Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller 2022-2026

Understanding the Wisconsin Income Tax Form 1

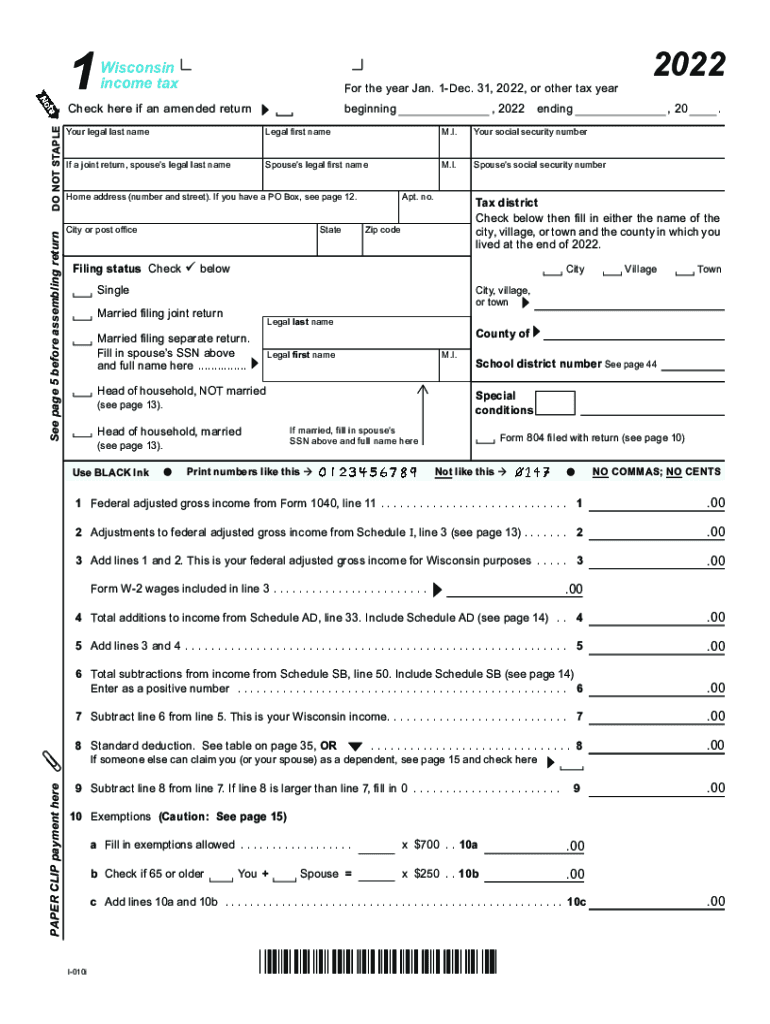

The Wisconsin Income Tax Form 1 is a crucial document for residents of Wisconsin who need to report their income and calculate their state tax obligations. This form is designed for individuals and is used to determine the amount of tax owed or the refund due based on the taxpayer's income, deductions, and credits. It is essential for anyone earning income in Wisconsin, including wages, self-employment income, and other sources of revenue.

Steps to Complete the Wisconsin Income Tax Form 1

Completing the Wisconsin Income Tax Form 1 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and other sources.

- Claim any deductions or credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submission.

Legal Use of the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 is legally binding when completed accurately and submitted in compliance with state regulations. To ensure its validity, taxpayers must follow specific guidelines, such as providing accurate information and signing the form. Electronic signatures are accepted as long as they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Filing Deadlines for the Wisconsin Income Tax Form 1

It is important to be aware of the filing deadlines for the Wisconsin Income Tax Form 1 to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their forms accurately.

Submission Methods for the Wisconsin Income Tax Form 1

Taxpayers have several options for submitting the Wisconsin Income Tax Form 1:

- Online submission through the Wisconsin Department of Revenue's e-filing system.

- Mailing a paper form to the appropriate address provided by the state.

- In-person submission at designated state offices, if applicable.

Key Elements of the Wisconsin Income Tax Form 1

The Wisconsin Income Tax Form 1 includes several key components that taxpayers must complete:

- Personal information section for identification.

- Income section to report all sources of income.

- Deductions and credits section to reduce taxable income.

- Signature section to validate the form.

Quick guide on how to complete form 1 ampquotwisconsin income taxampquot wisconsin templateroller

Complete Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller effortlessly on any gadget

Web-based document management has become increasingly favored by organizations and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller effortlessly

- Obtain Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from a device of your choice. Alter and electronically sign Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 ampquotwisconsin income taxampquot wisconsin templateroller

Create this form in 5 minutes!

People also ask

-

What is the 2023 Wisconsin tax filing deadline?

The deadline for filing your 2023 Wisconsin tax returns is typically April 15 of the following year. It's important to ensure you submit your tax documents on time to avoid any penalties. Using airSlate SignNow can help streamline your document signing process, making it easier to meet the deadline.

-

How can airSlate SignNow assist with 2023 Wisconsin tax documents?

airSlate SignNow simplifies the process of preparing and signing your 2023 Wisconsin tax documents. Our platform allows you to fill out, send, and eSign your tax forms quickly and securely. This can save you time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for tax professionals in 2023?

For 2023 Wisconsin tax professionals, airSlate SignNow provides features such as customizable templates, bulk sending, and secure document storage. These tools enhance efficiency and organization, allowing tax preparers to focus more on their clients rather than paperwork.

-

Is airSlate SignNow cost-effective for managing 2023 Wisconsin tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your 2023 Wisconsin tax documents. With flexible pricing plans, you can choose a plan that fits your needs without overspending, making it an economical choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other accounting software for 2023 Wisconsin tax filings?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, simplifying the management of your 2023 Wisconsin tax filings. This integration allows for a smooth workflow, ensuring that your documents and data are synchronized effortlessly.

-

What benefits does eSigning provide for my 2023 Wisconsin tax documents?

eSigning your 2023 Wisconsin tax documents with airSlate SignNow provides a range of benefits, including faster processing times and enhanced security. This method eliminates the need for physical signatures, reduces paper usage, and allows for remote signing, making it convenient for everyone involved.

-

How secure is the airSlate SignNow platform for 2023 Wisconsin tax signing?

The airSlate SignNow platform employs advanced security measures to protect your 2023 Wisconsin tax documents. With encryption, secure access controls, and compliance with legal standards, you can trust that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller

- Commercial sublease new hampshire form

- Residential lease renewal agreement new hampshire form

- Notice to lessor exercising option to purchase new hampshire form

- Assignment of lease and rent from borrower to lender new hampshire form

- Assignment of lease from lessor with notice of assignment new hampshire form

- Letter from landlord to tenant as notice of abandoned personal property new hampshire form

- Guaranty or guarantee of payment of rent new hampshire form

- Letter from landlord to tenant as notice of default on commercial lease new hampshire form

Find out other Form 1 "Wisconsin Income Tax" Wisconsin TemplateRoller

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors