Iowa Inheritance Tax Form 2020

What is the Iowa Inheritance Tax Form

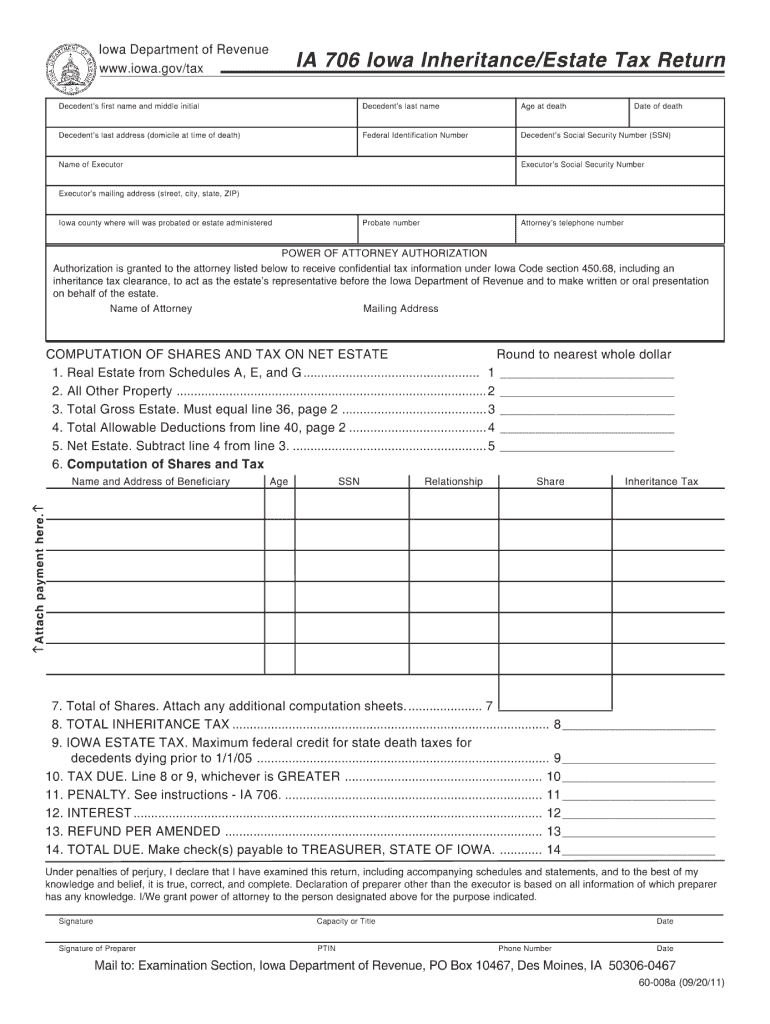

The Iowa Inheritance Tax Form is a legal document required to report and calculate the inheritance tax owed on property received by heirs following a person's death. This form is essential for ensuring compliance with Iowa state tax laws and is used to determine the tax liability based on the value of the estate and the relationship of the beneficiaries to the deceased. Understanding this form is crucial for executors and beneficiaries alike, as it outlines the necessary information needed for proper tax assessment.

How to use the Iowa Inheritance Tax Form

Using the Iowa Inheritance Tax Form involves several steps to ensure accurate reporting. First, gather all relevant information about the estate, including the total value of assets and the identities of beneficiaries. Next, complete the form by providing detailed information such as the decedent's details, asset valuations, and the relationship of each beneficiary to the deceased. After filling out the form, it must be signed and dated by the executor or administrator of the estate before submission to the appropriate state department.

Steps to complete the Iowa Inheritance Tax Form

Completing the Iowa Inheritance Tax Form requires a systematic approach. Follow these steps:

- Gather necessary documents, including the death certificate and asset valuations.

- Fill out the decedent's information, including name, date of birth, and date of death.

- List all assets and their values, ensuring to include real estate, bank accounts, and personal property.

- Identify each beneficiary and their relationship to the decedent.

- Calculate the total inheritance tax owed based on the provided information.

- Review the form for accuracy and completeness before signing.

Required Documents

To successfully complete the Iowa Inheritance Tax Form, certain documents are necessary. These include:

- The decedent's death certificate.

- A detailed inventory of the estate's assets, including appraisals if applicable.

- Documentation of any debts or liabilities that may affect the net value of the estate.

- Identification details of all beneficiaries, including their Social Security numbers.

Form Submission Methods

The Iowa Inheritance Tax Form can be submitted through various methods. Executors have the option to file the form online, by mail, or in person. For online submissions, ensure that all information is entered accurately into the designated state tax portal. If submitting by mail, send the completed form to the appropriate county treasurer's office. In-person submissions can be made directly at the local tax office, where assistance may also be available for any questions regarding the form.

Penalties for Non-Compliance

Failure to file the Iowa Inheritance Tax Form or inaccuracies in reporting can result in penalties. The state may impose fines based on the amount of tax owed and the duration of the delay in filing. Additionally, interest may accrue on any unpaid taxes, increasing the overall liability. It is important for executors to adhere to filing deadlines and ensure all information is correct to avoid these penalties.

Quick guide on how to complete iowa inheritance tax form 2011

Complete Iowa Inheritance Tax Form effortlessly on any device

The management of online documents has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Iowa Inheritance Tax Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Iowa Inheritance Tax Form without difficulty

- Obtain Iowa Inheritance Tax Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the information and then click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Iowa Inheritance Tax Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa inheritance tax form 2011

Create this form in 5 minutes!

How to create an eSignature for the iowa inheritance tax form 2011

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Iowa Inheritance Tax Form?

The Iowa Inheritance Tax Form is a legal document required by the state of Iowa for reporting the inheritance tax owed on estates. This form helps beneficiaries outline the assets received from the deceased and calculates the tax based on the value of those assets. Completing the Iowa Inheritance Tax Form accurately is essential to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the Iowa Inheritance Tax Form?

With airSlate SignNow, users can easily fill out and eSign the Iowa Inheritance Tax Form online, streamlining the process. Our platform provides templates and guides to help ensure that all necessary fields are completed accurately. By using airSlate SignNow, you can save time and reduce errors when submitting your Iowa Inheritance Tax Form.

-

Is there a cost associated with using airSlate SignNow for the Iowa Inheritance Tax Form?

Yes, airSlate SignNow offers various pricing plans that can accommodate different needs when processing the Iowa Inheritance Tax Form. Our plans are designed to be cost-effective and provide value-added features such as unlimited document signing and advanced templates. Customers can choose a plan that suits their budget and usage requirements.

-

Are there any features specific to the Iowa Inheritance Tax Form in airSlate SignNow?

AirSlate SignNow includes specific features that are particularly useful for the Iowa Inheritance Tax Form, such as customizable templates and guided workflows. Users can take advantage of our sign-in options to ensure secure access and ease of use. Additionally, our platform allows for real-time tracking of document status to keep you informed throughout the process.

-

What are the benefits of using airSlate SignNow for the Iowa Inheritance Tax Form?

Using airSlate SignNow for the Iowa Inheritance Tax Form provides numerous benefits, including time savings and enhanced accuracy. The ability to eSign documents means you can finalize the form without delays associated with physical signatures. Furthermore, our user-friendly interface simplifies the completion process for users of all technical levels.

-

Can I integrate airSlate SignNow with other applications for managing the Iowa Inheritance Tax Form?

Yes, airSlate SignNow offers integrations with a variety of applications to help manage the Iowa Inheritance Tax Form more efficiently. This means you can connect with tools you’re already using for document management and workflow automation. Our API makes it simple to streamline your processes across platforms.

-

Is customer support available for assistance with the Iowa Inheritance Tax Form on airSlate SignNow?

Absolutely! AirSlate SignNow provides dedicated customer support to help users with any questions related to the Iowa Inheritance Tax Form. Our support team is available through multiple channels, including chat and email, ensuring you receive the assistance you need promptly.

Get more for Iowa Inheritance Tax Form

Find out other Iowa Inheritance Tax Form

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment