Iowa State Sales Tax Exemption Form 2020

What is the Iowa State Sales Tax Exemption Form

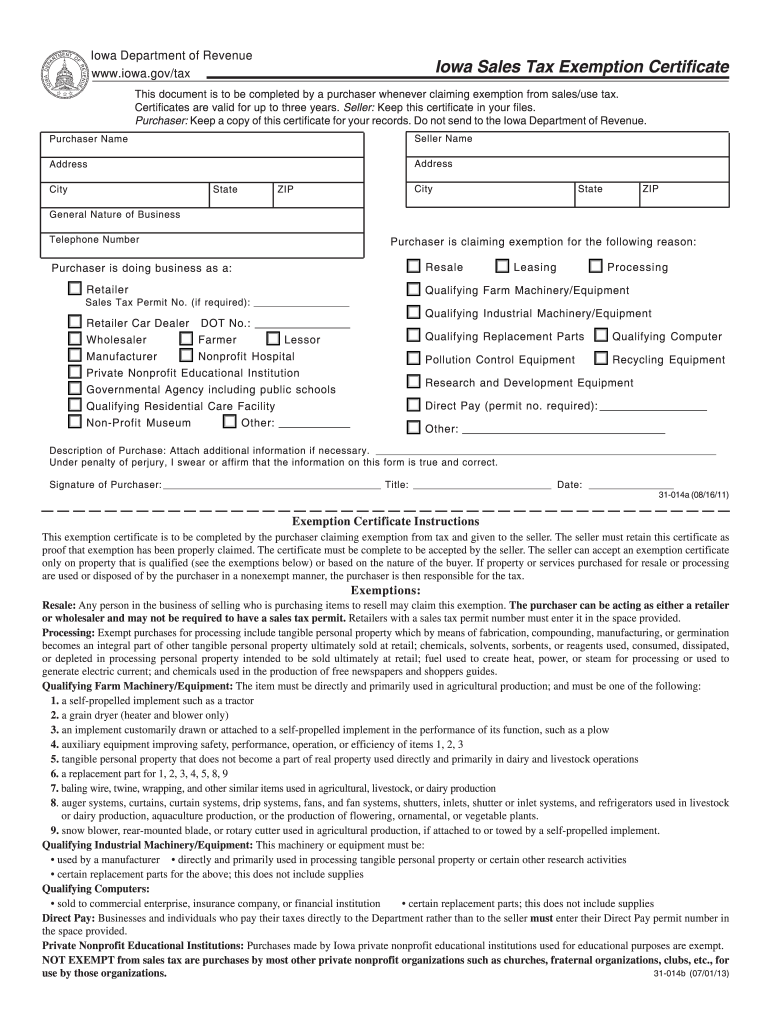

The Iowa State Sales Tax Exemption Form is a document that allows eligible purchasers to claim exemption from sales tax on certain purchases. This form is primarily used by organizations and entities that qualify under Iowa law, such as non-profit organizations, government agencies, and certain educational institutions. By completing this form, these entities can avoid paying sales tax on items that are directly related to their exempt purposes.

How to use the Iowa State Sales Tax Exemption Form

To use the Iowa State Sales Tax Exemption Form, individuals or organizations must first determine their eligibility for sales tax exemption. Once confirmed, the form should be filled out accurately, providing necessary details such as the purchaser's name, address, and the specific purpose for the exemption. After completing the form, it should be presented to the seller at the time of purchase to ensure that sales tax is not applied.

Steps to complete the Iowa State Sales Tax Exemption Form

Completing the Iowa State Sales Tax Exemption Form involves several key steps:

- Obtain the form from a reliable source, such as the Iowa Department of Revenue website.

- Fill in the required fields, including the name and address of the purchaser.

- Specify the reason for the exemption, ensuring it aligns with state guidelines.

- Sign and date the form to validate it.

- Present the completed form to the seller during the transaction.

Legal use of the Iowa State Sales Tax Exemption Form

The legal use of the Iowa State Sales Tax Exemption Form is governed by state tax laws. To ensure compliance, it is essential that the form is used only by eligible entities and for qualifying purchases. Misuse of the form can lead to penalties, including back taxes owed and potential fines. Therefore, it is crucial to maintain accurate records and to use the form in accordance with Iowa regulations.

