Alaska Federal Based Credits 2019

What is the Alaska Federal Based Credits

The Alaska Federal Based Credits are tax incentives designed to support individuals and businesses in Alaska. These credits can reduce the overall tax liability for qualifying taxpayers, making it easier for them to manage their financial responsibilities. The program aims to stimulate economic growth within the state by encouraging investment and job creation. Understanding the specifics of these credits is essential for anyone looking to benefit from them.

How to use the Alaska Federal Based Credits

Using the Alaska Federal Based Credits involves a straightforward process. Taxpayers must first determine their eligibility based on the criteria set forth by the IRS and state regulations. Once eligibility is confirmed, individuals can claim these credits on their federal tax returns. It is crucial to accurately report any relevant income and expenses to ensure compliance and maximize the benefits of the credits.

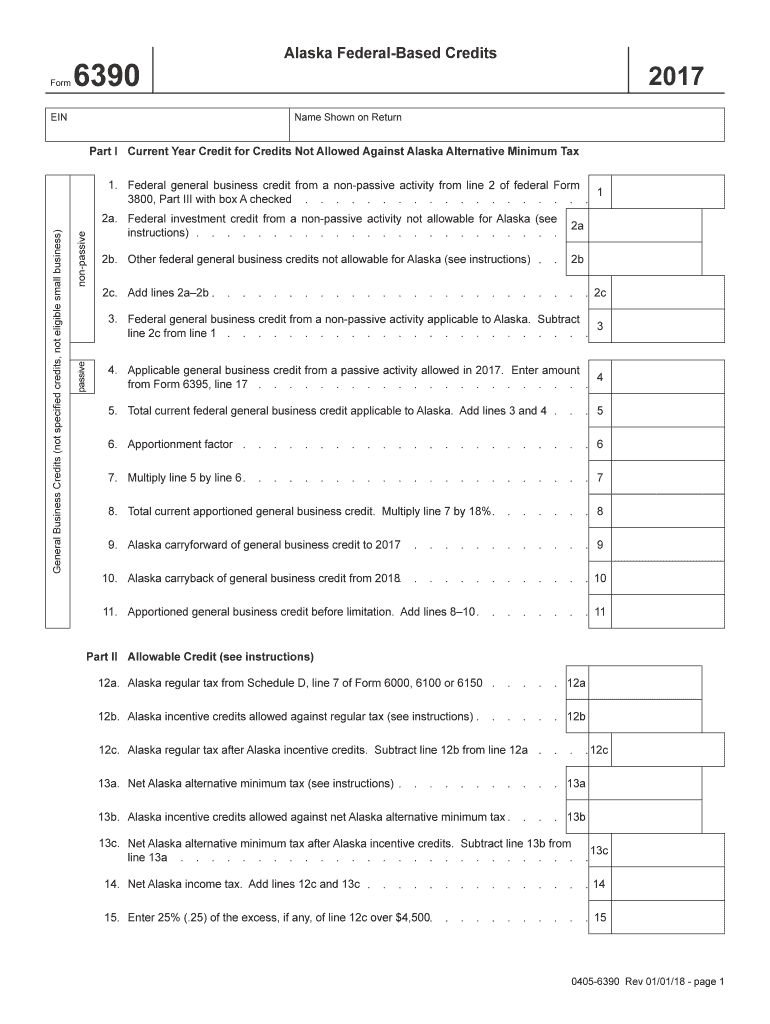

Steps to complete the Alaska Federal Based Credits

Completing the Alaska Federal Based Credits requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Review eligibility requirements to ensure compliance with IRS guidelines.

- Complete the appropriate tax forms, ensuring all information is accurate and complete.

- Submit the forms electronically or via mail, depending on your preference and the requirements.

Legal use of the Alaska Federal Based Credits

The legal use of the Alaska Federal Based Credits is governed by both state and federal tax laws. Taxpayers must adhere to the guidelines set forth by the IRS to ensure that their claims are valid. This includes maintaining accurate records and providing any necessary documentation to support the claims made on tax returns. Non-compliance can result in penalties or disqualification from future credits.

Eligibility Criteria

Eligibility for the Alaska Federal Based Credits varies based on several factors, including income level, filing status, and specific business activities. Generally, taxpayers must be residents of Alaska and meet certain income thresholds to qualify. It is advisable to consult the latest IRS guidelines or a tax professional to confirm eligibility and understand any changes that may affect the qualification process.

Required Documents

To successfully claim the Alaska Federal Based Credits, taxpayers must prepare several key documents. These typically include:

- Proof of income, such as W-2s or 1099 forms.

- Documentation of any business expenses related to the credits.

- Previous year’s tax returns for reference.

- Any additional forms required by the state of Alaska.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Federal Based Credits align with the standard federal tax deadlines. Typically, taxpayers must file their returns by April 15 each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines or specific requirements that may arise, especially in light of evolving tax regulations.

Quick guide on how to complete alaska federal based credits

Complete Alaska Federal Based Credits effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Alaska Federal Based Credits on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign Alaska Federal Based Credits without hassle

- Obtain Alaska Federal Based Credits and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or errors that require reprinting. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Alaska Federal Based Credits and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska federal based credits

Create this form in 5 minutes!

How to create an eSignature for the alaska federal based credits

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What are Alaska Federal Based Credits?

Alaska Federal Based Credits are financial incentives offered to businesses in Alaska that meet specific criteria. These credits can signNowly reduce tax liabilities, encouraging business development and investment within the state.

-

How can airSlate SignNow help with Alaska Federal Based Credits documentation?

airSlate SignNow provides a streamlined solution for managing the documentation associated with Alaska Federal Based Credits. Our eSigning platform ensures secure and efficient signing of necessary forms, expediting the application process.

-

What features does airSlate SignNow offer for managing Alaska Federal Based Credits?

airSlate SignNow includes features such as customizable templates, document tracking, and secure cloud storage. These tools are essential for businesses needing to manage and submit documentation related to Alaska Federal Based Credits efficiently.

-

Are there any costs associated with using airSlate SignNow for Alaska Federal Based Credits?

Yes, airSlate SignNow operates with a subscription model that offers various pricing plans depending on the features you need. Investing in this solution can save businesses time and money in managing Alaska Federal Based Credits documentation.

-

Can airSlate SignNow integrate with other software to manage Alaska Federal Based Credits?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications like CRM systems and accounting software. This integration allows users to connect workflows related to Alaska Federal Based Credits for better efficiency.

-

What are the benefits of using airSlate SignNow for Alaska Federal Based Credits?

Using airSlate SignNow simplifies the process of applying for Alaska Federal Based Credits by digitizing document management. The ease of use and quick access to eSigning features help businesses stay organized and compliant with state tax regulations.

-

How secure is airSlate SignNow when handling Alaska Federal Based Credits information?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents related to Alaska Federal Based Credits. Our platform complies with industry standards to ensure that your sensitive information remains safe.

Get more for Alaska Federal Based Credits

Find out other Alaska Federal Based Credits

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online