tax Return across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Steps to Alter and Electronically Sign Co Sales Tax Return with Ease

- Obtain Co Sales Tax Return and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Select important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Co Sales Tax Return and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct co sales tax return

Create this form in 5 minutes!

How to create an eSignature for the co sales tax return

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Colorado Form DR 0100A?

The Colorado Form DR 0100A is a document used for state tax purposes in Colorado. It is typically required for businesses to report their income and other financial details to the state. Understanding how to correctly fill out the Colorado Form DR 0100A is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with the Colorado Form DR 0100A?

AirSlate SignNow offers an intuitive platform that allows users to easily fill, sign, and send the Colorado Form DR 0100A electronically. With its user-friendly interface, businesses can streamline the completion of this form and ensure it is submitted on time. Using airSlate SignNow simplifies the process and enhances overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the Colorado Form DR 0100A?

Yes, there is a subscription cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Users gain access to a range of features that make handling documents, including the Colorado Form DR 0100A, more efficient. Consider the potential savings in time and errors to see the value in the investment.

-

Are there any integrations available for the Colorado Form DR 0100A on airSlate SignNow?

AirSlate SignNow offers a variety of integrations that can enhance the document workflow for the Colorado Form DR 0100A. Users can connect with popular tools like Google Drive, Dropbox, and more to streamline their processes. These integrations help businesses manage their documentation effectively and save time.

-

What are the key benefits of using airSlate SignNow for completing tax forms like the Colorado Form DR 0100A?

The primary benefits include ease of use, enhanced security, and cost savings. AirSlate SignNow allows users to electronically sign and submit the Colorado Form DR 0100A quickly and safely, minimizing the risk of lost documents. Additionally, the platform keeps your information secure, giving you peace of mind during tax season.

-

Can I track the status of my Colorado Form DR 0100A sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your sent Colorado Form DR 0100A. You can receive notifications when the document is viewed or signed, ensuring you stay informed about your submission process. This transparency helps manage deadlines and follow-ups effectively.

-

Is it easy to correct mistakes on the Colorado Form DR 0100A using airSlate SignNow?

Absolutely! If you make a mistake on the Colorado Form DR 0100A while using airSlate SignNow, you can easily make corrections prior to sending it out. The platform allows for edits and revisions without the hassle of printing and re-signing documents, streamlining your workflow and ensuring accuracy.

Get more for Co Sales Tax Return

- Standard industrialcommercial single tenant lease gross form

- Non commercial invoice form

- Esic form 18 for maternity leave download pdf

- Lifeline program application form

- Pre anesthesia assessment form pdf

- Health and activity card cbse how to fill form

- The age of exploration map activity answer key form

- Vehicle registration new registrations form

Find out other Co Sales Tax Return

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free