Key elements of the Iowa State Sales Tax Exemption Form

Key elements of the Iowa State Sales Tax Exemption Form include:

- Purchaser Information: Name and address of the entity claiming exemption.

- Exemption Reason: Clear indication of the purpose for which the exemption is being claimed.

- Signature: Authorized signature of the purchaser, validating the form.

- Date: The date on which the form is completed.

Eligibility Criteria

Eligibility for the Iowa State Sales Tax Exemption Form typically includes non-profit organizations, government entities, and certain educational institutions. To qualify, organizations must demonstrate that their purchases are directly related to their exempt purposes. It is advisable to review specific eligibility criteria outlined by the Iowa Department of Revenue to ensure compliance.

Quick guide on how to complete iowa state sales tax exemption form 2013

Complete Iowa State Sales Tax Exemption Form effortlessly on any gadget

E-document management has gained signNow traction among entities and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Iowa State Sales Tax Exemption Form on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Iowa State Sales Tax Exemption Form with ease

- Obtain Iowa State Sales Tax Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to finish your template.

- Emphasize important areas of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your template, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious template searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Iowa State Sales Tax Exemption Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa state sales tax exemption form 2013

Create this form in 5 minutes!

How to create an eSignature for the iowa state sales tax exemption form 2013

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the Iowa State Sales Tax Exemption Form?

The Iowa State Sales Tax Exemption Form is a document that allows eligible businesses and organizations to purchase goods and services without paying sales tax. This form must be filled out correctly and submitted to the seller. By using the Iowa State Sales Tax Exemption Form, businesses can save money and streamline their purchasing processes.

-

Who is eligible to use the Iowa State Sales Tax Exemption Form?

Eligibility for the Iowa State Sales Tax Exemption Form typically includes non-profit organizations, government entities, and certain businesses engaged in specific tax-exempt activities. It's important to check Iowa's specific regulations to ensure you qualify. If you meet the criteria, you can take advantage of this tax exemption while purchasing necessary supplies.

-

How do I obtain the Iowa State Sales Tax Exemption Form?

You can obtain the Iowa State Sales Tax Exemption Form from the Iowa Department of Revenue's website or through your accountant. Once you have the form, ensure that you complete it accurately. Utilizing airSlate SignNow can make this process easier by allowing you to eSign your documents quickly and securely.

-

Can I eSign the Iowa State Sales Tax Exemption Form with airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the Iowa State Sales Tax Exemption Form efficiently. The platform provides a user-friendly interface for signing documents electronically, ensuring compliance and security. This eliminates the need for printing and scanning, saving you time and resources.

-

What are the benefits of using airSlate SignNow for my Iowa State Sales Tax Exemption Form?

Using airSlate SignNow to manage your Iowa State Sales Tax Exemption Form offers several advantages, including ease of use, cost-effectiveness, and enhanced security. The platform simplifies the eSigning process, ensuring your documents are legally binding and safe. Additionally, it helps you maintain organized records for tax purposes.

-

Is there a fee to use airSlate SignNow for the Iowa State Sales Tax Exemption Form?

While airSlate SignNow offers a range of pricing plans, creating and eSigning the Iowa State Sales Tax Exemption Form is generally cost-effective. The platform provides various subscription levels to suit different business needs, ensuring you only pay for what you need. Consider exploring their pricing options for more details.

-

How can airSlate SignNow integrate with my current systems for handling the Iowa State Sales Tax Exemption Form?

airSlate SignNow offers seamless integrations with many popular business applications, which can help streamline the handling of your Iowa State Sales Tax Exemption Form. This includes integration with document management systems, CRM tools, and more. These integrations enhance workflow efficiency and reduce manual data entry.

Get more for Iowa State Sales Tax Exemption Form

- Blank form 114 278837

- Where im from poem template form

- Akosombo international school entrance exams past papers form

- Example 60 hour driving log filled out 65921343 form

- Readers and writers notebook grade 5 answer key pdf form

- Wine tasting notes template form

- Application for employment fentons creamery and restaurant form

- Driving school record of completion state of new mexico form

Find out other Iowa State Sales Tax Exemption Form

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF