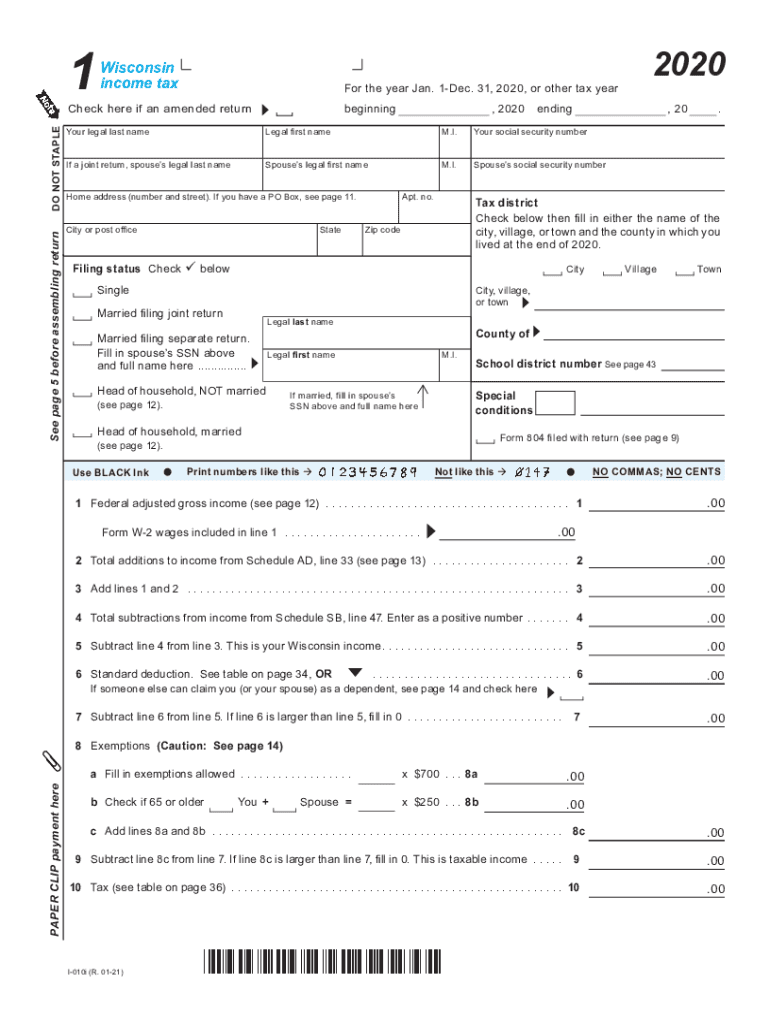

I 010 Form 1, Wisconsin Income Tax Fillable 2020

What is the Wisconsin Income Tax Form 1?

The Wisconsin Income Tax Form 1 is a crucial document used by residents of Wisconsin to report their income and calculate their state tax liability. This form is designed for individual taxpayers, including those who are self-employed, retirees, and students. It captures essential information such as total income, deductions, and credits, ultimately determining the amount of tax owed or the refund due. The form is available in a fillable format, making it easier for taxpayers to complete and submit electronically.

Steps to Complete the Wisconsin Income Tax Form 1

Completing the Wisconsin Income Tax Form 1 involves several key steps:

- Gather necessary documents: Collect your W-2s, 1099s, and any other income statements.

- Fill in personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, interest, and dividends.

- Claim deductions: Identify and enter any eligible deductions, such as student loan interest or mortgage interest.

- Calculate tax: Follow the instructions to compute your tax liability based on the information provided.

- Review and sign: Ensure all information is accurate, then sign and date the form.

How to Obtain the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 can be obtained easily through several methods:

- Online: Access the form directly from the Wisconsin Department of Revenue's website, where it is available for download.

- Tax software: Many tax preparation software programs include the Wisconsin Income Tax Form 1 as part of their offerings.

- Local offices: Visit local Department of Revenue offices or libraries, where printed copies of the form may be available.

Legal Use of the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 is legally binding when completed accurately and submitted according to state regulations. To ensure compliance, it is essential to follow the guidelines set forth by the Wisconsin Department of Revenue. This includes providing truthful information, signing the form, and submitting it by the designated deadlines. Failure to comply with these requirements can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines for the Wisconsin Income Tax Form 1

Timely filing of the Wisconsin Income Tax Form 1 is crucial to avoid penalties. The typical deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file without incurring penalties.

Form Submission Methods for the Wisconsin Income Tax Form 1

Taxpayers have multiple options for submitting the Wisconsin Income Tax Form 1:

- Online submission: Use the Wisconsin Department of Revenue's e-file system for a quick and secure submission.

- Mail: Send a completed paper form to the appropriate address provided by the Department of Revenue.

- In-person: Deliver the form directly to a local Department of Revenue office for immediate processing.

Quick guide on how to complete 2020 i 010 form 1 wisconsin income tax fillable

Prepare I 010 Form 1, Wisconsin Income Tax fillable effortlessly on any device

Digital document management has become prevalent among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage I 010 Form 1, Wisconsin Income Tax fillable across any platform using airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to modify and eSign I 010 Form 1, Wisconsin Income Tax fillable effortlessly

- Find I 010 Form 1, Wisconsin Income Tax fillable and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about missing or misplaced files, cumbersome form searching, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign I 010 Form 1, Wisconsin Income Tax fillable and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 i 010 form 1 wisconsin income tax fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 i 010 form 1 wisconsin income tax fillable

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Wisconsin income form and how does it work?

The Wisconsin income form is an essential document used for filing state income taxes in Wisconsin. It allows residents to report their earnings, deductions, and tax credits. With airSlate SignNow, you can easily complete, sign, and send your Wisconsin income form electronically, streamlining the tax filing process.

-

How can airSlate SignNow help with filling out the Wisconsin income form?

airSlate SignNow provides a user-friendly platform to complete the Wisconsin income form with ease. The software allows you to upload, edit, and fill your tax form digitally in a secure environment. Additionally, you can sign it electronically, greatly simplifying the submission process.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin income form?

Yes, there is a cost for using airSlate SignNow, but the pricing is competitive compared to traditional document management solutions. You can choose from various plans based on your business needs which often include features tailored for handling forms like the Wisconsin income form. The investment is worth it for the efficiency and security offered.

-

What features does airSlate SignNow offer for handling the Wisconsin income form?

airSlate SignNow offers a range of features for managing the Wisconsin income form, including customizable templates, automated workflows, and easy eSigning capabilities. These tools ensure that you can efficiently prepare and submit your documents while reducing the chances of errors. The platform also allows for real-time tracking of your forms.

-

Can I integrate airSlate SignNow with other software for managing the Wisconsin income form?

Absolutely! airSlate SignNow can integrate with various third-party applications to streamline your workflow when handling the Wisconsin income form. Integrations with popular software like Google Drive and CRM systems allow for seamless document management and access, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for the Wisconsin income form?

Using airSlate SignNow for the Wisconsin income form offers numerous benefits such as increased efficiency, lower administrative costs, and enhanced security. The ability to eSign and share documents digitally eliminates time delays associated with traditional mailing. Additionally, the platform's user-friendly interface makes the tax filing process straightforward.

-

Is airSlate SignNow secure for submitting the Wisconsin income form?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption methods to ensure that your Wisconsin income form and any sensitive data are protected during submission. With compliance to various regulations, you can trust that your information remains confidential and secure.

Get more for I 010 Form 1, Wisconsin Income Tax fillable

- Form xix see rule 78 2 b wage slip in excel

- Nalc fmla form 1

- Tn child support form

- Lead based paint disclosure virginia form

- Oci consent letter adults form

- Police verification certificate tripura form

- Veelgestelde vragen over de commissie werkelijke schade form

- Target2 form for collection of static data ancillary systems

Find out other I 010 Form 1, Wisconsin Income Tax fillable

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe