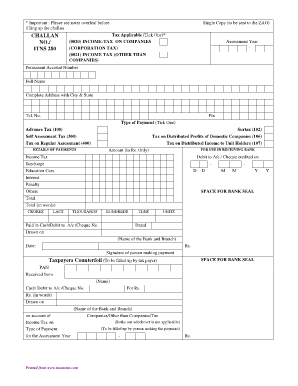

Challan 280 in Excel Form

What is the Challan 280 in Excel?

The Challan 280 is a crucial form used for the payment of income tax in the United States. It serves as a receipt for tax payments made by individuals and businesses. The Excel version of the Challan 280 allows users to fill out the form digitally, making it easier to manage calculations and data entry. This format is particularly useful for those who prefer to work with spreadsheets, as it enables users to input data directly into the cells, ensuring accuracy and efficiency.

How to Use the Challan 280 in Excel

Using the Challan 280 in Excel involves several straightforward steps. First, download the Excel template for the Challan 280 from a reliable source. Once opened, you can fill in the required fields, including personal information, tax details, and payment amounts. The Excel format allows for automatic calculations, which can help minimize errors. After completing the form, it can be saved and printed for submission or electronic filing.

Steps to Complete the Challan 280 in Excel

To complete the Challan 280 in Excel, follow these steps:

- Open the downloaded Excel file.

- Enter your personal information, such as name, address, and taxpayer identification number.

- Fill in the relevant tax details, including the assessment year and the type of payment.

- Input the amount of tax being paid.

- Review all entries for accuracy.

- Save the completed form and print it if necessary.

Legal Use of the Challan 280 in Excel

The Challan 280 in Excel is legally recognized as long as it is filled out correctly and submitted according to IRS guidelines. Digital forms, including those completed in Excel, are considered valid if they meet the necessary requirements for electronic submissions. It is essential to ensure that the information provided is accurate and complete to avoid penalties or issues with the IRS.

Required Documents for Challan 280 Submission

When submitting the Challan 280, certain documents may be required to support your payment. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a Social Security number or taxpayer identification number.

- Any previous tax payment receipts, if applicable.

Form Submission Methods

The Challan 280 can be submitted through various methods, including online and in-person options. For online submissions, users can utilize the IRS e-file system or authorized e-filing services. For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS office. In-person submissions may also be accepted at designated tax offices.

Quick guide on how to complete challan 280 in excel

Complete Challan 280 In Excel effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Challan 280 In Excel on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Challan 280 In Excel without hassle

- Locate Challan 280 In Excel and click Get Form to commence.

- Use the tools we provide to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Challan 280 In Excel and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the challan 280 in excel

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is a challan 280 pdf editable?

A challan 280 pdf editable is a digital form that allows users to make changes and fill in details electronically. This format streamlines the process of submitting taxes or payments, making it easier for individuals and businesses to manage their financial responsibilities.

-

How can I download a challan 280 pdf editable using airSlate SignNow?

You can easily download a challan 280 pdf editable through airSlate SignNow by selecting the document template you need from our extensive library. Once selected, our user-friendly platform allows you to customize and download it in an editable format for your convenience.

-

Is there a cost associated with obtaining a challan 280 pdf editable from airSlate SignNow?

While airSlate SignNow offers a range of free templates, the availability of a challan 280 pdf editable may depend on your subscription plan. We provide affordable pricing options designed to suit businesses of all sizes, ensuring you get the best value.

-

What features does the airSlate SignNow platform provide for editing a challan 280 pdf editable?

The airSlate SignNow platform provides robust features for editing a challan 280 pdf editable, including drag-and-drop functionality, form field customization, and eSign capabilities. These features enhance the document editing process, making it user-friendly and efficient.

-

Can I integrate airSlate SignNow with other applications to manage my challan 280 pdf editable?

Yes, airSlate SignNow offers seamless integration with numerous applications such as Google Drive, Dropbox, and more. This integration allows users to effortlessly manage, store, and distribute their challan 280 pdf editable documents alongside their existing workflows.

-

Are eSignature options available for the challan 280 pdf editable?

Absolutely! airSlate SignNow provides various eSignature options for your challan 280 pdf editable, allowing you to sign documents securely and legally. This feature helps expedite the approval process, making it ideal for businesses and individuals alike.

-

What are the benefits of using airSlate SignNow for my challan 280 pdf editable?

Using airSlate SignNow for your challan 280 pdf editable brings numerous benefits, including faster processing times, enhanced security, and reduced paper usage. Our platform simplifies financial documentation, allowing you to focus on your business operations without the hassle of traditional paperwork.

Get more for Challan 280 In Excel

Find out other Challan 280 In Excel

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe